- Hong Kong

- /

- Real Estate

- /

- SEHK:683

Is Kerry Properties (SEHK:683) Overvalued After Strong 2024 Share Price Momentum?

Reviewed by Simply Wall St

Kerry Properties (SEHK:683) has been catching the eye of investors lately, which is understandable given how its share price has unfolded over the past several months. There has not been a single event propelling the move, but the stock's recent gains have certainly raised eyebrows and have people asking whether something is brewing beneath the surface. Sometimes, even without a clear-cut headline, price momentum alone can make for a compelling story, especially for those weighing whether to jump in or stay put.

Looking at the bigger picture, Kerry Properties has delivered a sizable 66% total return for investors over the past year, reflecting a strong shift compared to previous years. Gains have picked up steam in the past three months and, with a 43% year-to-date advance, momentum seems to have accelerated recently. While there are no high-profile catalysts for the rally, this type of climb often sparks debates around what is really driving sentiment and how sustainable it might be, especially against the company’s improving earnings and revenue growth.

With that kind of performance, is there genuine value to be found here, or has the market already priced in all the potential for Kerry Properties?

Price-to-Earnings of 50.2x: Is it justified?

When measured against its preferred valuation multiple, Kerry Properties currently trades at a price-to-earnings (P/E) ratio of 50.2x. This is substantially higher than both its estimated fair P/E ratio of 35.9x and the Hong Kong Real Estate industry average of 14x. This suggests that the market is assigning a considerable premium to its shares.

The price-to-earnings ratio reflects how much investors are willing to pay for every dollar of earnings that the company generates. For property developers and real estate firms, a higher P/E can sometimes signal expectations of strong future profits or a willingness to pay up for stability and asset quality. However, it may also suggest an overheated valuation if earnings do not keep up.

In Kerry Properties' case, the current premium suggests market optimism about its future growth trajectory, despite some recent headwinds in profit margins and significant one-off items impacting its most recent results. With forecasts for strong earnings growth ahead, investors appear to be betting that the company can deliver on these expectations, even as the P/E remains well above rivals and the wider sector.

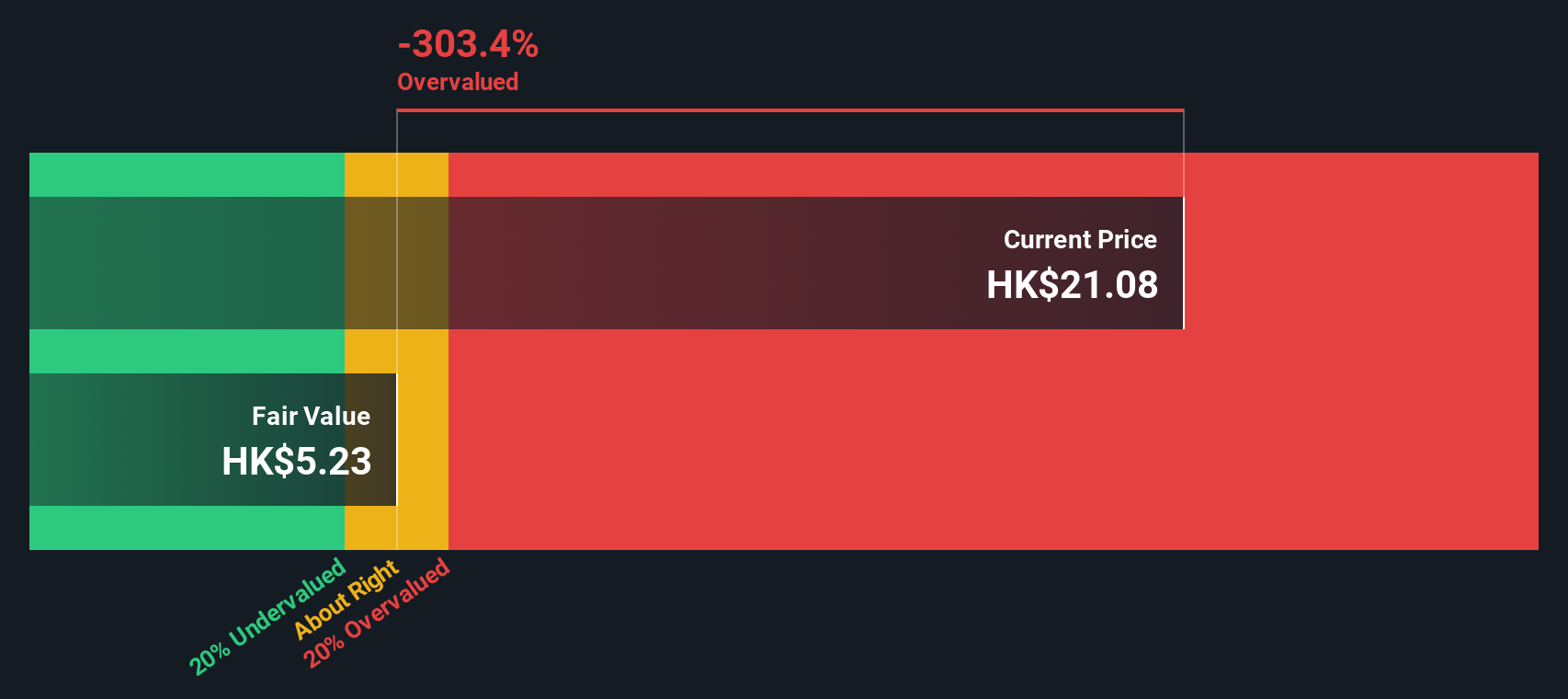

Result: Fair Value of $5.23 (OVERVALUED)

See our latest analysis for Kerry Properties.However, if revenue growth slows or profit momentum reverses, current optimism could quickly diminish, making the stock vulnerable to a sharp pullback.

Find out about the key risks to this Kerry Properties narrative.Another View: What Does the SWS DCF Model Say?

Instead of relying on market comparisons, our DCF model takes a closer look at Kerry Properties' future cash flows. This approach also suggests the stock is trading well above its fair value, offering little disagreement with the premium seen earlier. However, is price momentum outpacing fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kerry Properties Narrative

If you see things differently or would rather dig into the details on your own, it is easy to develop your own perspective in just a couple of minutes. Do it your way

A great starting point for your Kerry Properties research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons and boost your portfolio by checking out these unique investment angles on Simply Wall Street.

- Amplify your search for undervalued stocks by uncovering companies with robust cash flows. Your shortcut is undervalued stocks based on cash flows.

- Pursue tomorrow’s innovators in computing power and technology breakthroughs by exploring quantum computing stocks.

- Tap into a new generation of income potential with stocks offering impressive yield above 3%. Start with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kerry Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:683

Kerry Properties

An investment holding company, engages in the development, investment, management, and trading of properties in Hong Kong, Mainland China, and the Asia Pacific region.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)