Is Lansen Pharmaceutical Holdings (HKG:503) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Lansen Pharmaceutical Holdings Limited (HKG:503) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Lansen Pharmaceutical Holdings

What Is Lansen Pharmaceutical Holdings's Net Debt?

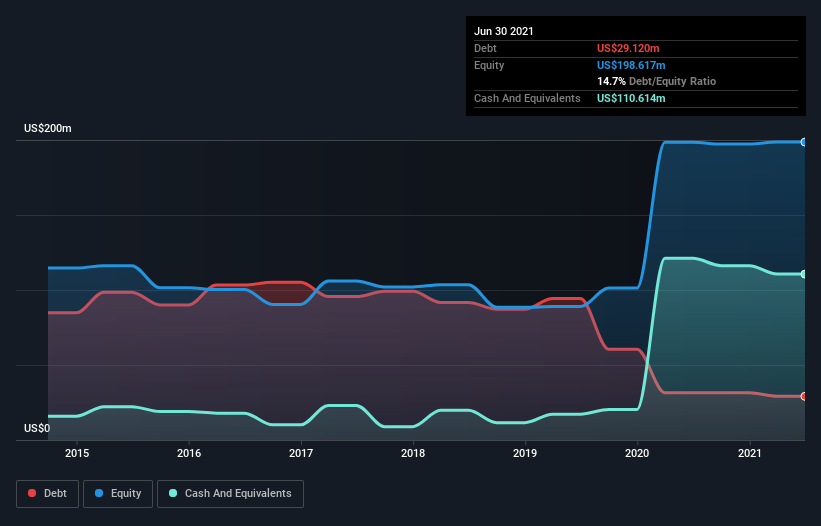

The image below, which you can click on for greater detail, shows that Lansen Pharmaceutical Holdings had debt of US$29.1m at the end of June 2021, a reduction from US$31.5m over a year. However, its balance sheet shows it holds US$110.6m in cash, so it actually has US$81.5m net cash.

How Healthy Is Lansen Pharmaceutical Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Lansen Pharmaceutical Holdings had liabilities of US$52.0m due within 12 months and liabilities of US$2.47m due beyond that. Offsetting this, it had US$110.6m in cash and US$57.0m in receivables that were due within 12 months. So it can boast US$113.1m more liquid assets than total liabilities.

This luscious liquidity implies that Lansen Pharmaceutical Holdings' balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Lansen Pharmaceutical Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

In addition to that, we're happy to report that Lansen Pharmaceutical Holdings has boosted its EBIT by 45%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Lansen Pharmaceutical Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Lansen Pharmaceutical Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Lansen Pharmaceutical Holdings actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While it is always sensible to investigate a company's debt, in this case Lansen Pharmaceutical Holdings has US$81.5m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 167% of that EBIT to free cash flow, bringing in US$17m. At the end of the day we're not concerned about Lansen Pharmaceutical Holdings's debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Lansen Pharmaceutical Holdings .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:503

Lansen Pharmaceutical Holdings

Lansen Pharmaceutical Holdings Limited, an investment holding company, develops, produces, and sells specialty pharmaceuticals for use in the field of rheumatology and dermatology in the People’s Republic of China and Hong Kong.

Excellent balance sheet with acceptable track record.