- Hong Kong

- /

- Real Estate

- /

- SEHK:1009

International Entertainment Corporation (HKG:1009) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, International Entertainment Corporation (HKG:1009) shares are down a considerable 27% in the last month, which continues a horrid run for the company. Regardless, last month's decline is barely a blip on the stock's price chart as it has gained a monstrous 329% in the last year.

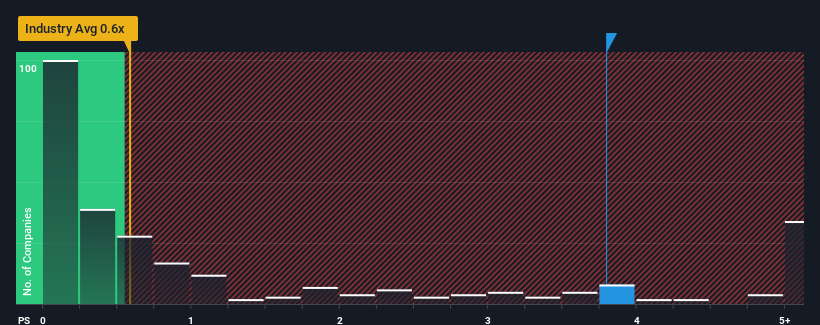

Even after such a large drop in price, when almost half of the companies in Hong Kong's Real Estate industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider International Entertainment as a stock not worth researching with its 3.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for International Entertainment

How Has International Entertainment Performed Recently?

Recent times have been quite advantageous for International Entertainment as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for International Entertainment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is International Entertainment's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like International Entertainment's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 46% last year. The latest three year period has also seen an excellent 117% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 3.9% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why International Entertainment is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Even after such a strong price drop, International Entertainment's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of International Entertainment revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for International Entertainment with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on International Entertainment, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1009

International Entertainment

An investment holding company, engages in the leasing of properties equipped with entertainment equipment.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives