- Hong Kong

- /

- Real Estate

- /

- SEHK:672

Zhong An Group Limited's (HKG:672) Price Is Right But Growth Is Lacking After Shares Rocket 28%

The Zhong An Group Limited (HKG:672) share price has done very well over the last month, posting an excellent gain of 28%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

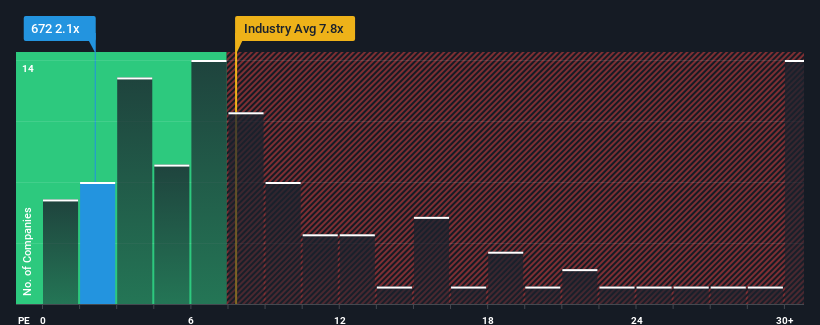

Although its price has surged higher, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Zhong An Group as a highly attractive investment with its 2.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been quite advantageous for Zhong An Group as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Zhong An Group

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Zhong An Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 35% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 22% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Zhong An Group is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Zhong An Group's P/E?

Shares in Zhong An Group are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Zhong An Group revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for Zhong An Group (1 makes us a bit uncomfortable!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Zhong An Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:672

Zhong An Group

An investment holding company, engages in property development, property leasing, and hotel operations.

Adequate balance sheet with low risk.

Market Insights

Community Narratives