- Hong Kong

- /

- Real Estate

- /

- SEHK:2165

Most Shareholders Will Probably Find That The Compensation For Ling Yue Services Group Limited's (HKG:2165) CEO Is Reasonable

Key Insights

- Ling Yue Services Group's Annual General Meeting to take place on 30th of May

- Salary of CN¥287.0k is part of CEO Ziqin Luo's total remuneration

- The overall pay is 65% below the industry average

- Over the past three years, Ling Yue Services Group's EPS fell by 0.3% and over the past three years, the total shareholder return was 82%

Shareholders may be wondering what CEO Ziqin Luo plans to do to improve the less than great performance at Ling Yue Services Group Limited (HKG:2165) recently. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 30th of May. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for Ling Yue Services Group

How Does Total Compensation For Ziqin Luo Compare With Other Companies In The Industry?

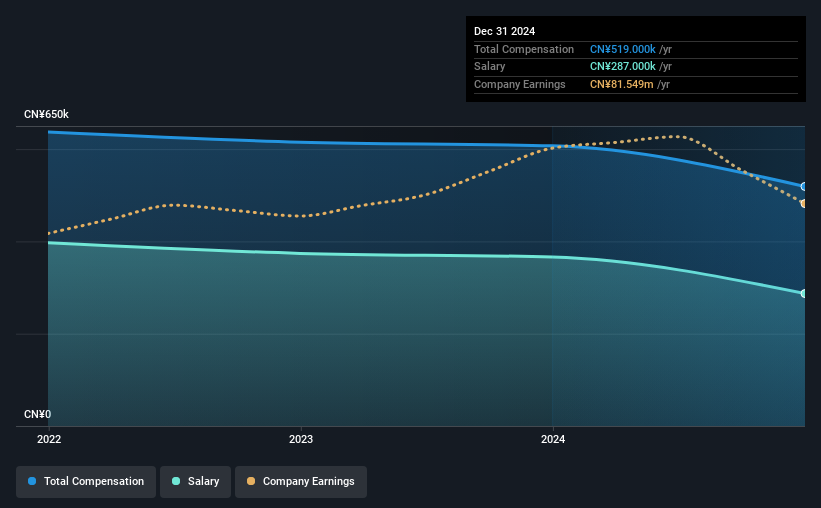

At the time of writing, our data shows that Ling Yue Services Group Limited has a market capitalization of HK$349m, and reported total annual CEO compensation of CN¥519k for the year to December 2024. We note that's a decrease of 14% compared to last year. We note that the salary of CN¥287.0k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Hong Kong Real Estate industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was CN¥1.5m. In other words, Ling Yue Services Group pays its CEO lower than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥287k | CN¥366k | 55% |

| Other | CN¥232k | CN¥241k | 45% |

| Total Compensation | CN¥519k | CN¥607k | 100% |

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. Ling Yue Services Group pays a modest slice of remuneration through salary, as compared to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Ling Yue Services Group Limited's Growth

Over the last three years, Ling Yue Services Group Limited has not seen its earnings per share change much, though they have deteriorated slightly. It achieved revenue growth of 7.2% over the last year.

A lack of EPS improvement is not good to see. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Ling Yue Services Group Limited Been A Good Investment?

We think that the total shareholder return of 82%, over three years, would leave most Ling Yue Services Group Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Ling Yue Services Group that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2165

Ling Yue Services Group

An investment holding company, provides property management, value-added, and community value-added services in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026