As the Hong Kong market navigates a period of economic uncertainty, characterized by mixed inflation data and fluctuating indices, investors are keenly observing the tech sector for opportunities. In this landscape, identifying high-growth tech stocks involves assessing companies with strong fundamentals, innovative capabilities, and resilience to broader market volatility.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| Innovent Biologics | 22.34% | 59.40% | ★★★★★☆ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 33.07% | 54.67% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets for oncology, ophthalmology, autoimmune, cardiovascular, and metabolic diseases in China with a market cap of HK$71.85 billion.

Operations: Innovent Biologics generates revenue primarily from its biotechnology segment, reporting CN¥7.46 billion. The company focuses on developing and commercializing monoclonal antibodies and other drug assets across multiple therapeutic areas in China.

Innovent Biologics has seen a robust 22.3% annual revenue growth, outpacing the Hong Kong market's 7.3%. Despite a net loss of ¥392.62 million for H1 2024, sales surged to ¥3.95 billion from ¥2.70 billion the previous year. Innovent's R&D expenses reflect its commitment to innovation, with significant investments leading to key product approvals like Dupert® for NSCLC patients with KRAS G12C mutations, potentially transforming lung cancer treatment in China.

Tencent Holdings (SEHK:700)

Simply Wall St Growth Rating: ★★★★☆☆

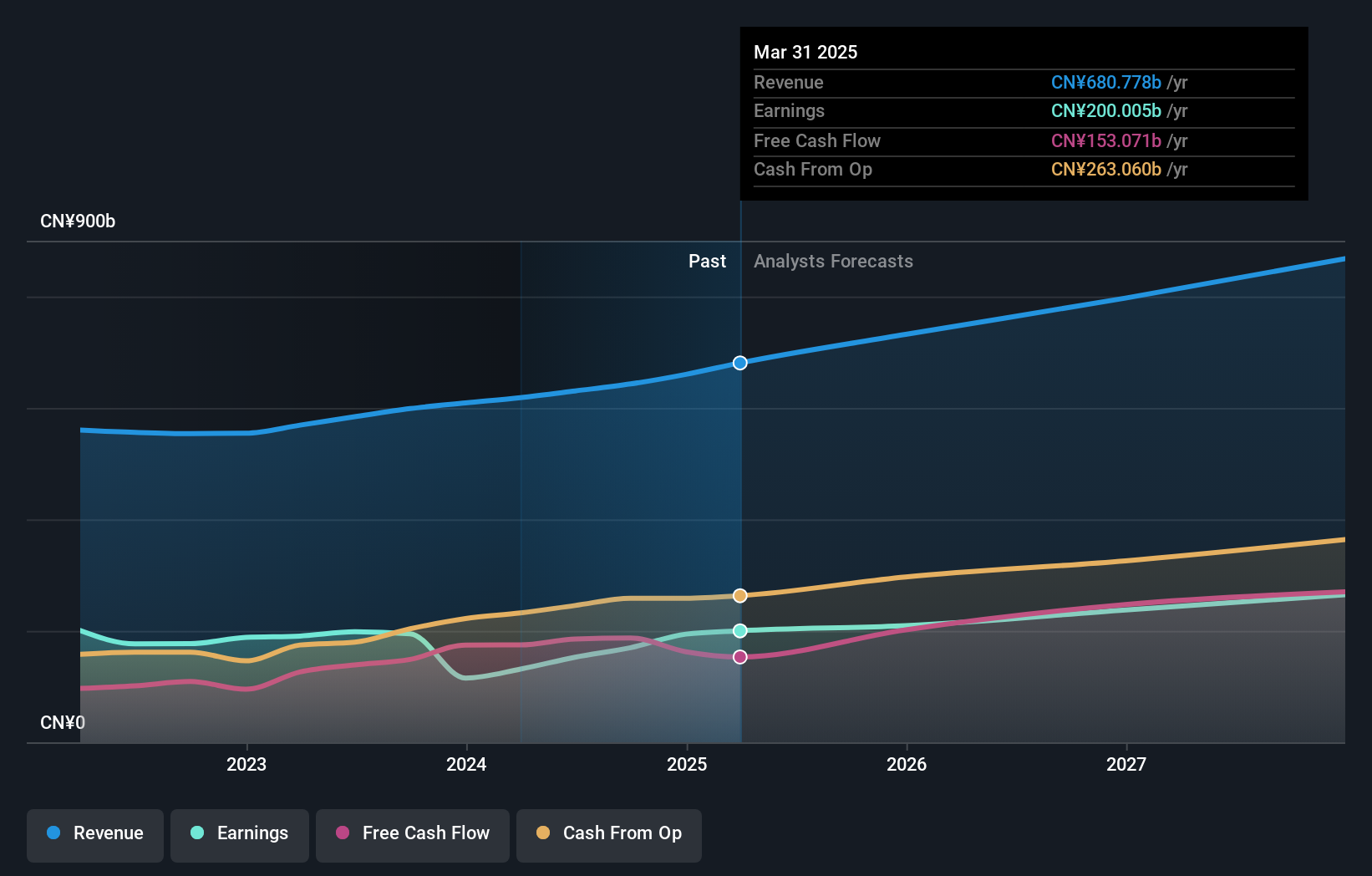

Overview: Tencent Holdings Limited, an investment holding company, provides a range of services including value-added services (VAS), online advertising, fintech, and business solutions both in China and globally, with a market cap of approximately HK$3.45 trillion.

Operations: Tencent Holdings generates revenue primarily through value-added services (CN¥302.28 billion), fintech and business services (CN¥209.17 billion), and online advertising (CN¥111.89 billion). The company focuses on diverse digital offerings both domestically and internationally.

Tencent Holdings has demonstrated robust financial performance, with Q2 2024 revenue rising to ¥161.12 billion from ¥149.21 billion the previous year, and net income climbing to ¥47.63 billion from ¥26.17 billion. The company's R&D expenses have been substantial, reflecting a strong commitment to innovation; in 2023 alone, Tencent allocated over ¥58 billion towards R&D efforts. Forecasted annual profit growth of 12.8% surpasses the Hong Kong market's average of 11.7%, indicating potential for sustained profitability despite recent negative earnings growth (-23%).

- Click to explore a detailed breakdown of our findings in Tencent Holdings' health report.

Evaluate Tencent Holdings' historical performance by accessing our past performance report.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$53.38 billion.

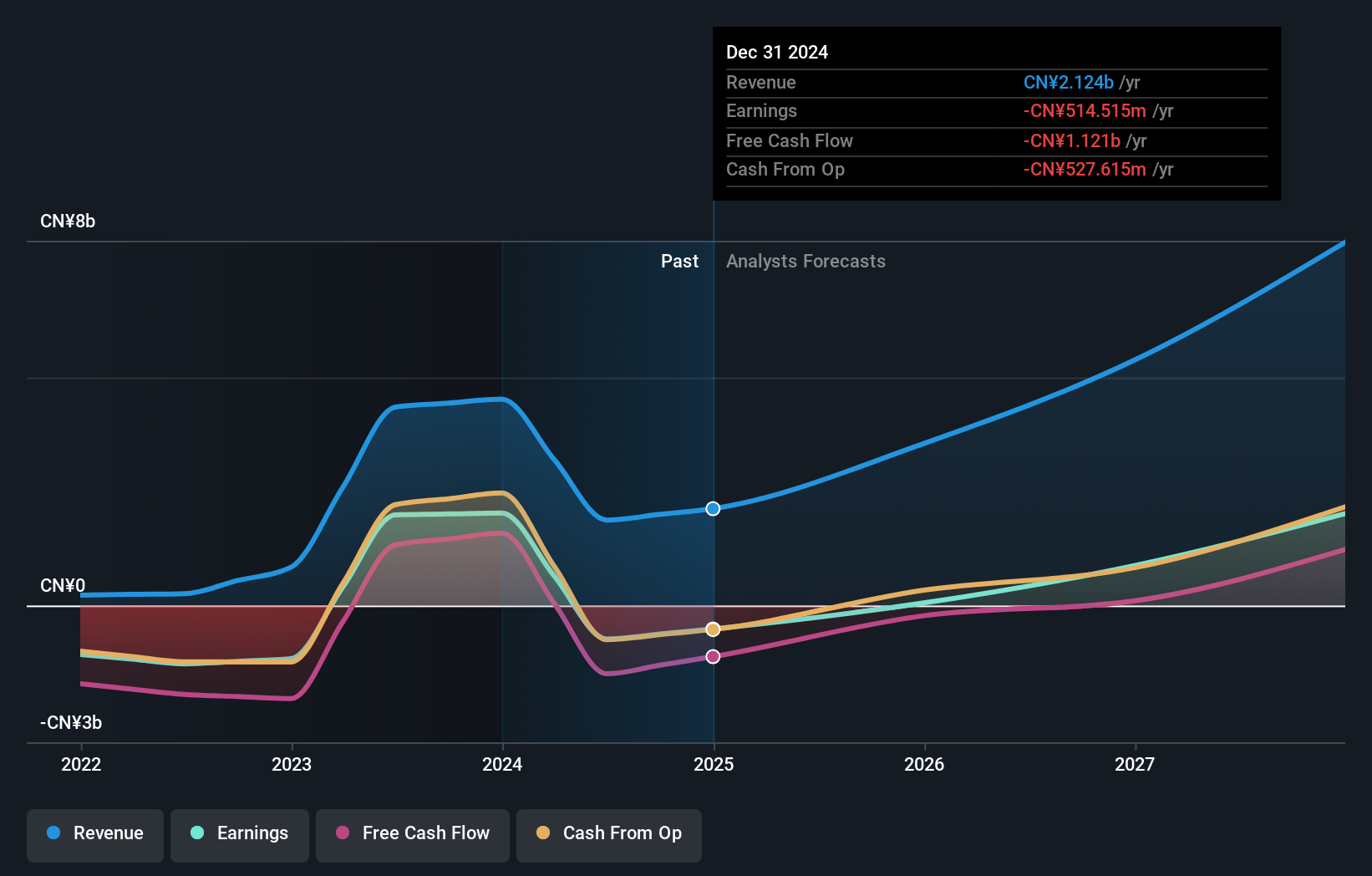

Operations: Akeso focuses on the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion in revenue from these activities. The company operates within the antibody drug market.

Akeso, a prominent biotech firm in Hong Kong, is experiencing significant growth with its innovative drug development pipeline. The company’s revenue is forecasted to grow at 33.1% annually, outpacing the Hong Kong market's average of 7.3%. Despite recent financial challenges including a net loss of ¥238.59 million for H1 2024, Akeso's R&D expenses reflect its commitment to innovation; over ¥58 billion was allocated towards R&D in 2023 alone. With earnings projected to grow by 54.67% per year and the company's strategic focus on cutting-edge therapies like ivonescimab for NSCLC, Akeso remains a dynamic player in the biotech sector.

- Unlock comprehensive insights into our analysis of Akeso stock in this health report.

Assess Akeso's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Gain an insight into the universe of 45 SEHK High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.