- Hong Kong

- /

- Real Estate

- /

- SEHK:3913

The Price Is Right For KWG Living Group Holdings Limited (HKG:3913) Even After Diving 29%

The KWG Living Group Holdings Limited (HKG:3913) share price has fared very poorly over the last month, falling by a substantial 29%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

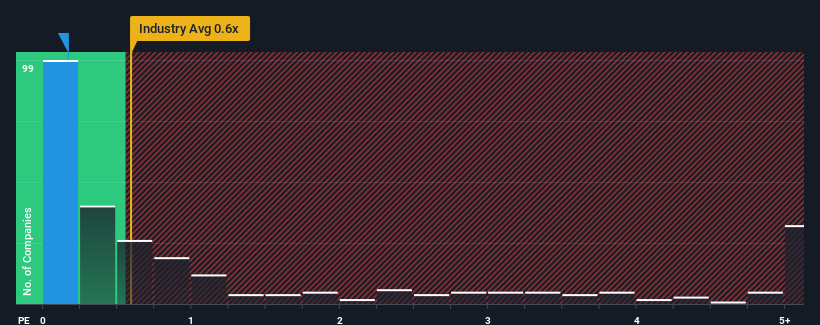

Although its price has dipped substantially, it's still not a stretch to say that KWG Living Group Holdings' price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Real Estate industry in Hong Kong, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for KWG Living Group Holdings

How KWG Living Group Holdings Has Been Performing

While the industry has experienced revenue growth lately, KWG Living Group Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on KWG Living Group Holdings.How Is KWG Living Group Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like KWG Living Group Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 154% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 5.2% over the next year. With the industry predicted to deliver 4.1% growth , the company is positioned for a comparable revenue result.

With this information, we can see why KWG Living Group Holdings is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

With its share price dropping off a cliff, the P/S for KWG Living Group Holdings looks to be in line with the rest of the Real Estate industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A KWG Living Group Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Real Estate industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for KWG Living Group Holdings (1 can't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade KWG Living Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KWG Living Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3913

KWG Living Group Holdings

An investment holding company, provides property management services in the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives