- Japan

- /

- Diversified Financial

- /

- TSE:8793

New Hope Service Holdings Leads Our 3 Top Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly focused on strategies that offer stability amid volatility. With the Fed's recent rate cut and looming government shutdown fears impacting sentiment, dividend stocks present an attractive option for those seeking consistent income streams. In this context, selecting robust dividend stocks like New Hope Service Holdings can provide a reliable hedge against market fluctuations while offering potential long-term benefits.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

New Hope Service Holdings (SEHK:3658)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Hope Service Holdings Limited offers property management, value-added services, commercial operations, and lifestyle services with a market cap of HK$1.62 billion.

Operations: New Hope Service Holdings Limited's revenue is derived from lifestyle services (CN¥325.85 million), property management services (CN¥734.92 million), commercial operational services (CN¥146.34 million), and value-added services to non-property owners (CN¥162.85 million).

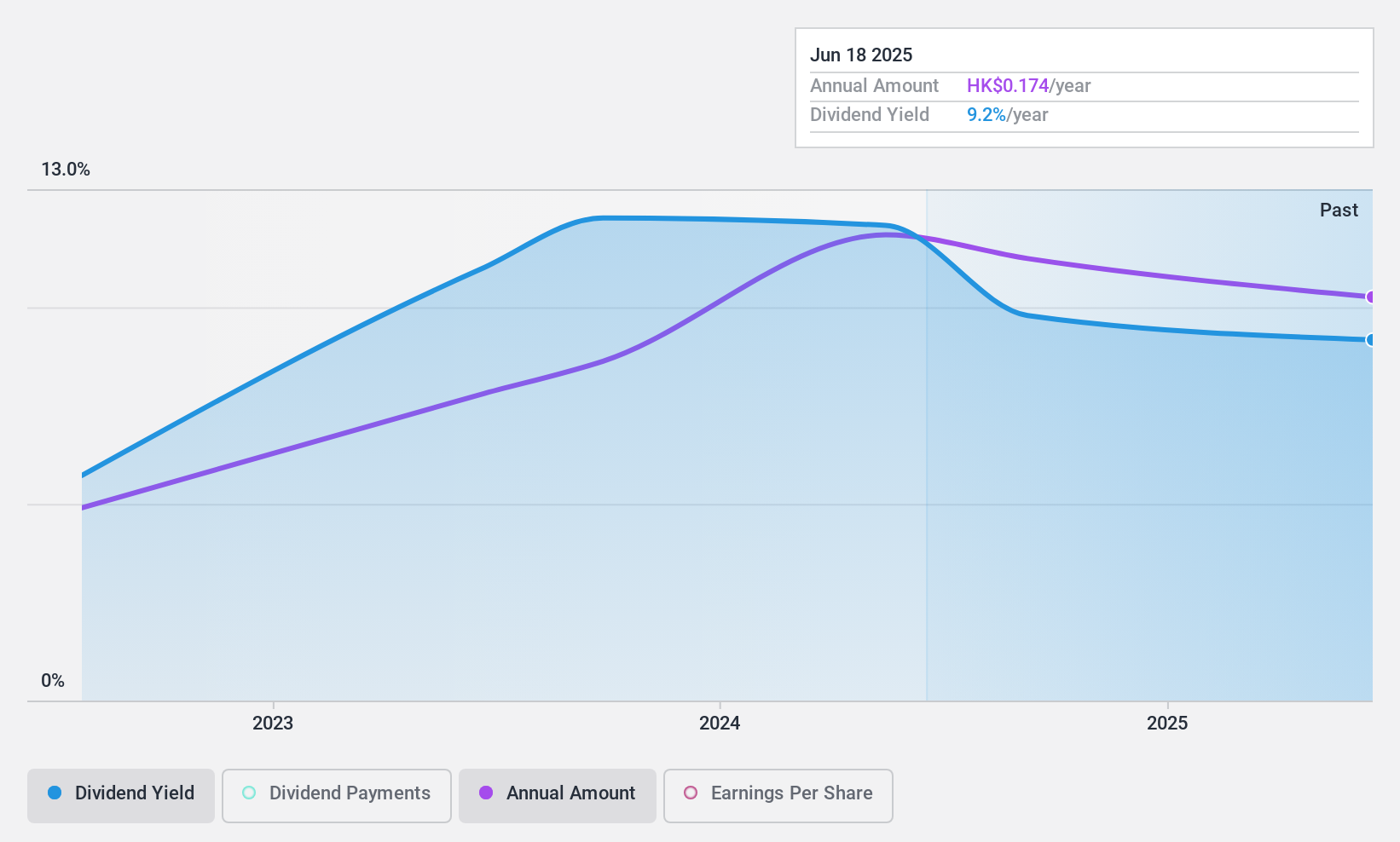

Dividend Yield: 9.2%

New Hope Service Holdings' dividend payments are covered by both earnings and cash flows, with payout ratios around 63%. However, the company has a history of volatile dividends over its three-year payment period, including annual drops exceeding 20%. Despite this instability, its dividend yield is in the top 25% within the Hong Kong market. Earnings grew by 5.2% last year, but overall dividend reliability remains a concern for investors.

- Delve into the full analysis dividend report here for a deeper understanding of New Hope Service Holdings.

- The valuation report we've compiled suggests that New Hope Service Holdings' current price could be quite moderate.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products in Singapore, Greater China, Australia, India, and internationally with a market cap of SGD254.07 million.

Operations: Multi-Chem Limited generates revenue from several segments, including SGD389.78 million from the IT Business in Singapore, SGD68.30 million from the IT Business in India, SGD45.99 million from the IT Business in Australia, and SGD1.63 million from the PCB Business in Singapore.

Dividend Yield: 9.4%

Multi-Chem's dividend yield ranks in the top 25% of Singapore's market, supported by a payout ratio of 79.8% and a cash payout ratio of 72.7%, indicating coverage by both earnings and cash flows. Despite this, dividends have been volatile over the past decade with significant fluctuations. Recent earnings growth of 16.4% suggests potential for future stability, but historical instability may concern investors seeking consistent dividend income.

- Get an in-depth perspective on Multi-Chem's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Multi-Chem is trading behind its estimated value.

NEC Capital Solutions (TSE:8793)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NEC Capital Solutions Limited offers financial services in Japan and has a market cap of ¥82.50 billion.

Operations: NEC Capital Solutions Limited generates revenue through its Lease Business at ¥229.64 billion, Finance Business at ¥9.15 billion, and Investment Business at ¥11.99 billion.

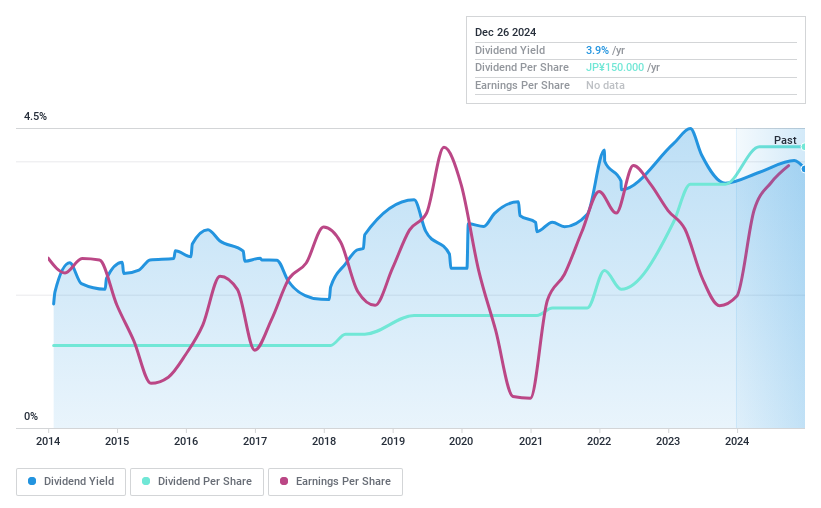

Dividend Yield: 3.9%

NEC Capital Solutions' dividend yield is among the top 25% in Japan, yet its sustainability is questionable due to a lack of free cash flow coverage. Despite a low payout ratio of 35.6%, dividends have been unreliable and volatile over the past decade, with significant drops exceeding 20% annually. Recent earnings growth of 114.5% might offer some optimism, but investors should remain cautious about ongoing dividend stability amidst recent corporate restructuring events like SBI Shinsei Bank's acquisition.

- Click here and access our complete dividend analysis report to understand the dynamics of NEC Capital Solutions.

- Insights from our recent valuation report point to the potential undervaluation of NEC Capital Solutions shares in the market.

Make It Happen

- Click here to access our complete index of 1951 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NEC Capital Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8793

Solid track record, good value and pays a dividend.