High Growth Tech Stocks To Watch In Hong Kong This September 2024

Reviewed by Simply Wall St

As global markets show signs of recovery with technology stocks leading the charge, Hong Kong's tech sector remains a focal point for investors seeking high growth opportunities. Amidst this dynamic landscape, identifying promising tech stocks involves evaluating their innovation potential, market position, and resilience to economic fluctuations.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Akeso | 33.07% | 54.67% | ★★★★★★ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 22.35% | 59.39% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315)

Simply Wall St Growth Rating: ★★★★★☆

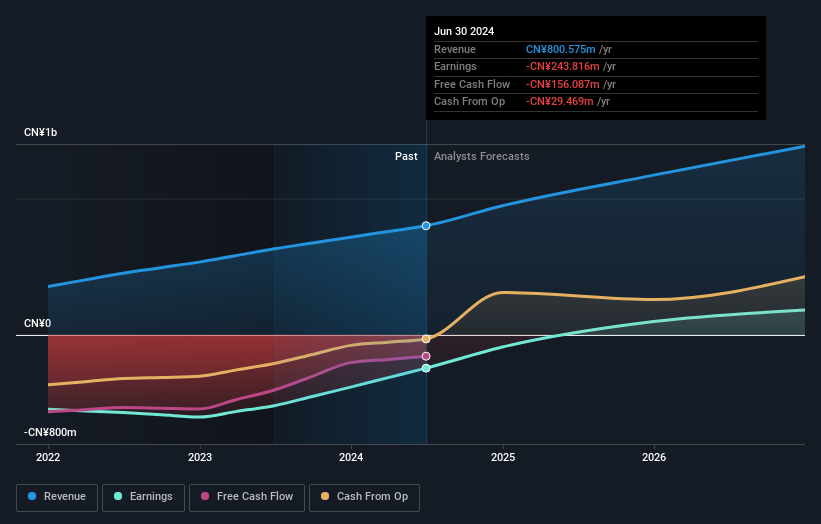

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology company focused on the research and development of antibody-based drugs, operating in China, the United States, and internationally, with a market cap of HK$2.48 billion.

Operations: Biocytogen Pharmaceuticals generates revenue primarily from animal model sales (CN¥354.44 million), antibody development (CN¥205.83 million), and pre-clinical pharmacology and efficacy evaluation (CN¥185.41 million). The company also engages in gene editing services, contributing CN¥75.50 million to its revenue stream.

Biocytogen Pharmaceuticals (Beijing) has shown resilience with a significant reduction in net loss from CNY 189.81 million to CNY 50.67 million year-on-year, reflecting robust operational improvements and strategic R&D investments. The company's sales surged by 21.5% to CNY 410.5 million, outpacing the industry's average growth rate, driven by its high-margin antibody licensing and innovative animal model sales which continue to attract global pharmaceutical clients. With continued focus on these areas alongside a decrease in R&D expenses as a percentage of revenue, Biocytogen is strategically positioning itself for sustained growth in the biotech sector, leveraging cutting-edge gene-editing technologies to enhance its market footprint significantly.

Wasion Holdings (SEHK:3393)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wasion Holdings Limited is an investment holding company that focuses on the research, development, production, and sale of energy metering and energy efficiency management solutions for various global markets including China, Africa, the United States, Europe, and Asia; its market cap stands at approximately HK$5.66 billion.

Operations: Wasion Holdings generates revenue primarily from three segments: Power Advanced Metering Infrastructure (CN¥2.99 billion), Advanced Distribution Operations (CN¥2.51 billion), and Communication and Fluid Advanced Metering Infrastructure (CN¥2.42 billion). The company operates in markets including China, Africa, the United States, Europe, and Asia.

Wasion Holdings has demonstrated a robust financial trajectory with its recent half-year earnings, showing a significant increase in net income from CNY 213.82 million to CNY 331.03 million. This growth is propelled by a notable rise in sales revenue, up by over 16% year-on-year to CNY 3.74 billion, and strategic cost control measures that have enhanced profitability. The company's commitment to innovation is evident in its R&D investments which are crucial for sustaining its competitive edge in the high-tech industry of Hong Kong. Moreover, Wasion's successful expansion into international markets through winning substantial contracts in Hungary and Southeast Asia underscores its growing global footprint and the trust international clients place in its advanced smart meter solutions.

- Take a closer look at Wasion Holdings' potential here in our health report.

Examine Wasion Holdings' past performance report to understand how it has performed in the past.

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphamab Oncology, a clinical stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of oncology biologics with a market cap of HK$2.44 billion.

Operations: The company's primary revenue stream is derived from the sale of pharmaceuticals, amounting to CN¥255.87 million. As a clinical stage biopharmaceutical entity, it focuses on oncology biologics through its research, development, and manufacturing efforts.

Alphamab Oncology, a player in the high-growth tech sector of Hong Kong, is making significant strides with its innovative biopharmaceutical solutions. The company's recent presentation at the ESMO Congress 2024 highlighted promising clinical data from its anti-HER2 antibody-drug conjugate, JSKN003, showing an objective response rate of 56.8% in platinum-resistant ovarian cancer patients. This positions Alphamab as a frontrunner in addressing urgent needs within oncology treatment frameworks. Financially, while still navigating towards profitability with a reported net loss of CNY 44.9 million for the first half of 2024, Alphamab's revenue has grown by 39.4% year-on-year to CNY 173.56 million—indicative of robust market demand for its specialized therapies. Furthermore, the company's commitment to enhancing shareholder value is evident from its recent share repurchase initiative launched on August 27, underlining confidence in its long-term growth trajectory within the competitive biotech landscape.

- Get an in-depth perspective on Alphamab Oncology's performance by reading our health report here.

Gain insights into Alphamab Oncology's past trends and performance with our Past report.

Summing It All Up

- Gain an insight into the universe of 45 SEHK High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biocytogen Pharmaceuticals (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2315

Biocytogen Pharmaceuticals (Beijing)

A biotechnology company, engages in the research and development of antibody-based drugs in the People’s Republic of China, the United States, and internationally.

Adequate balance sheet and slightly overvalued.