- Hong Kong

- /

- Real Estate

- /

- SEHK:1009

International Entertainment (HKG:1009) jumps 45% this week, taking three-year gains to 269%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For instance the International Entertainment Corporation (HKG:1009) share price is 269% higher than it was three years ago. How nice for those who held the stock! Better yet, the share price has risen 45% in the last week.

The past week has proven to be lucrative for International Entertainment investors, so let's see if fundamentals drove the company's three-year performance.

See our latest analysis for International Entertainment

International Entertainment wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

International Entertainment's revenue trended up 48% each year over three years. That's well above most pre-profit companies. Meanwhile, the share price performance has been pretty solid at 55% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

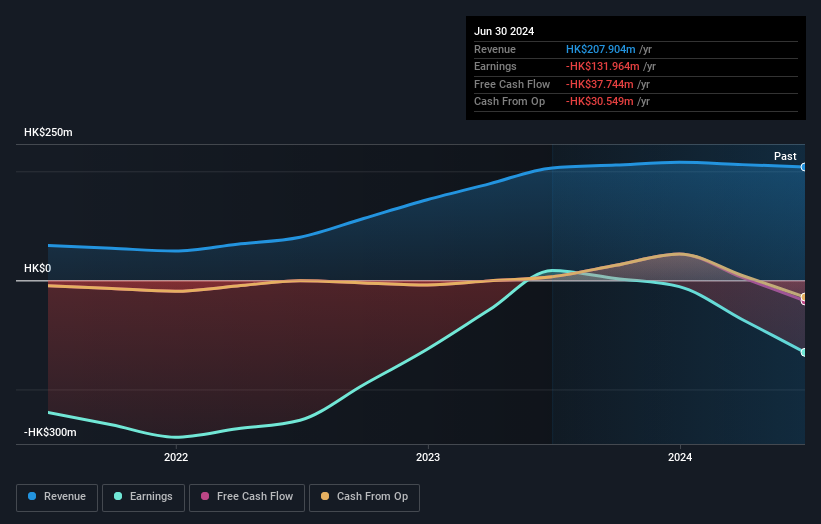

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

International Entertainment shareholders are up 21% for the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 20% per year over five year. It is possible that returns will improve along with the business fundamentals. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for International Entertainment you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1009

International Entertainment

An investment holding company, engages in the leasing of properties equipped with entertainment equipment.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives