As global markets face economic headwinds and investor sentiment remains cautious, the Hong Kong market has shown resilience, particularly in its high-growth tech sector. In this article, we will explore three promising tech stocks in Hong Kong that have captured attention for their potential to thrive despite broader market challenges.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Cowell e Holdings | 31.82% | 35.43% | ★★★★★★ |

| RemeGen | 26.30% | 52.19% | ★★★★★☆ |

| Akeso | 32.86% | 54.67% | ★★★★★★ |

| Innovent Biologics | 22.36% | 59.39% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

Click here to see the full list of 45 stocks from our SEHK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. develops, manufactures, and commercializes vaccines in the People’s Republic of China with a market cap of HK$7.74 billion.

Operations: CanSino Biologics focuses on the development, manufacturing, and commercialization of vaccines in China. The company's revenue streams are derived from vaccine sales, while costs primarily involve research and development as well as production expenses.

CanSino Biologics has shown remarkable revenue growth, with a 32% increase per year, significantly outpacing the Hong Kong market's 7.3%. For the first half of 2024, it reported sales of ¥303.43 million compared to ¥25.91 million a year ago and reduced its net loss to ¥225.37 million from ¥841.43 million in the same period last year. The company's earnings are forecasted to grow at an impressive rate of 117.56% per year, driven by substantial R&D investments aimed at advancing its biotechnological innovations. The biotech firm's commitment to R&D is evident from its significant expenditure in this area, which supports its goal of becoming profitable within three years—a projection well above average market growth rates. CanSino's strategic focus on innovative vaccine development could position it favorably in the global healthcare industry despite current unprofitability and low forecasted return on equity (3.8%). This robust growth trajectory underscores potential long-term value creation through continuous advancements in biotechnology and strategic partnerships.

- Get an in-depth perspective on CanSino Biologics' performance by reading our health report here.

Examine CanSino Biologics' past performance report to understand how it has performed in the past.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$39.71 billion.

Operations: Kelun-Biotech generates revenue primarily from its pharmaceuticals segment, which reported CN¥1.88 billion in revenue. The company focuses on the development and commercialization of innovative drugs to meet unmet medical needs both domestically and internationally.

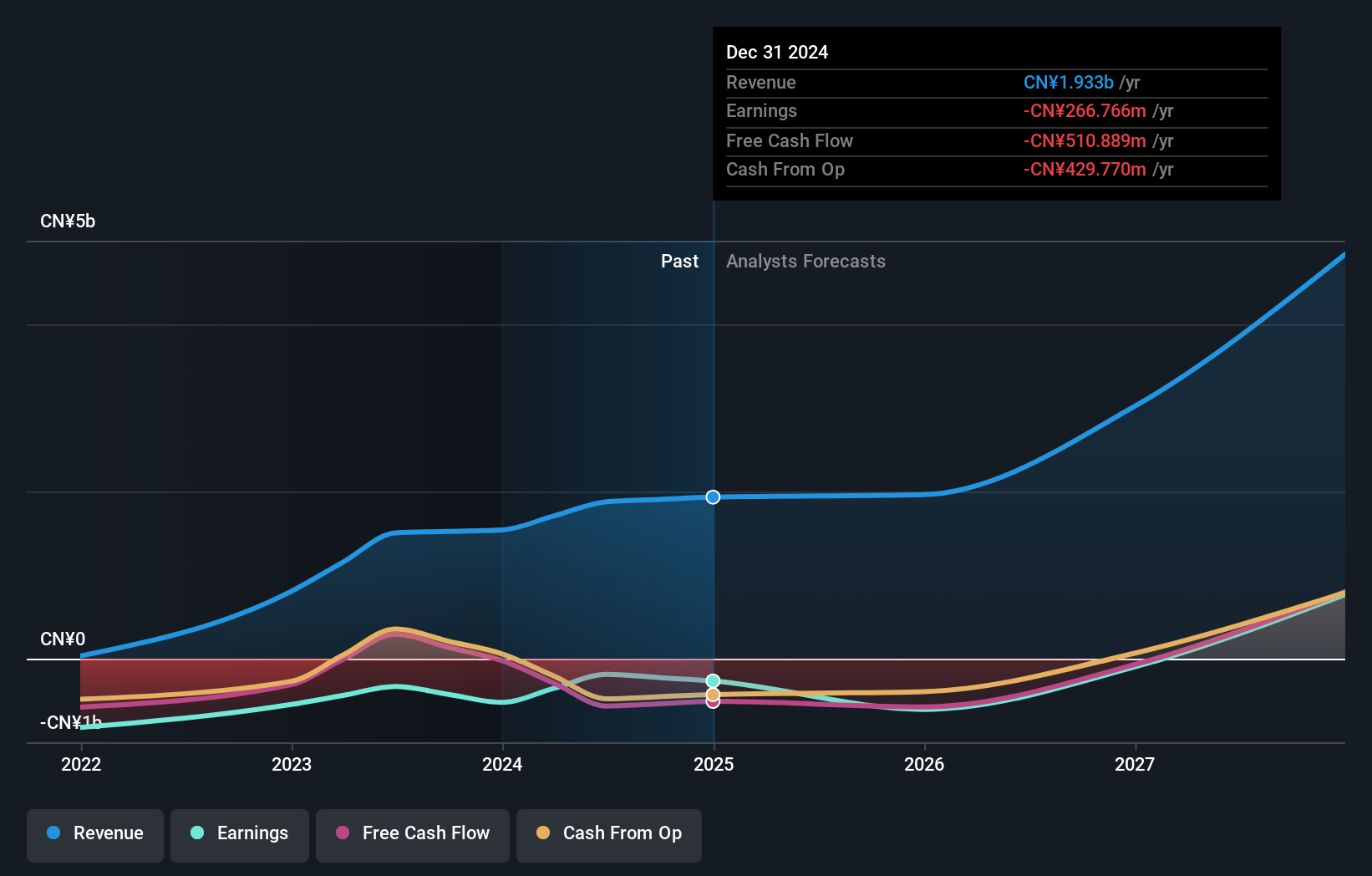

Sichuan Kelun-Biotech Biopharmaceutical's revenue surged by 24.7% over the past year, significantly outpacing the Hong Kong market's growth rate of 7.3%. The company reported a net income of ¥310.23 million for H1 2024, reversing a net loss of ¥31.13 million from the previous year. With R&D expenses constituting a notable portion of its budget, this investment in innovation has driven an impressive earnings forecast growth rate of 8.53% per year despite current unprofitability.

- Navigate through the intricacies of Sichuan Kelun-Biotech Biopharmaceutical with our comprehensive health report here.

Learn about Sichuan Kelun-Biotech Biopharmaceutical's historical performance.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$48.75 billion.

Operations: Akeso, Inc. generates revenue primarily from the research, development, production, and sale of biopharmaceutical products, totaling CN¥1.87 billion. The company's focus is on antibody drugs within the biopharmaceutical sector.

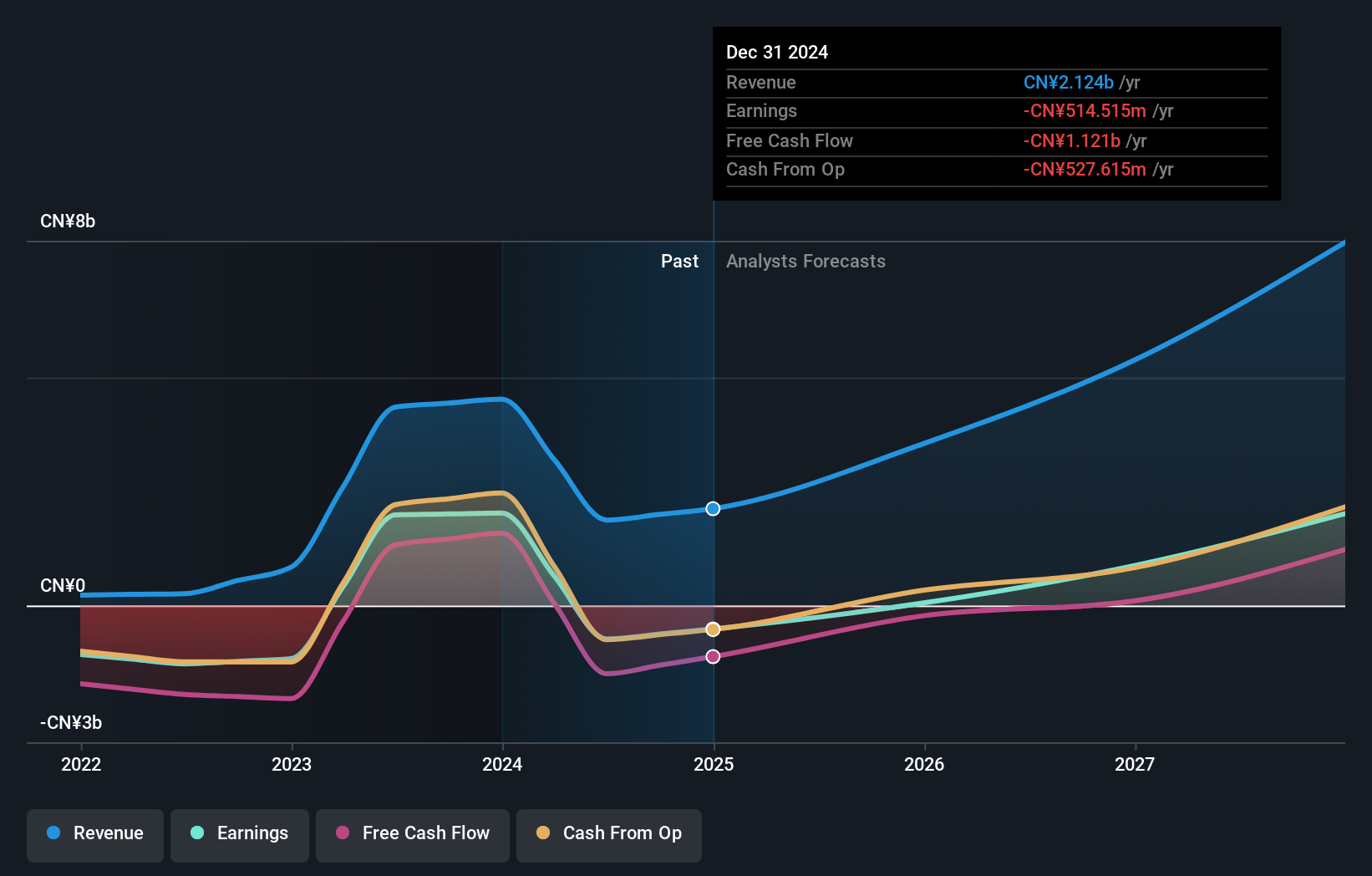

Akeso's recent earnings report shows a revenue of ¥1.02 billion for H1 2024, down from ¥3.68 billion the previous year, with a net loss of ¥238.59 million compared to a net income of ¥2.53 billion previously. Despite these setbacks, Akeso's innovative bi-specific antibody ivonescimab has gained significant traction, receiving priority review for multiple indications and demonstrating superior efficacy in clinical trials. With R&D expenses constituting 32.9% of its budget and expected annual profit growth at 54.7%, Akeso is poised to leverage its strong pipeline to drive future growth in the biotech sector.

- Take a closer look at Akeso's potential here in our health report.

Understand Akeso's track record by examining our Past report.

Where To Now?

- Gain an insight into the universe of 45 SEHK High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs to address unmet medical needs in the People’s Republic of China and internationally.

High growth potential with excellent balance sheet.