- Hong Kong

- /

- Real Estate

- /

- SEHK:9608

What Sundy Service Group Co. Ltd's (HKG:9608) 26% Share Price Gain Is Not Telling You

Sundy Service Group Co. Ltd (HKG:9608) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 62%.

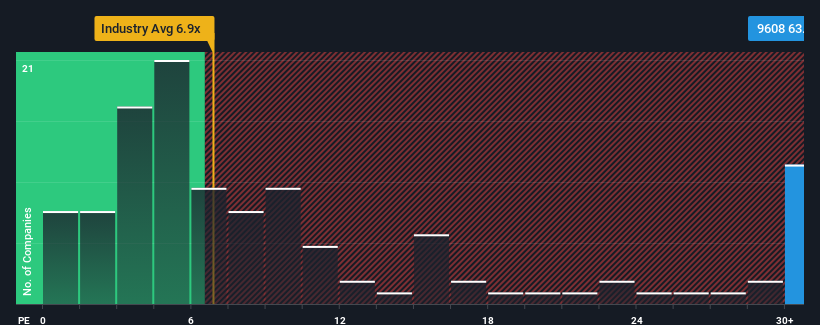

Since its price has surged higher, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may consider Sundy Service Group as a stock to avoid entirely with its 63.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Sundy Service Group's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Sundy Service Group

How Is Sundy Service Group's Growth Trending?

Sundy Service Group's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 72%. The last three years don't look nice either as the company has shrunk EPS by 82% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 18% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that Sundy Service Group's P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Sundy Service Group's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sundy Service Group revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 5 warning signs for Sundy Service Group you should be aware of, and 2 of them don't sit too well with us.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9608

Sundy Service Group

An investment holding company, operates as an integrated property management service provider in the People’s Republic of China.

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026