- Hong Kong

- /

- Real Estate

- /

- SEHK:2869

Greentown Service Group's (HKG:2869) Upcoming Dividend Will Be Larger Than Last Year's

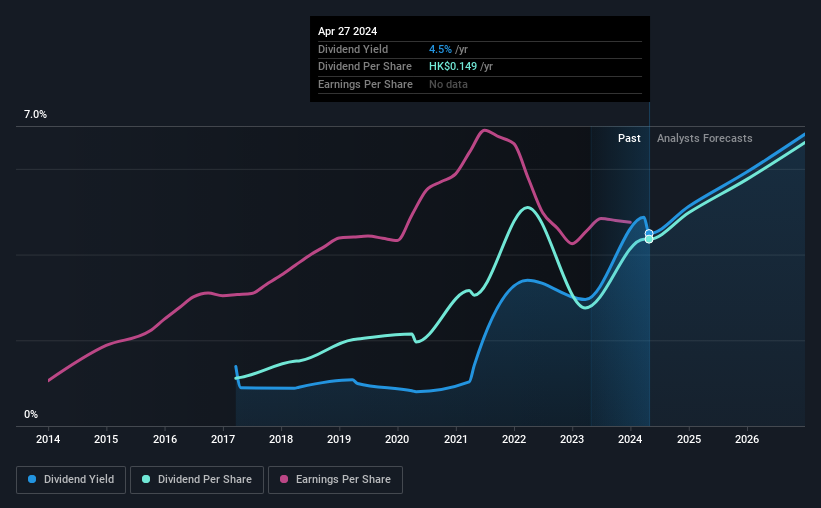

The board of Greentown Service Group Co. Ltd. (HKG:2869) has announced that it will be paying its dividend of CN¥0.15 on the 11th of July, an increased payment from last year's comparable dividend. Even though the dividend went up, the yield is still quite low at only 4.5%.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Greentown Service Group's stock price has increased by 31% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

Check out our latest analysis for Greentown Service Group

Greentown Service Group's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. The last payment made up 72% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Over the next year, EPS is forecast to expand by 66.1%. If the dividend continues on this path, the payout ratio could be 55% by next year, which we think can be pretty sustainable going forward.

Greentown Service Group's Dividend Has Lacked Consistency

Greentown Service Group has been paying dividends for a while, but the track record isn't stellar. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. Since 2017, the annual payment back then was CN¥0.0354, compared to the most recent full-year payment of CN¥0.138. This means that it has been growing its distributions at 22% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. However, Greentown Service Group's EPS was effectively flat over the past five years, which could stop the company from paying more every year. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 2 warning signs for Greentown Service Group that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2869

Greentown Service Group

Provides residential property management services in the People's Republic of China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.