There's No Escaping Uni-Bio Science Group Limited's (HKG:690) Muted Earnings Despite A 32% Share Price Rise

Uni-Bio Science Group Limited (HKG:690) shares have continued their recent momentum with a 32% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 61%.

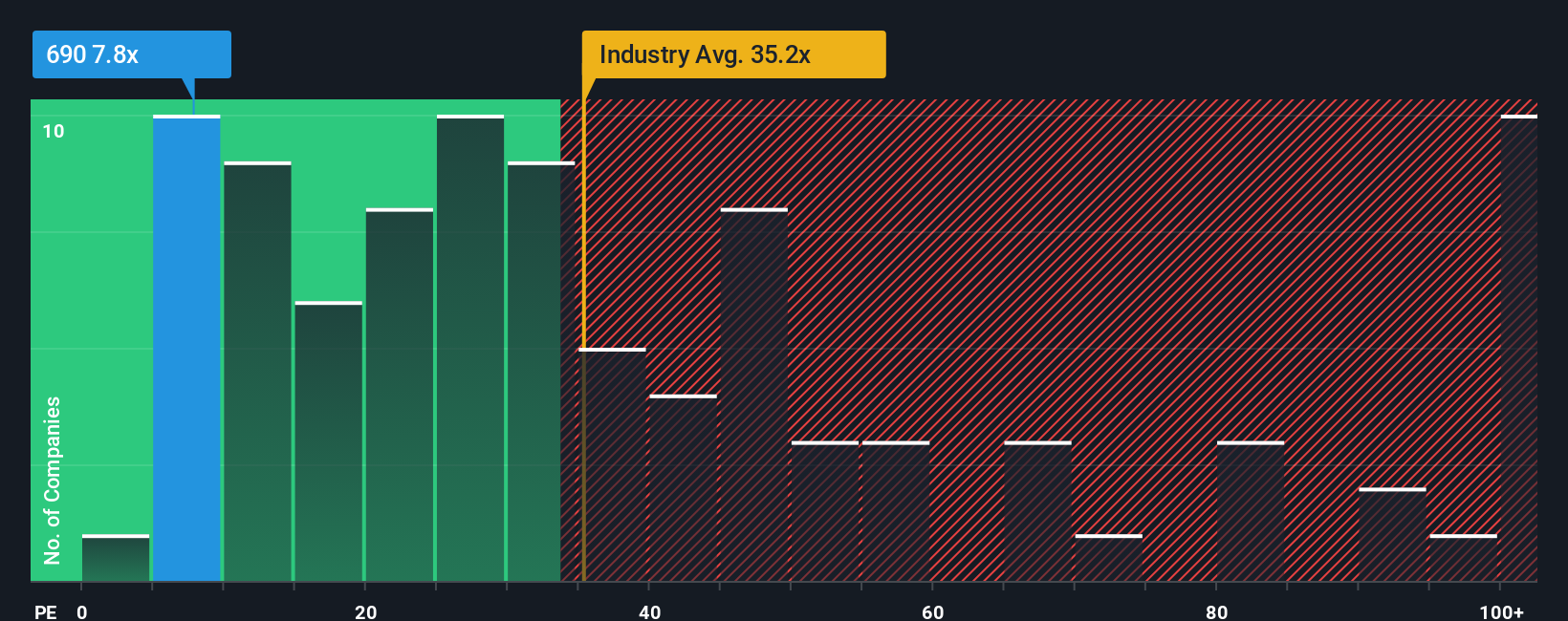

Even after such a large jump in price, Uni-Bio Science Group's price-to-earnings (or "P/E") ratio of 7.8x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 12x and even P/E's above 24x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Uni-Bio Science Group recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Uni-Bio Science Group

Does Growth Match The Low P/E?

Uni-Bio Science Group's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 21% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why Uni-Bio Science Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Uni-Bio Science Group's P/E?

The latest share price surge wasn't enough to lift Uni-Bio Science Group's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Uni-Bio Science Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Uni-Bio Science Group is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If you're unsure about the strength of Uni-Bio Science Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:690

Uni-Bio Science Group

An investment holding company, researches and develops, manufactures, and sells biological and chemical pharmaceutical products to treat human diseases in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026