The board of Swire Properties Limited (HKG:1972) has announced that it will pay a dividend of HK$0.35 per share on the 9th of October. This takes the annual payment to 5.2% of the current stock price, which unfortunately is below what the industry is paying.

Swire Properties' Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Swire Properties' Could Struggle to Maintain Dividend Payments In The Future

Swire Properties' Future Dividends May Potentially Be At Risk

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Swire Properties is unprofitable despite paying a dividend, and it is paying out 108% of its free cash flow. This makes us feel that the dividend will be hard to maintain.

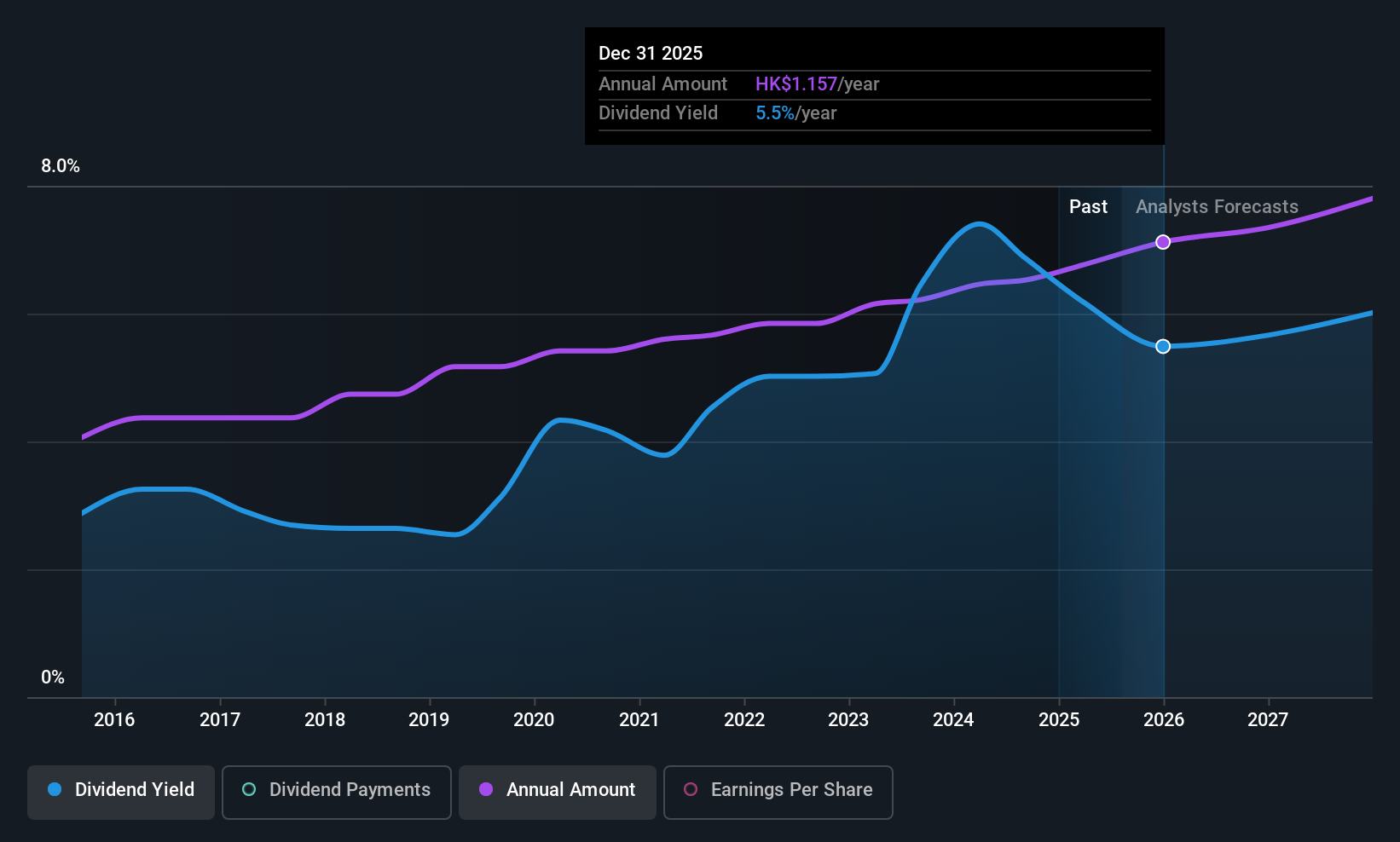

Over the next year, EPS is forecast to expand by 182.4%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

See our latest analysis for Swire Properties

Swire Properties Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was HK$0.66 in 2015, and the most recent fiscal year payment was HK$1.10. This means that it has been growing its distributions at 5.2% per annum over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Swire Properties' EPS has fallen by approximately 31% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Swire Properties' Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Swire Properties' payments are rock solid. Although they have been consistent in the past, we think the payments are a little high to be sustained. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For instance, we've picked out 1 warning sign for Swire Properties that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, and the United States.

Moderate growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)