- Hong Kong

- /

- Real Estate

- /

- SEHK:535

Investors in Gemdale Properties and Investment (HKG:535) from five years ago are still down 79%, even after 11% gain this past week

Gemdale Properties and Investment Corporation Limited (HKG:535) shareholders should be happy to see the share price up 17% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 83% lower after that period. The recent bounce might mean the long decline is over, but we are not confident. The million dollar question is whether the company can justify a long term recovery. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

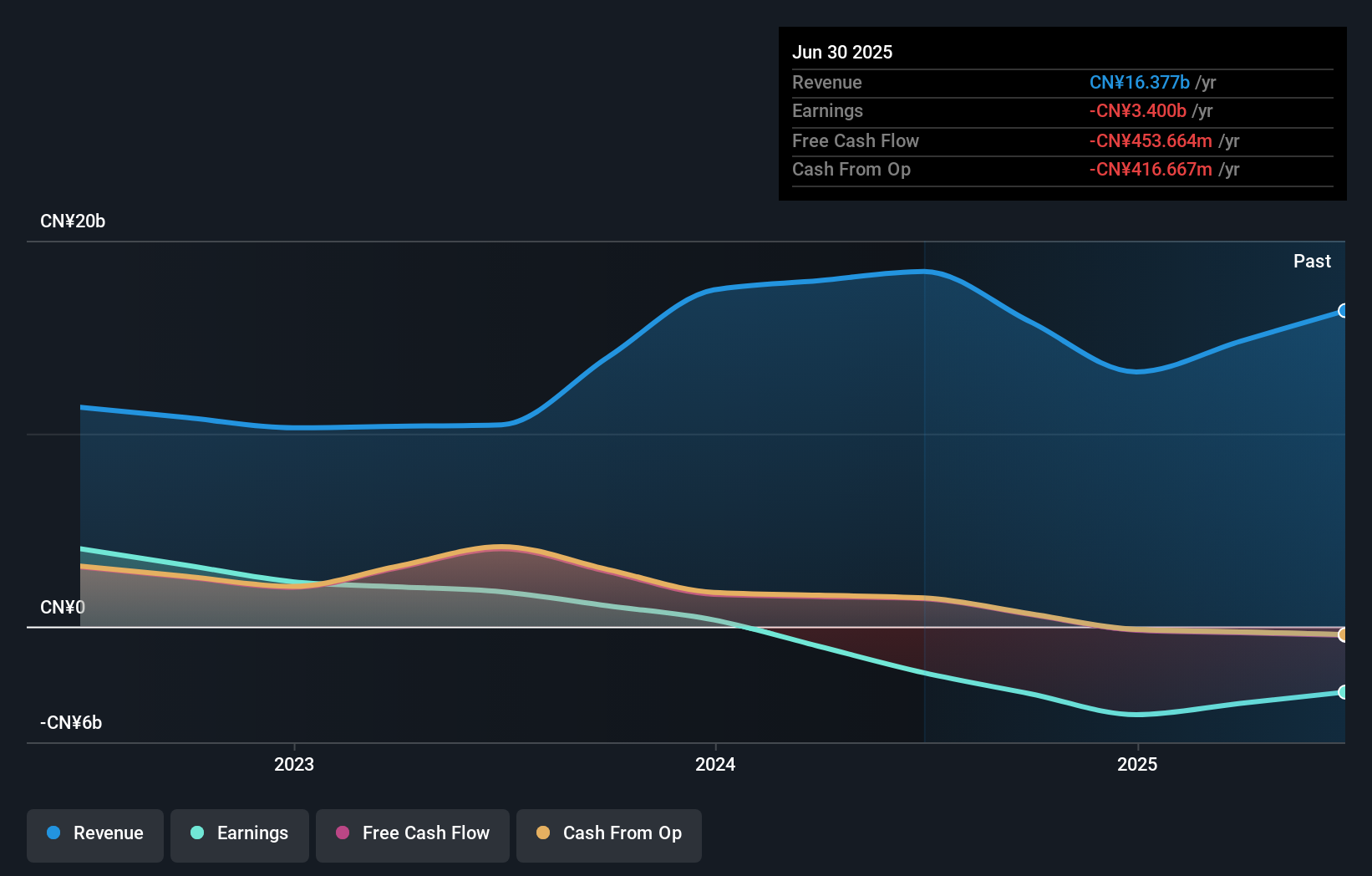

Given that Gemdale Properties and Investment didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Gemdale Properties and Investment saw its revenue increase by 0.7% per year. That's far from impressive given all the money it is losing. Nonetheless, it's fair to say the rapidly declining share price (down 13%, compound, over five years) suggests the market is very disappointed with this level of growth. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Gemdale Properties and Investment's earnings, revenue and cash flow.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. Over the last 5 years, Gemdale Properties and Investment generated a TSR of -79%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

Investors in Gemdale Properties and Investment had a tough year, with a total loss of 32%, against a market gain of about 41%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Gemdale Properties and Investment better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Gemdale Properties and Investment you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:535

Gemdale Properties and Investment

An investment holding company, engages in the property investment, development, and management activities in Mainland China.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026