- Hong Kong

- /

- Real Estate

- /

- SEHK:101

Will Board Expertise Drive a Strategic Shift at Hang Lung Properties (SEHK:101)?

Reviewed by Sasha Jovanovic

- The Board of Directors of Hang Lung Properties Limited recently appointed Mr. Andrew Walter Bougourd Ross Weir as a Non-Executive Director, effective October 1, 2025, bringing thirty-eight years of experience in auditing, finance, and governance across multiple prominent organizations.

- Mr. Weir's longstanding leadership roles in the finance sector and contributions to professional governance underscore an enhanced focus on board expertise at Hang Lung Properties.

- We’ll explore how the addition of Mr. Weir’s governance and risk management background could influence Hang Lung Properties’ investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hang Lung Properties Investment Narrative Recap

Investors considering Hang Lung Properties are generally betting on a recovery in tenant sales, a pick-up in premium retail demand, and successful execution of projects in Mainland China. While the addition of Mr. Andrew Weir to the board brings significant audit and governance experience, it is not expected to materially alter the main short-term catalyst, strengthening consumer demand in retail, or directly resolve the biggest risk, which remains weak tenant sales and office leasing challenges in key cities.

The announcement of the reduced interim dividend of HK$0.12 per share, declared shortly before Mr. Weir's appointment, highlights ongoing earnings and cash flow pressures that remain front of mind for shareholders. This aligns with the need for disciplined financial management, especially as the company approaches the end of its capital expenditure cycle.

However, investors should also be alert to the risk that persistent weakness in tenant sales and flat rental growth could...

Read the full narrative on Hang Lung Properties (it's free!)

Hang Lung Properties' outlook forecasts HK$12.7 billion in revenue and HK$4.1 billion in earnings by 2028. This implies an annual revenue growth rate of 8.1% and a HK$2.1 billion increase in earnings from the current HK$2.0 billion.

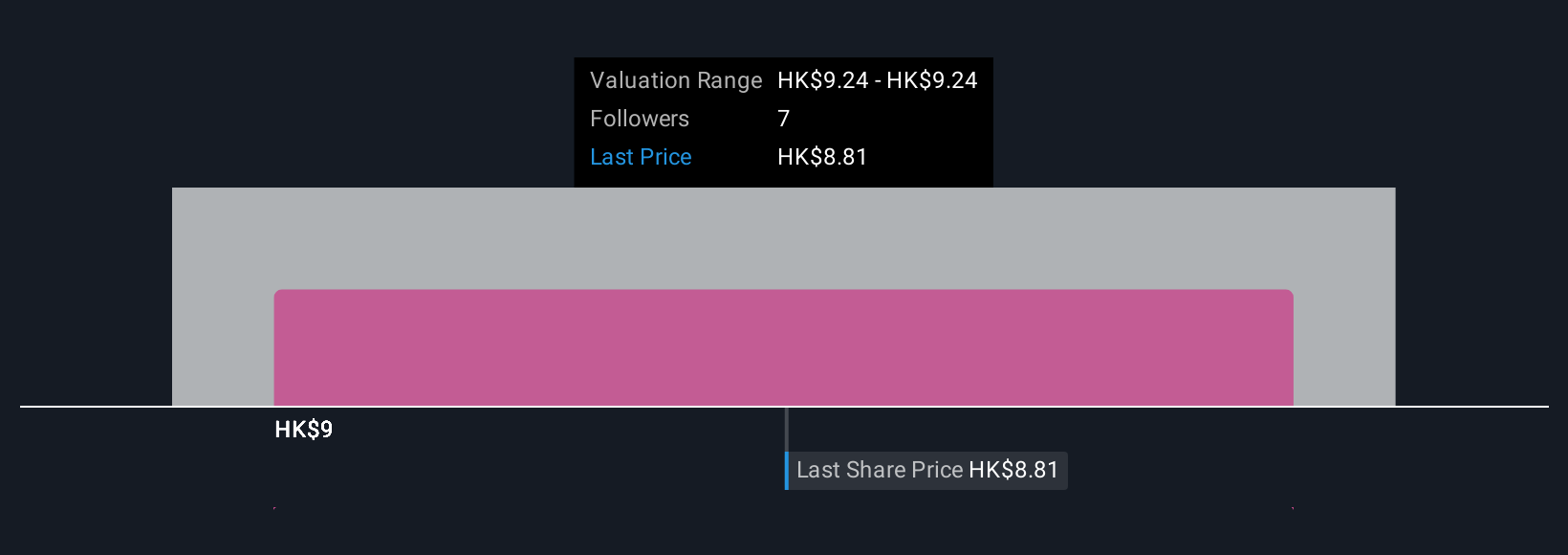

Uncover how Hang Lung Properties' forecasts yield a HK$9.08 fair value, a 5% upside to its current price.

Exploring Other Perspectives

One Simply Wall St Community estimate pegs Hang Lung Properties’ fair value at HK$9.08, signaling limited diversity in community outlooks. With revenue and rental growth under pressure, the importance of independent perspectives is clear, explore several alternative viewpoints before making decisions.

Explore another fair value estimate on Hang Lung Properties - why the stock might be worth just HK$9.08!

Build Your Own Hang Lung Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hang Lung Properties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Hang Lung Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hang Lung Properties' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:101

Hang Lung Properties

An investment holding company, engages in the property investment, development, and management activities in Hong Kong and Mainland China.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives