Not Many Are Piling Into Congyu Intelligent Agricultural Holdings Limited (HKG:875) Stock Yet As It Plummets 30%

Congyu Intelligent Agricultural Holdings Limited (HKG:875) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

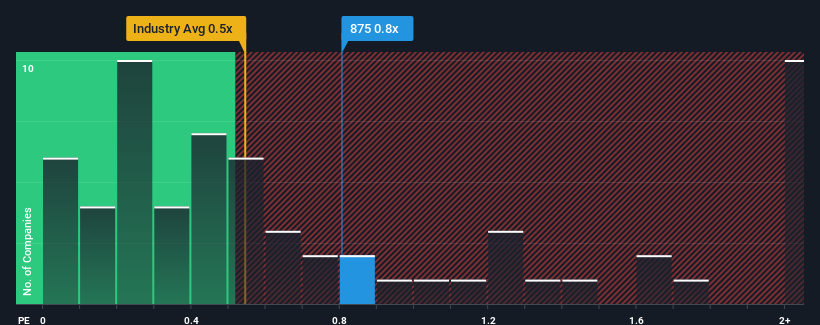

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Congyu Intelligent Agricultural Holdings' P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Food industry in Hong Kong is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Congyu Intelligent Agricultural Holdings

How Has Congyu Intelligent Agricultural Holdings Performed Recently?

For instance, Congyu Intelligent Agricultural Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Congyu Intelligent Agricultural Holdings will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Congyu Intelligent Agricultural Holdings?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Congyu Intelligent Agricultural Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 62%. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 5.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Congyu Intelligent Agricultural Holdings' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Following Congyu Intelligent Agricultural Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Congyu Intelligent Agricultural Holdings currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Plus, you should also learn about these 4 warning signs we've spotted with Congyu Intelligent Agricultural Holdings (including 1 which doesn't sit too well with us).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:875

Congyu Intelligent Agricultural Holdings

An investment holding company, engages in growing, processing, and trading of agricultural produce, trading of seafood, and meat produce in the People’s Republic of China.

Excellent balance sheet low.

Market Insights

Community Narratives