Does MG-K10’s COPD Trial Approval Change the Bull Case for China Medical System Holdings (SEHK:867)?

Reviewed by Sasha Jovanovic

- On September 29, 2025, China Medical System Holdings announced that its innovative anti-IL-4Ra monoclonal antibody MG-K10 received regulatory approval from China's National Medical Products Administration to begin clinical trials for Chronic Obstructive Pulmonary Disease (COPD).

- This milestone not only expands the company’s respiratory pipeline, but also highlights MG-K10’s potential as the first long-acting anti-IL-4Ra antibody therapy for multiple type 2 inflammatory diseases.

- We will examine how MG-K10's advancement into COPD trials shapes China Medical System Holdings' investment narrative and respiratory medicine ambitions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is China Medical System Holdings' Investment Narrative?

For anyone considering China Medical System Holdings, the investment story mainly rests on whether its pipeline of innovative drugs can deliver meaningful growth, both in revenue and market presence. The recent clinical trial approval for MG-K10 in COPD is a fresh catalyst, positioning the company at the forefront of long-acting therapies for chronic respiratory conditions. This development could accelerate the company’s transition from a dermatology and autoimmune focus to a broader respiratory portfolio, possibly improving its medium-term growth outlook. However, it’s important to recognize this approval is for clinical trials, not regulatory marketing clearance, so near-term impacts on earnings may remain limited until further clinical results emerge. The risks now tilt more toward whether these ambitious clinical programs translate into commercial success, especially as some earlier risks, like portfolio concentration, could ease with validation in new indications. On the flip side, failure in late-stage trials or delays could keep the share price and fair value debate alive.

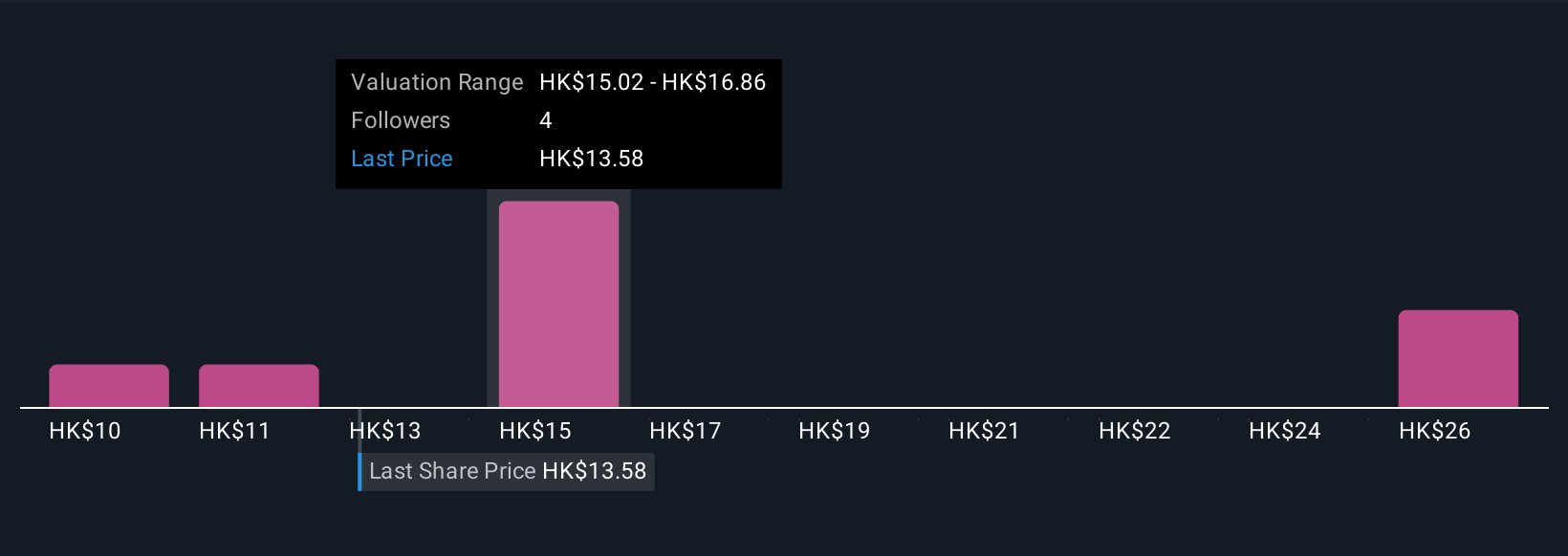

But emerging opportunities bring fresh clinical and commercial risks investors should keep in view. Despite retreating, China Medical System Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 4 other fair value estimates on China Medical System Holdings - why the stock might be worth 30% less than the current price!

Build Your Own China Medical System Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Medical System Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Medical System Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Medical System Holdings' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:867

China Medical System Holdings

An investment holding company, manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026