High Growth Tech Stocks in Hong Kong to Watch This September 2024

Reviewed by Simply Wall St

As global markets face heightened volatility and economic uncertainties, the Hong Kong market has not been immune to these pressures, with the Hang Seng Index recently experiencing a notable decline. Despite this backdrop, investors continue to seek opportunities in high-growth sectors such as technology, which remains a focal point for potential long-term gains. In this environment, identifying stocks with strong fundamentals and innovative capabilities becomes crucial for navigating market turbulence and capitalizing on growth prospects.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.86% | 54.67% | ★★★★★★ |

| Innovent Biologics | 21.45% | 59.82% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that develops and commercializes monoclonal antibodies and other drug assets in oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China with a market cap of HK$68.84 billion.

Operations: Innovent Biologics generates revenue primarily from its biotechnology segment, amounting to CN¥7.46 billion. The company's focus includes developing and commercializing monoclonal antibodies across various therapeutic areas in China.

Innovent Biologics has shown robust revenue growth, with a 21.4% annual increase forecasted, outpacing the Hong Kong market's 7.3%. The company's R&D expenses are significant, reflecting its commitment to innovation; for instance, it reported CNY 3.95 billion in sales for H1 2024 but incurred a net loss of CNY 392.62 million due to high R&D costs and other factors. Innovent's recent approval of Dupert®, China's first KRAS G12C inhibitor for NSCLC patients, highlights its potential in precision oncology treatments.

- Click here to discover the nuances of Innovent Biologics with our detailed analytical health report.

Understand Innovent Biologics' track record by examining our Past report.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$38.82 billion.

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, which reported CN¥1.88 billion. The company is involved in the full lifecycle of drug development, from research and manufacturing to commercialization.

Sichuan Kelun-Biotech Biopharmaceutical reported a notable revenue increase of 24.7% year-over-year, reaching CNY 1.38 billion for H1 2024. This growth significantly outpaces the Hong Kong market's average of 7.3%. Despite high R&D expenses, which amounted to CNY 392 million, the company achieved a net income of CNY 310 million compared to a loss last year. The recent Phase III results for sacituzumab tirumotecan (sac-TMT) in various cancers underscore its potential in oncology treatments and highlight promising future prospects in this sector.

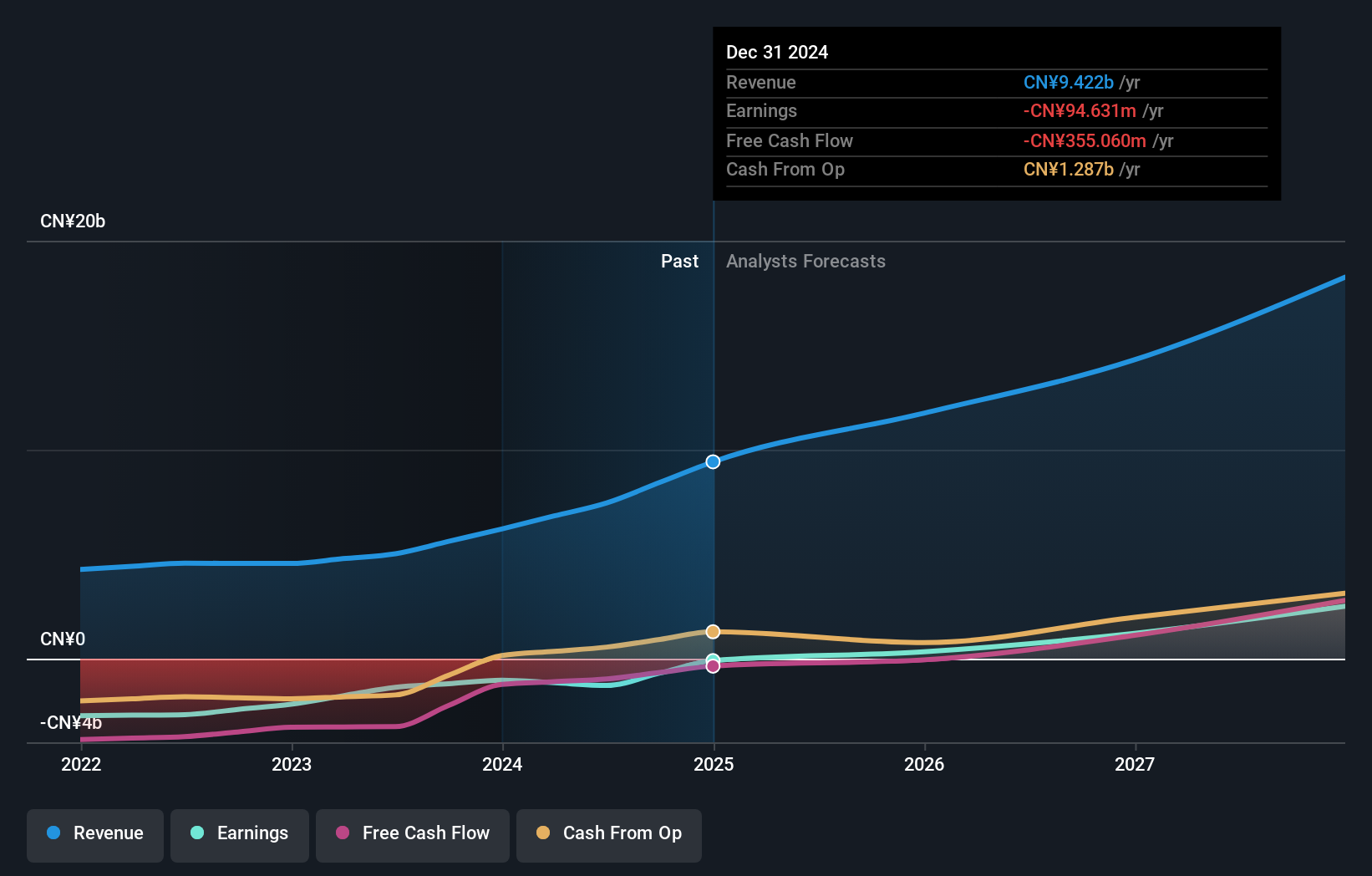

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market cap of HK$50.22 billion.

Operations: Akeso generates revenue primarily from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion. The company focuses on antibody drugs within the biopharmaceutical sector.

Akeso's revenue for H1 2024 was CNY 1.02 billion, a significant drop from the previous year's CNY 3.68 billion, resulting in a net loss of CNY 238.59 million. Despite this, their R&D expenses highlight substantial investment in innovation; they spent CNY 392 million on R&D, reflecting their commitment to developing groundbreaking treatments like ivonescimab and AK117. With forecasted annual revenue growth at an impressive 32.9% and earnings expected to grow by 54.7%, Akeso remains a dynamic player in the biotech space with promising future prospects driven by innovative therapies targeting unmet clinical needs.

- Dive into the specifics of Akeso here with our thorough health report.

Assess Akeso's past performance with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 45 SEHK High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, researches, develops, manufactures, and commercializes antibody drugs.

Exceptional growth potential with adequate balance sheet.