- Hong Kong

- /

- Real Estate

- /

- SEHK:173

3 Promising Penny Stocks With Market Caps Under US$800M

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and consumer spending concerns, major U.S. stock indexes have experienced fluctuations, closing lower after an initial rise earlier in the week. In such volatile times, investors often seek opportunities in less conventional areas of the market. Penny stocks, despite their somewhat antiquated name, continue to attract attention for their potential value and growth prospects. These smaller or newer companies can offer affordability coupled with significant upside when backed by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.80 | HK$43.62B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.295 | MYR820.74M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.95 | SEK295.44M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.90 | £319.11M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.04 | THB2.42B | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.90 | £450.22M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.155 | £303.34M | ★★★★☆☆ |

| United U-LI Corporation Berhad (KLSE:ULICORP) | MYR1.46 | MYR317.99M | ★★★★★★ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

K. Wah International Holdings (SEHK:173)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: K. Wah International Holdings Limited is an investment holding company involved in property development and investment in Hong Kong and Mainland China, with a market capitalization of approximately HK$5.61 billion.

Operations: The company's revenue is primarily derived from property development in Mainland China (HK$2.81 billion) and Hong Kong (HK$670 million), along with property investment generating HK$634.10 million.

Market Cap: HK$5.61B

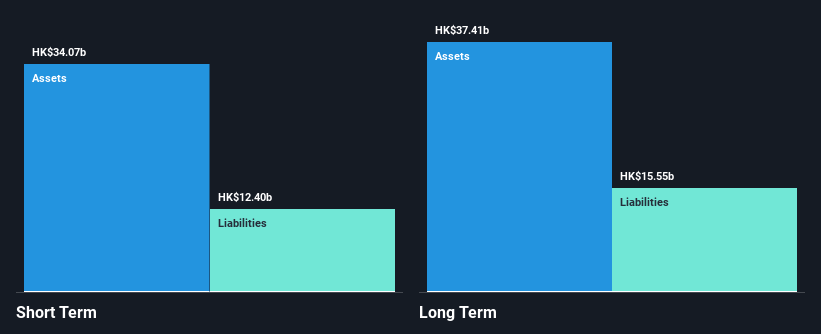

K. Wah International Holdings, with a market capitalization of HK$5.61 billion, has seen its earnings decline by 31.4% annually over the past five years, while facing a forecasted average earnings decline of 14.3% per year for the next three years. Despite negative operating cash flow and a dividend not well covered by free cash flows, the company maintains strong asset coverage over both short-term (HK$12.4B) and long-term liabilities (HK$15.6B). Its board is seasoned with an average tenure of 14.8 years, and interest payments are well-covered by EBIT at 5.7 times coverage, indicating financial resilience amidst volatility in earnings growth.

- Click here and access our complete financial health analysis report to understand the dynamics of K. Wah International Holdings.

- Examine K. Wah International Holdings' earnings growth report to understand how analysts expect it to perform.

Guangdong Wanlima Industry Ltd (SZSE:300591)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangdong Wanlima Industry Co., Ltd designs, researches, produces, manufactures, and markets leather products in China with a market cap of CN¥1.73 billion.

Operations: Guangdong Wanlima Industry Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥1.73B

Guangdong Wanlima Industry Ltd., with a market cap of CN¥1.73 billion, faces challenges as it remains unprofitable and has seen losses increase by 25.8% annually over the past five years. The company's short-term assets (CN¥592.8M) comfortably cover both its short-term (CN¥443.8M) and long-term liabilities (CN¥23.8M), indicating some financial stability despite its negative return on equity (-33.8%). The management team is experienced, averaging 7.1 years in tenure, while the debt to equity ratio has improved from 68.5% to 35.7%, reflecting prudent financial management amidst ongoing profitability struggles.

- Click here to discover the nuances of Guangdong Wanlima Industry Ltd with our detailed analytical financial health report.

- Evaluate Guangdong Wanlima Industry Ltd's historical performance by accessing our past performance report.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, other European countries, the United States, and internationally, and has a market cap of €112.32 million.

Operations: Heidelberg Pharma generates revenue primarily from its ADC Technology and Customer Specific Research segment, amounting to €8.47 million.

Market Cap: €112.32M

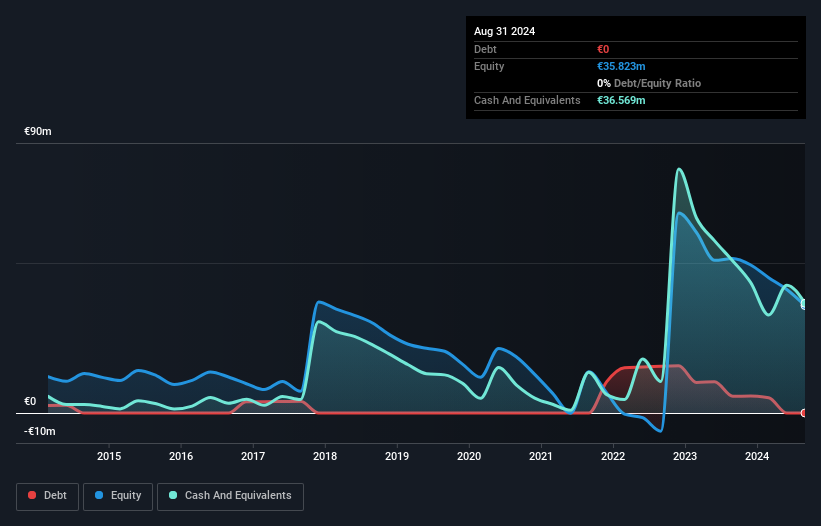

Heidelberg Pharma AG, with a market cap of €112.32 million, is advancing its ATAC candidate HDP-101 in a Phase I/IIa study for multiple myeloma, showing promising results such as complete remission in heavily pre-treated patients. Despite being unprofitable and experiencing increased losses over five years, the company maintains financial stability with short-term assets exceeding both short and long-term liabilities and remains debt-free. The management team is relatively new with an average tenure of 1.9 years; however, the board is seasoned with an average tenure of 12.8 years. Revenue growth is forecasted at 16.64% annually despite ongoing challenges to profitability.

- Dive into the specifics of Heidelberg Pharma here with our thorough balance sheet health report.

- Gain insights into Heidelberg Pharma's future direction by reviewing our growth report.

Taking Advantage

- Click through to start exploring the rest of the 5,711 Penny Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K. Wah International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:173

K. Wah International Holdings

An investment holding company, engages in the property development and investment businesses in Hong Kong and Mainland China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives