- Hong Kong

- /

- Real Estate

- /

- SEHK:95

Auditors Have Doubts About LVGEM (China) Real Estate Investment (HKG:95)

The harsh reality for LVGEM (China) Real Estate Investment Company Limited (HKG:95) shareholders is that its auditors, Deloitte Touche Tohmatsu CPA Ltd, expressed doubts about its ability to continue as a going concern, in its reported results to December 2022. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

See our latest analysis for LVGEM (China) Real Estate Investment

How Much Debt Does LVGEM (China) Real Estate Investment Carry?

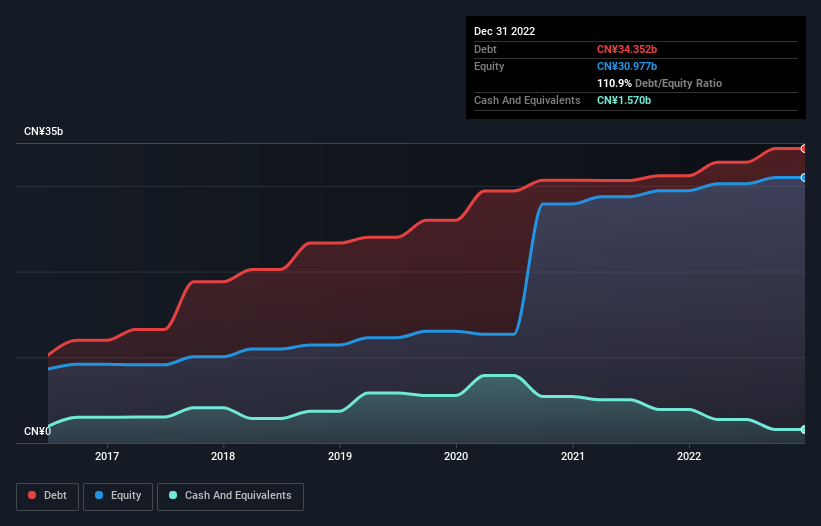

You can click the graphic below for the historical numbers, but it shows that as of December 2022 LVGEM (China) Real Estate Investment had CN¥34.4b of debt, an increase on CN¥31.2b, over one year. However, it does have CN¥1.57b in cash offsetting this, leading to net debt of about CN¥32.8b.

How Healthy Is LVGEM (China) Real Estate Investment's Balance Sheet?

According to the last reported balance sheet, LVGEM (China) Real Estate Investment had liabilities of CN¥26.8b due within 12 months, and liabilities of CN¥42.0b due beyond 12 months. Offsetting this, it had CN¥1.57b in cash and CN¥1.68b in receivables that were due within 12 months. So its liabilities total CN¥65.5b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the CN¥7.50b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, LVGEM (China) Real Estate Investment would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

LVGEM (China) Real Estate Investment shareholders face the double whammy of a high net debt to EBITDA ratio (72.8), and fairly weak interest coverage, since EBIT is just 0.22 times the interest expense. This means we'd consider it to have a heavy debt load. Worse, LVGEM (China) Real Estate Investment's EBIT was down 74% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine LVGEM (China) Real Estate Investment's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, LVGEM (China) Real Estate Investment burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both LVGEM (China) Real Estate Investment's EBIT growth rate and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its interest cover fails to inspire much confidence. It looks to us like LVGEM (China) Real Estate Investment carries a significant balance sheet burden. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. We prefer to invest in companies that ensure the balance sheet remains healthier than that. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with LVGEM (China) Real Estate Investment , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade LVGEM (China) Real Estate Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:95

LVGEM (China) Real Estate Investment

An investment holding company, engages in property development and investment businesses in the People’s Republic of China.

Good value slight.

Market Insights

Community Narratives