Top Undervalued Small Caps With Insider Action In Hong Kong For September 2024

Reviewed by Simply Wall St

The Hong Kong market has been buoyed by China's recent stimulus measures, leading to a surge in the Hang Seng Index and renewed optimism among investors. As economic conditions improve, small-cap stocks with insider action are drawing attention for their potential undervaluation. In this environment, identifying good stocks often involves looking for companies that show strong fundamentals and have insider buying activity, which can signal confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Edianyun | NA | 0.6x | 38.74% | ★★★★★☆ |

| Ferretti | 10.8x | 0.7x | 47.18% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.3x | 37.05% | ★★★★☆☆ |

| Beijing Chunlizhengda Medical Instruments | 14.0x | 3.1x | 49.51% | ★★★☆☆☆ |

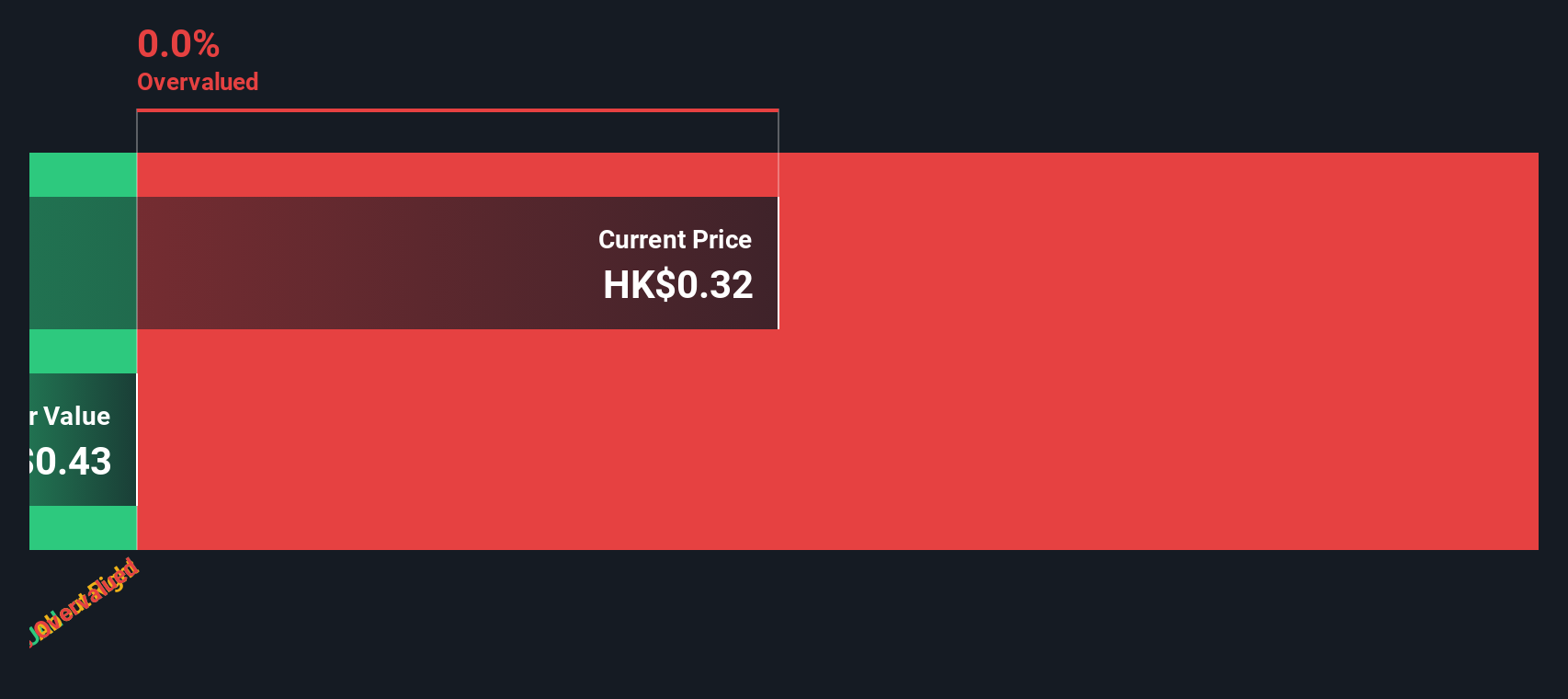

| China Lesso Group Holdings | 5.8x | 0.4x | -503.01% | ★★★☆☆☆ |

| Skyworth Group | 6.2x | 0.1x | -336.93% | ★★★☆☆☆ |

| Jinke Smart Services Group | NA | 0.9x | 36.96% | ★★★☆☆☆ |

| CN Logistics International Holdings | 20.9x | 0.5x | 20.08% | ★★★☆☆☆ |

| Guangdong Kanghua Healthcare Group | 13.8x | 0.3x | 4.86% | ★★★☆☆☆ |

| Emperor International Holdings | NA | 0.9x | 28.14% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer of building materials and interior decoration products, with a market cap of CN¥22.45 billion.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with operating expenses and non-operating expenses impacting net income. Over recent periods, gross profit margins have fluctuated around 26%, while net income margins have varied between approximately 6% and 13%.

PE: 5.8x

China Lesso Group Holdings, a small cap in Hong Kong, reported a decline in sales and net income for the half year ended June 30, 2024. Sales were CNY 13.56 billion compared to CNY 15.30 billion last year, while net income dropped to CNY 1.04 billion from CNY 1.49 billion. Despite this, insider confidence is evident with Luen Hei Wong purchasing four million shares worth approximately US$10 million between August and September 2024, indicating potential long-term value amidst current challenges.

- Click here to discover the nuances of China Lesso Group Holdings with our detailed analytical valuation report.

Learn about China Lesso Group Holdings' historical performance.

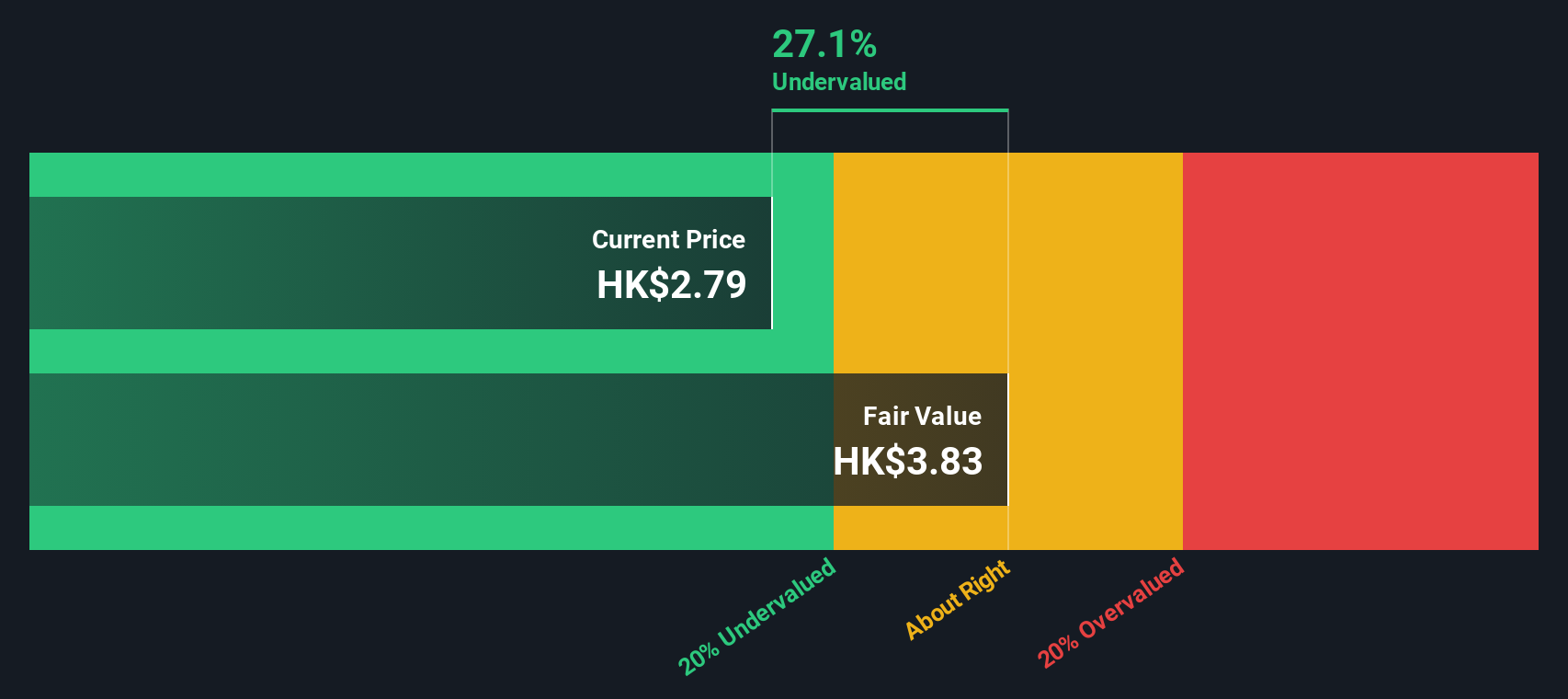

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment focuses on property development and investment management, with operations in these segments contributing to its market presence.

Operations: The company generates revenue primarily through Property Development (CN¥17.26 billion) and Property Investment and Management (CN¥1.23 billion). For the period ending September 30, 2023, it reported a gross profit margin of 5.79% and a net income margin of 7.68%.

PE: -2.1x

Gemdale Properties and Investment, a smaller player in Hong Kong's real estate market, recently reported mixed financial results. For the first half of 2024, the company saw sales climb to CNY 3.29 billion from CNY 2.33 billion year-on-year but faced a net loss of CNY 2.18 billion due to increased impairment losses on properties under development and joint ventures. Despite these challenges, insider confidence is evident with Lian Huat Loh purchasing 10 million shares worth approximately A$2.6 million in August, boosting their holdings by nearly fivefold. The company's aggregate contracted sales for January-August 2024 reached RMB 12.43 billion over an area of approximately 944,400 square meters at an average price of RMB 13,600 per square meter.

- Click here and access our complete valuation analysis report to understand the dynamics of Gemdale Properties and Investment.

Understand Gemdale Properties and Investment's track record by examining our Past report.

Ming Yuan Cloud Group Holdings (SEHK:909)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ming Yuan Cloud Group Holdings is a company that provides cloud services and on-premise software solutions, with a market cap of approximately CN¥10.68 billion.

Operations: The company's revenue streams primarily come from Cloud Services and On-premise Software and Services, with recent quarterly revenues totaling CN¥1.64 billion. The gross profit margin has shown fluctuations, most recently recorded at 79.48%. Operating expenses include significant allocations to sales & marketing, R&D, and general & administrative costs.

PE: -13.7x

Ming Yuan Cloud Group Holdings, a small cap in Hong Kong, has seen insider confidence with VP & Executive Director Xiaohui Chen purchasing 1 million shares valued at approximately HK$2.53 million, representing a 0.38% increase in their holdings. Despite reporting a net loss of CNY115.37 million for H1 2024, the company’s earnings per share improved from CNY-0.18 to CNY-0.06 year-on-year. Recent board changes and an ongoing share repurchase program indicate strategic efforts to bolster investor trust and enhance shareholder value amidst volatile market conditions.

Key Takeaways

- Get an in-depth perspective on all 11 Undervalued SEHK Small Caps With Insider Buying by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:909

Ming Yuan Cloud Group Holdings

An investment holding company, provides cloud services and on-premises software and services in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives