Companies Like Uni-Bio Science Group (HKG:690) Can Afford To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Uni-Bio Science Group (HKG:690) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Uni-Bio Science Group

Does Uni-Bio Science Group Have A Long Cash Runway?

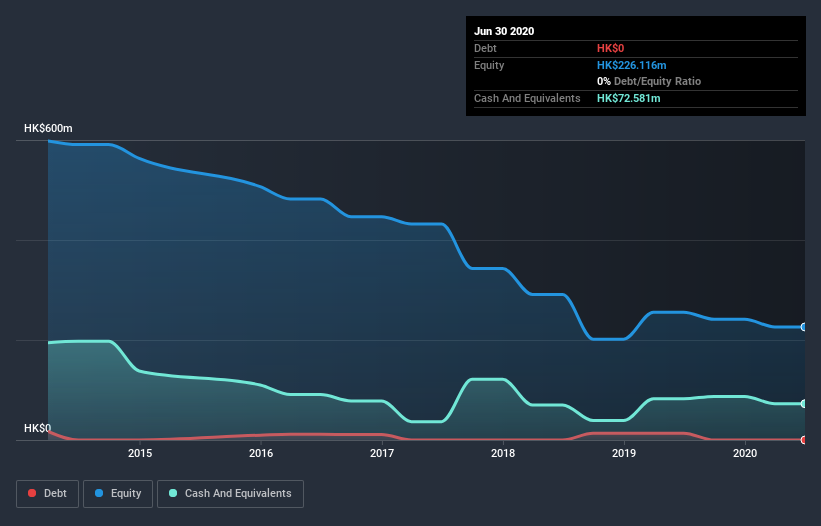

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In June 2020, Uni-Bio Science Group had HK$73m in cash, and was debt-free. Importantly, its cash burn was HK$15m over the trailing twelve months. So it had a cash runway of about 4.9 years from June 2020. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Uni-Bio Science Group Growing?

Uni-Bio Science Group managed to reduce its cash burn by 73% over the last twelve months, which suggests it's on the right flight path. And it could also show revenue growth of 3.8% in the same period. We think it is growing rather well, upon reflection. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Uni-Bio Science Group is building its business over time.

How Hard Would It Be For Uni-Bio Science Group To Raise More Cash For Growth?

There's no doubt Uni-Bio Science Group seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of HK$697m, Uni-Bio Science Group's HK$15m in cash burn equates to about 2.1% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

Is Uni-Bio Science Group's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Uni-Bio Science Group's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. On this analysis its revenue growth was its weakest feature, but we are not concerned about it. Looking at all the measures in this article, together, we're not worried about its rate of cash burn; the company seems well on top of its medium-term spending needs. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Uni-Bio Science Group that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you’re looking to trade Uni-Bio Science Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:690

Uni-Bio Science Group

An investment holding company, researches and develops, manufactures, and sells biological and chemical pharmaceutical products to treat human diseases in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.