Some Alphamab Oncology (HKG:9966) Shareholders Look For Exit As Shares Take 48% Pounding

Alphamab Oncology (HKG:9966) shareholders that were waiting for something to happen have been dealt a blow with a 48% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

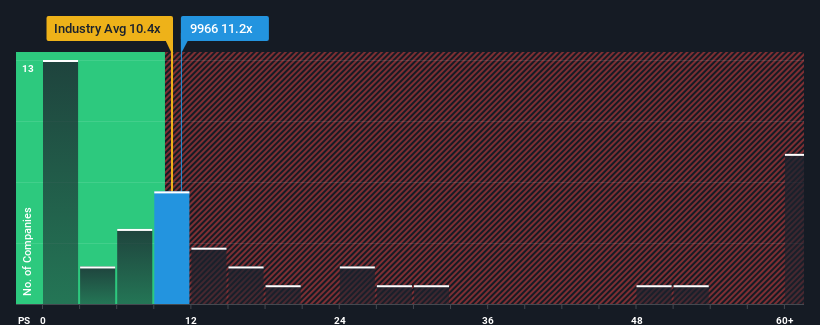

Although its price has dipped substantially, it's still not a stretch to say that Alphamab Oncology's price-to-sales (or "P/S") ratio of 11.2x right now seems quite "middle-of-the-road" compared to the Biotechs industry in Hong Kong, where the median P/S ratio is around 10.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Alphamab Oncology

How Alphamab Oncology Has Been Performing

Alphamab Oncology could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Alphamab Oncology.How Is Alphamab Oncology's Revenue Growth Trending?

In order to justify its P/S ratio, Alphamab Oncology would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 46% per year over the next three years. With the industry predicted to deliver 53% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Alphamab Oncology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Alphamab Oncology's P/S Mean For Investors?

Following Alphamab Oncology's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Alphamab Oncology's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Alphamab Oncology that you should be aware of.

If these risks are making you reconsider your opinion on Alphamab Oncology, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9966

Alphamab Oncology

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of biotherapeutics for cancer treatment in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026