Do Hansoh Pharmaceutical Group's (HKG:3692) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hansoh Pharmaceutical Group (HKG:3692). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hansoh Pharmaceutical Group with the means to add long-term value to shareholders.

See our latest analysis for Hansoh Pharmaceutical Group

How Quickly Is Hansoh Pharmaceutical Group Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Hansoh Pharmaceutical Group grew its EPS by 8.2% per year. That growth rate is fairly good, assuming the company can keep it up.

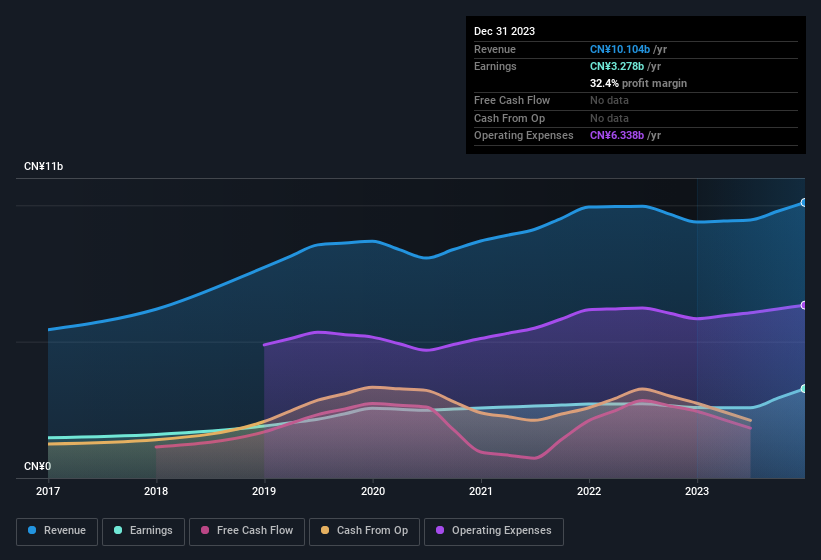

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Hansoh Pharmaceutical Group maintained stable EBIT margins over the last year, all while growing revenue 7.7% to CN¥10b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Hansoh Pharmaceutical Group's future profits.

Are Hansoh Pharmaceutical Group Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a HK$92b company like Hansoh Pharmaceutical Group. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥15b. Coming in at 16% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Should You Add Hansoh Pharmaceutical Group To Your Watchlist?

One important encouraging feature of Hansoh Pharmaceutical Group is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. If you think Hansoh Pharmaceutical Group might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Although Hansoh Pharmaceutical Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hansoh Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3692

Hansoh Pharmaceutical Group

An investment holding company, engages in the research, development, manufacture, and sale of pharmaceutical products in the People’s Republic of China.

Solid track record with excellent balance sheet.