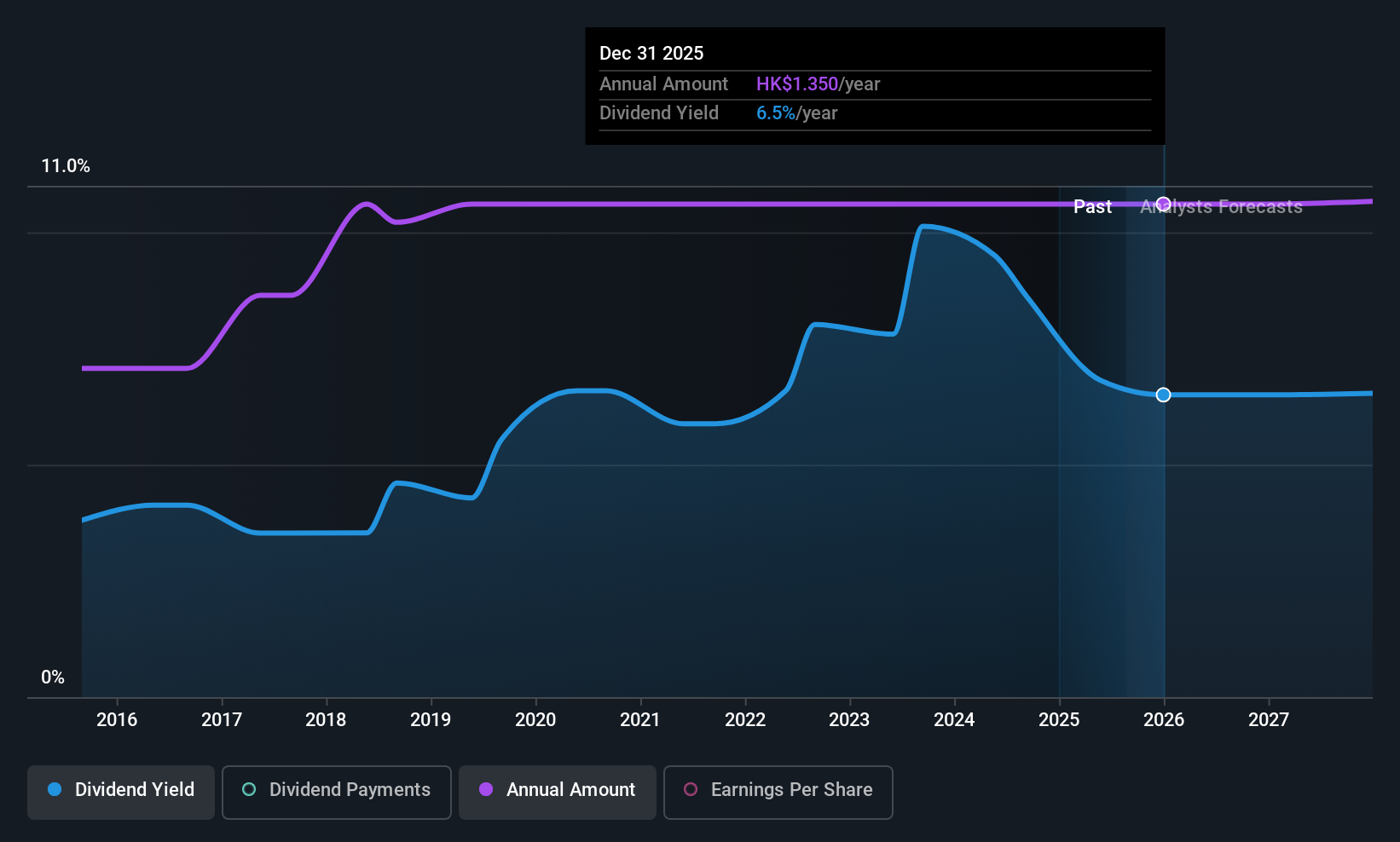

Kerry Properties Limited's (HKG:683) investors are due to receive a payment of HK$0.40 per share on 23rd of September. This payment means that the dividend yield will be 6.5%, which is around the industry average.

Kerry Properties' Future Dividend Projections Appear Well Covered By Earnings

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, the company was paying out 310% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Analysts expect a massive rise in earnings per share in the next year. If recent patterns in the dividend continue, we could see the payout ratio reaching 42% which is fairly sustainable.

Check out our latest analysis for Kerry Properties

Kerry Properties Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2015, the dividend has gone from HK$0.90 total annually to HK$1.35. This means that it has been growing its distributions at 4.1% per annum over that time. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

The Dividend Has Limited Growth Potential

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Kerry Properties' earnings per share has shrunk at 32% a year over the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 4 warning signs for Kerry Properties (of which 2 are potentially serious!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kerry Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:683

Kerry Properties

An investment holding company, engages in the development, investment, management, and trading of properties in Hong Kong, Mainland China, and the Asia Pacific region.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)