- Hong Kong

- /

- Real Estate

- /

- SEHK:81

We Think You Can Look Beyond China Overseas Grand Oceans Group's (HKG:81) Lackluster Earnings

The market for China Overseas Grand Oceans Group Limited's (HKG:81) shares didn't move much after it posted weak earnings recently. Our analysis suggests that while the profits are soft, the foundations of the business are strong.

View our latest analysis for China Overseas Grand Oceans Group

Zooming In On China Overseas Grand Oceans Group's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

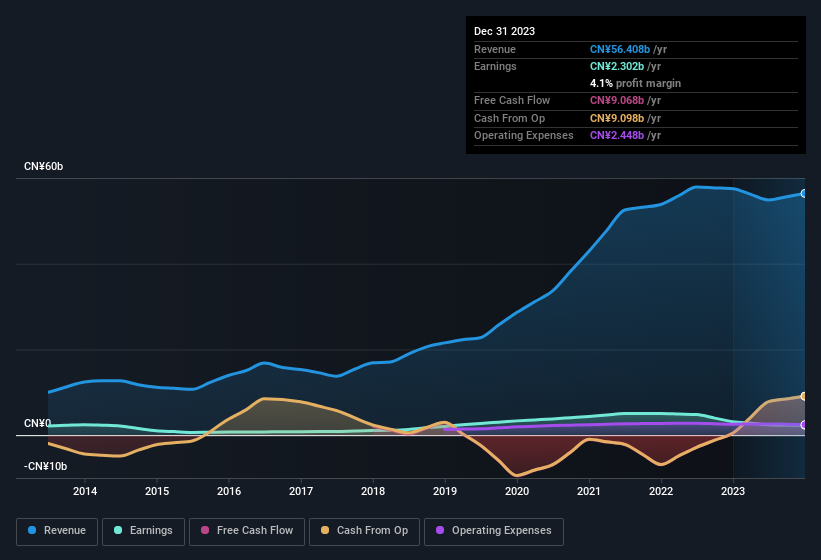

Over the twelve months to December 2023, China Overseas Grand Oceans Group recorded an accrual ratio of -0.12. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. In fact, it had free cash flow of CN¥9.1b in the last year, which was a lot more than its statutory profit of CN¥2.30b. China Overseas Grand Oceans Group's free cash flow improved over the last year, which is generally good to see. Having said that, there is more to the story. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

China Overseas Grand Oceans Group's profit was reduced by unusual items worth CN¥1.5b in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. This is what you'd expect to see where a company has a non-cash charge reducing paper profits. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect China Overseas Grand Oceans Group to produce a higher profit next year, all else being equal.

Our Take On China Overseas Grand Oceans Group's Profit Performance

In conclusion, both China Overseas Grand Oceans Group's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. Looking at all these factors, we'd say that China Overseas Grand Oceans Group's underlying earnings power is at least as good as the statutory numbers would make it seem. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Be aware that China Overseas Grand Oceans Group is showing 4 warning signs in our investment analysis and 1 of those is significant...

After our examination into the nature of China Overseas Grand Oceans Group's profit, we've come away optimistic for the company. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:81

China Overseas Grand Oceans Group

An investment holding company, invests in, develops, and leases real estate properties in the People’s Republic of China and Hong Kong.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026