- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9997

Kangji Medical Holdings And 2 Other Undiscovered Gems With Solid Metrics

Reviewed by Simply Wall St

As global markets experience a rebound driven by easing core inflation and strong bank earnings, small-cap stocks are catching the attention of investors looking for opportunities in a landscape where value is outperforming growth. In this environment, identifying stocks with solid metrics becomes crucial, as these companies can offer potential resilience and growth amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Great China Metal Ind | 0.32% | 2.69% | -3.41% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Firich Enterprises | 34.24% | -2.31% | 25.41% | ★★★★★☆ |

| Systex | 31.75% | 12.06% | -1.88% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Kangji Medical Holdings (SEHK:9997)

Simply Wall St Value Rating: ★★★★★★

Overview: Kangji Medical Holdings Limited is an investment holding company that focuses on the design, development, manufacture, and sale of minimally invasive surgical instruments and accessories in Mainland China and internationally, with a market cap of approximately HK$7.34 billion.

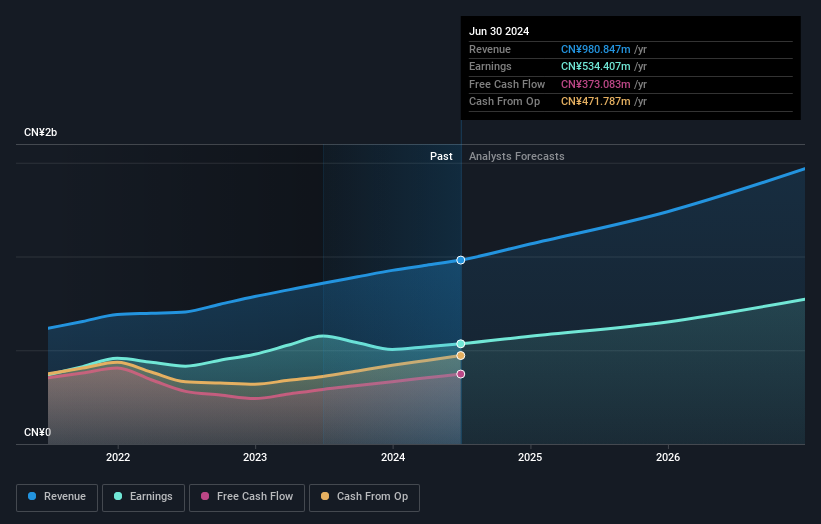

Operations: Kangji Medical generates revenue primarily from its surgical and medical equipment segment, amounting to CN¥980.85 million. The company's financial performance is influenced by the net profit margin, which reflects its profitability after accounting for all expenses.

Kangji Medical Holdings, a nimble player in the medical equipment space, shows promise despite recent challenges. Earnings took a hit with a 7.3% dip over the past year, contrasting with the industry average of -4.3%. However, it remains debt-free and boasts high-quality earnings, suggesting robust financial health. The company is trading at 41% below its estimated fair value and has maintained positive free cash flow consistently over three years (US$373 million by mid-2025). With forecasts predicting 12% annual earnings growth, Kangji seems poised for potential upside as it navigates market dynamics effectively.

- Click here and access our complete health analysis report to understand the dynamics of Kangji Medical Holdings.

Explore historical data to track Kangji Medical Holdings' performance over time in our Past section.

TechMatrix (TSE:3762)

Simply Wall St Value Rating: ★★★★★★

Overview: TechMatrix Corporation operates in Japan's information infrastructure and application service sectors with a market capitalization of ¥91.06 billion.

Operations: TechMatrix Corporation generates revenue primarily from its Information Infrastructure segment, which contributes ¥40.89 billion, and its Application Service Business, adding ¥8.99 billion. The Medical System Business also adds ¥10.14 billion to the total revenue stream.

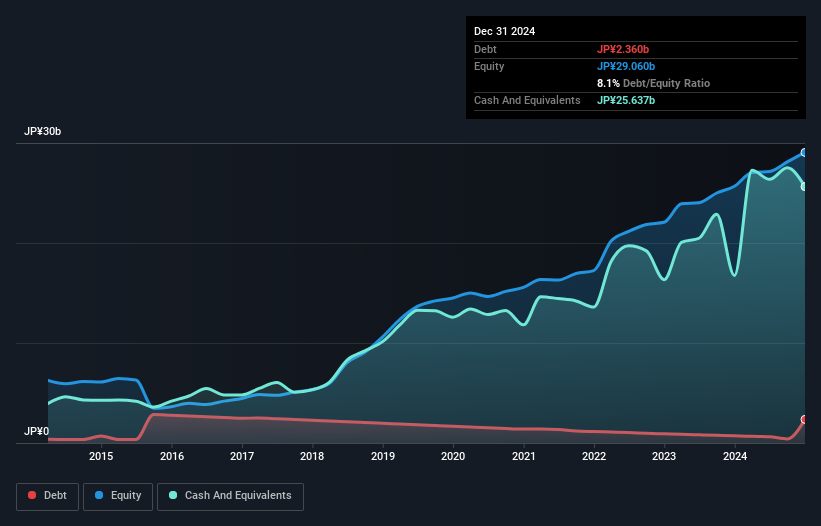

TechMatrix, a small cap player in the tech industry, has shown impressive financial resilience. Over the past five years, its debt to equity ratio has significantly improved from 12.3% to 1.5%, indicating prudent financial management. The company is trading at 37% below its estimated fair value, suggesting potential undervaluation in the market. Moreover, TechMatrix's earnings grew by 16.3% last year and are expected to continue growing at a similar rate annually, outpacing the broader IT industry growth of 11.4%. This robust performance is complemented by high-quality earnings and positive free cash flow generation (US$8 billion).

- Dive into the specifics of TechMatrix here with our thorough health report.

Assess TechMatrix's past performance with our detailed historical performance reports.

Lion Travel Service (TWSE:2731)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lion Travel Service Co., Ltd. operates as a provider of travel services both in Taiwan and internationally, with a market capitalization of NT$11.99 billion.

Operations: Lion Travel Service generates revenue primarily from its Tour Department, which accounts for NT$28.15 billion. The company has a market capitalization of NT$11.99 billion.

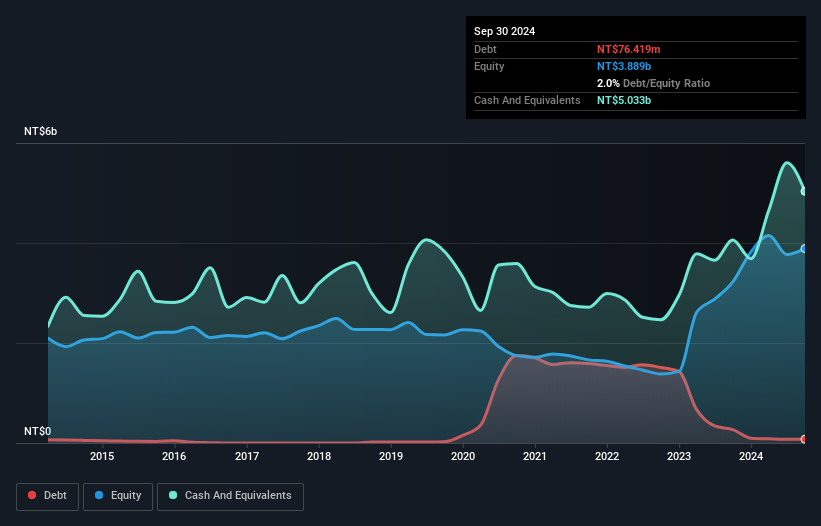

Travel Service, with its small cap charm, has seen a significant earnings growth of 223.5% over the past year, outpacing the hospitality industry's -8.9%. Despite a large one-off gain of NT$464.7M affecting recent results, it trades at 83% below estimated fair value. The company's debt to equity ratio rose from 1.2% to 2% in five years, yet it holds more cash than total debt and remains free cash flow positive. Recent quarterly sales reached TWD 8 billion compared to TWD 6.65 billion last year; however, net income was TWD 83 million versus TWD 263 million previously.

Key Takeaways

- Investigate our full lineup of 4649 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kangji Medical Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9997

Kangji Medical Holdings

An investment holding company, engages in the design, development, manufacture, and sale of minimally invasive surgical instruments and accessories in Mainland China and internationally.

Flawless balance sheet and undervalued.