Grand Pharmaceutical Group (HKG:512) Is Paying Out A Larger Dividend Than Last Year

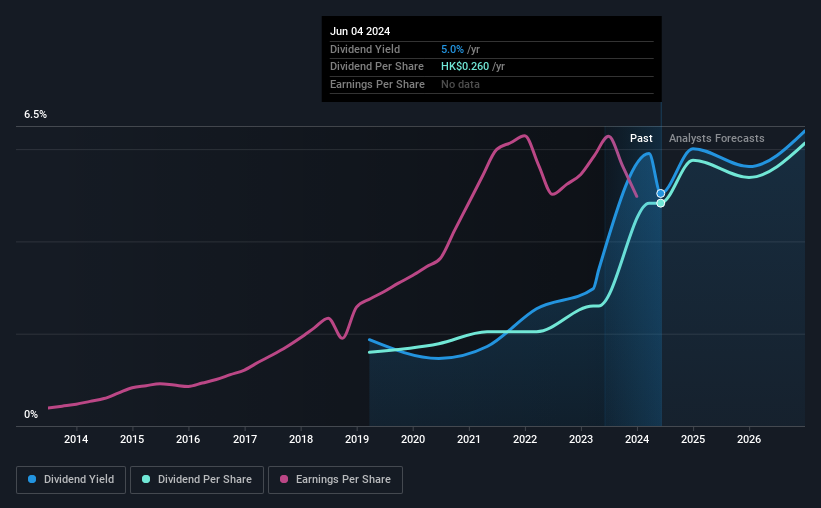

Grand Pharmaceutical Group Limited (HKG:512) will increase its dividend from last year's comparable payment on the 27th of June to HK$0.26. This will take the dividend yield to an attractive 5.0%, providing a nice boost to shareholder returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Grand Pharmaceutical Group's stock price has increased by 48% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

View our latest analysis for Grand Pharmaceutical Group

Grand Pharmaceutical Group's Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last dividend was quite easily covered by Grand Pharmaceutical Group's earnings. This means that a large portion of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 51.1% over the next year. If the dividend continues on this path, the payout ratio could be 37% by next year, which we think can be pretty sustainable going forward.

Grand Pharmaceutical Group Is Still Building Its Track Record

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2019, the annual payment back then was HK$0.086, compared to the most recent full-year payment of HK$0.26. This implies that the company grew its distributions at a yearly rate of about 25% over that duration. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Looks Likely To Grow

Investors could be attracted to the stock based on the quality of its payment history. It's encouraging to see that Grand Pharmaceutical Group has been growing its earnings per share at 14% a year over the past five years. The company is paying a reasonable amount of earnings to shareholders, and is growing earnings at a decent rate so we think it could be a decent dividend stock.

Grand Pharmaceutical Group Looks Like A Great Dividend Stock

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Grand Pharmaceutical Group that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:512

Grand Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical preparations and medical devices, biotechnology and healthcare products, and pharmaceutical raw materials.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives