- Hong Kong

- /

- Real Estate

- /

- SEHK:10

What Hang Lung Group (SEHK:10)'s Golden Week Sales Surge Means For Shareholders

Reviewed by Sasha Jovanovic

- Hang Lung Properties announced strong operational results from its Chinese mainland and Hong Kong properties during the National Day Golden Week, including major sales and visitor increases, especially at Heartland 66, Grand Gateway 66, and Hong Kong’s Peak Galleria.

- Sales growth in mainland malls resumed in the third quarter, reversing earlier declines, highlighting the impact of flagship store openings and reinvigorated consumer activity.

- With tenant sales rebounding and new flagship stores opening, we’ll explore how this renewed retail momentum may shape Hang Lung’s investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Hang Lung Group's Investment Narrative?

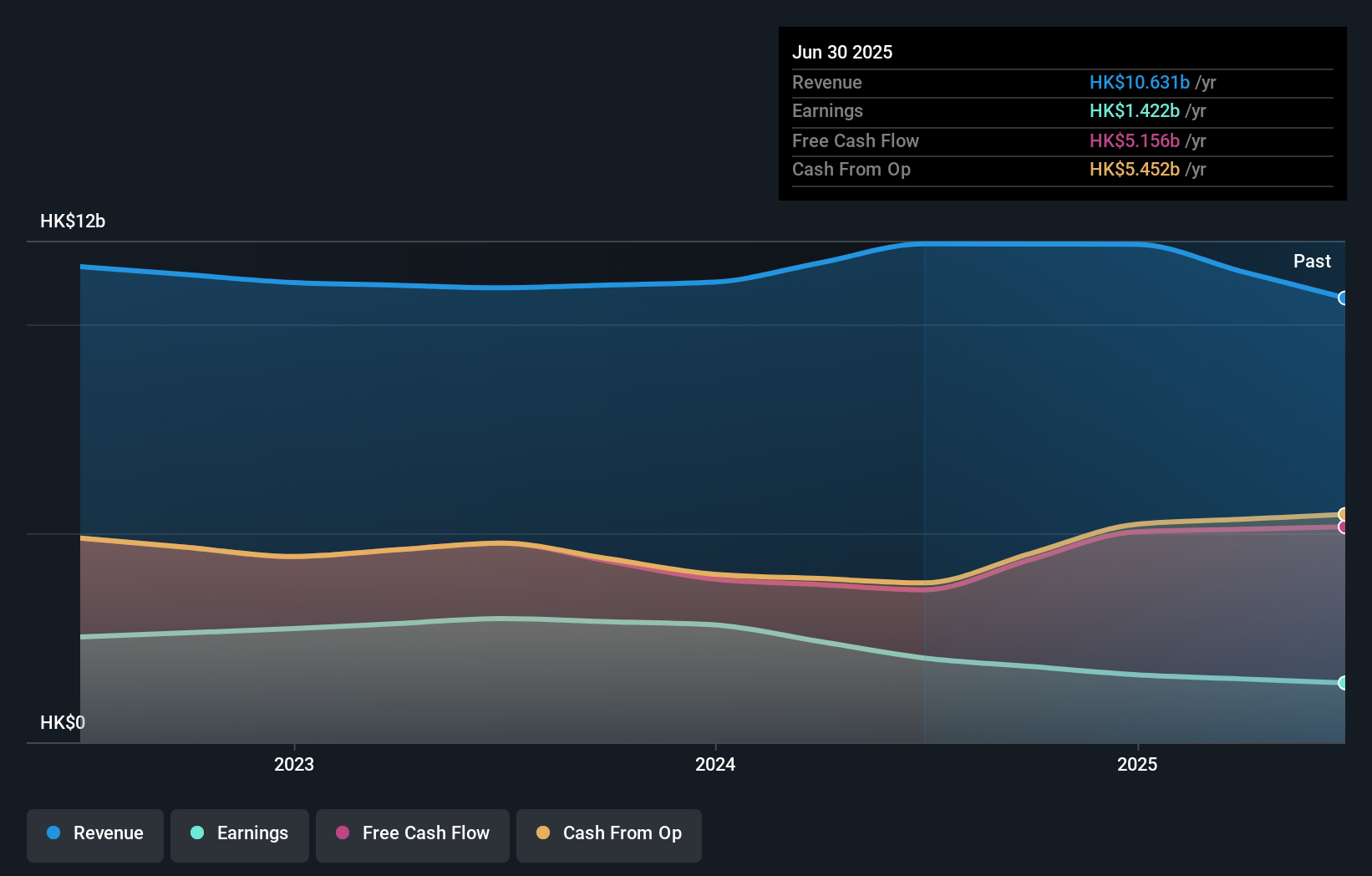

Owning Hang Lung Group means believing in the resilience and recovery prospects of Asia’s retail and commercial property markets, especially in mainland China and Hong Kong. For much of 2025, the company’s earnings story was weighed down by softer revenue, declining net income and slimmed margins, with earlier analysis spotlighting weak consumer demand as a major risk. However, this October’s Golden Week news moderates that picture: strong sales and surging footfall at flagship malls and the opening of new high-profile stores could energize short-term performance and push retail momentum back to the center of the investment case. That said, while this operational uptick is promising, it remains to be seen if it fundamentally changes the company’s biggest risk, persistent earnings volatility caused by shifting consumer sentiment and market conditions. Investors may want to watch if these early signs of revival turn into a meaningful trend.

But even with improving retail activity, there’s still the potential for earnings volatility ahead, something investors should watch closely.

Exploring Other Perspectives

Explore another fair value estimate on Hang Lung Group - why the stock might be worth just HK$42.90!

Build Your Own Hang Lung Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hang Lung Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hang Lung Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hang Lung Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:10

Hang Lung Group

An investment holding company, operates as a property developer in Hong Kong and Mainland China.

Established dividend payer with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.