- Hong Kong

- /

- Real Estate

- /

- SEHK:2777

Strong week for Guangzhou R&F Properties (HKG:2777) shareholders doesn't alleviate pain of five-year loss

It is doubtless a positive to see that the Guangzhou R&F Properties Co., Ltd. (HKG:2777) share price has gained some 121% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Indeed, the share price is down a whopping 87% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

On a more encouraging note the company has added HK$675m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Check out our latest analysis for Guangzhou R&F Properties

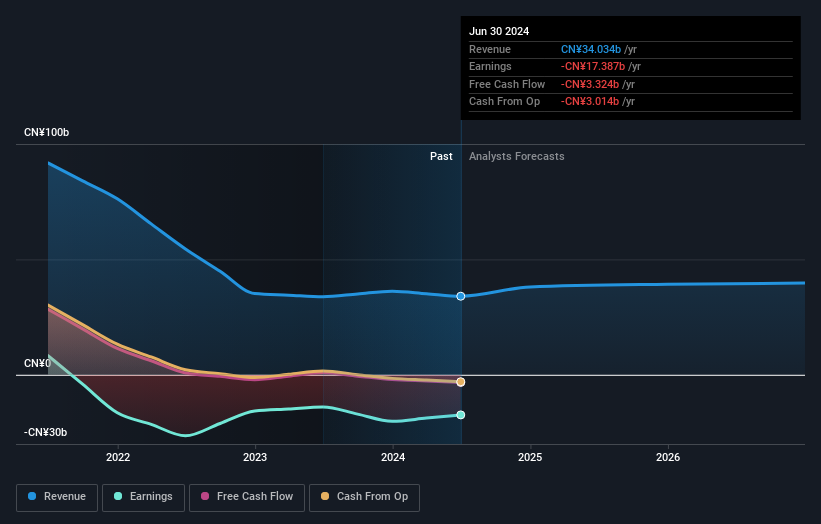

Guangzhou R&F Properties wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Guangzhou R&F Properties saw its revenue shrink by 23% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 13% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Guangzhou R&F Properties' financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Guangzhou R&F Properties' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Guangzhou R&F Properties' TSR of was a loss of 83% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Guangzhou R&F Properties shareholders have received a total shareholder return of 41% over one year. That certainly beats the loss of about 13% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Guangzhou R&F Properties , and understanding them should be part of your investment process.

We will like Guangzhou R&F Properties better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2777

Guangzhou R&F Properties

Engages in the development and sale of residential and commercial properties in the People’s Republic of China, Malaysia, Cambodia, Korea, the United Kingdom, and Australia.

Mediocre balance sheet low.