- Hong Kong

- /

- Real Estate

- /

- SEHK:683

Kerry Properties Limited's (HKG:683) Business Is Yet to Catch Up With Its Share Price

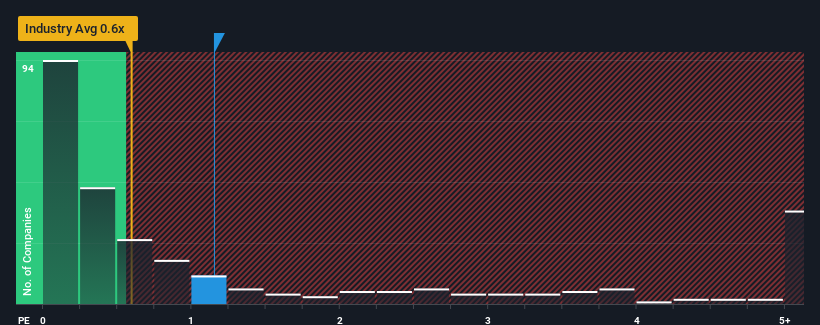

When close to half the companies in the Real Estate industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.6x, you may consider Kerry Properties Limited (HKG:683) as a stock to potentially avoid with its 1.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Kerry Properties

How Kerry Properties Has Been Performing

Recent times have been pleasing for Kerry Properties as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Kerry Properties.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kerry Properties' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 11% as estimated by the seven analysts watching the company. That's not great when the rest of the industry is expected to grow by 8.2%.

In light of this, it's alarming that Kerry Properties' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Kerry Properties' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Kerry Properties' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 3 warning signs for Kerry Properties (1 is significant!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kerry Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:683

Kerry Properties

An investment holding company, engages in the development, investment, management, and trading of properties in Hong Kong, Mainland China, and the Asia Pacific region.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)