Optimistic Investors Push CanSino Biologics Inc. (HKG:6185) Shares Up 26% But Growth Is Lacking

CanSino Biologics Inc. (HKG:6185) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 104% following the latest surge, making investors sit up and take notice.

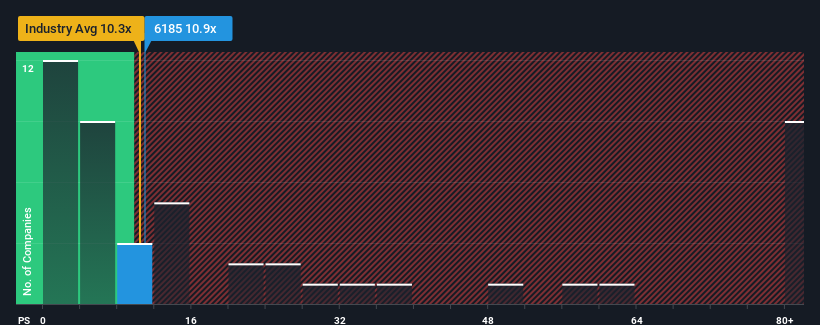

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about CanSino Biologics' P/S ratio of 10.9x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Hong Kong is also close to 10.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for CanSino Biologics

How CanSino Biologics Has Been Performing

With revenue growth that's inferior to most other companies of late, CanSino Biologics has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think CanSino Biologics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like CanSino Biologics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 49%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 76% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 46% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 55% growth each year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that CanSino Biologics' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does CanSino Biologics' P/S Mean For Investors?

CanSino Biologics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that CanSino Biologics' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for CanSino Biologics with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6185

CanSino Biologics

Develops, manufactures, and commercializes vaccines in the People’s Republic of China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives