Update: SinoMab BioScience (HKG:3681) Stock Gained 21% In The Last Year

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Over the last year the SinoMab BioScience Limited (HKG:3681) share price is up 21%, but that's less than the broader market return. We'll need to follow SinoMab BioScience for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

View our latest analysis for SinoMab BioScience

We don't think SinoMab BioScience's revenue of CN¥6,583,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that SinoMab BioScience comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

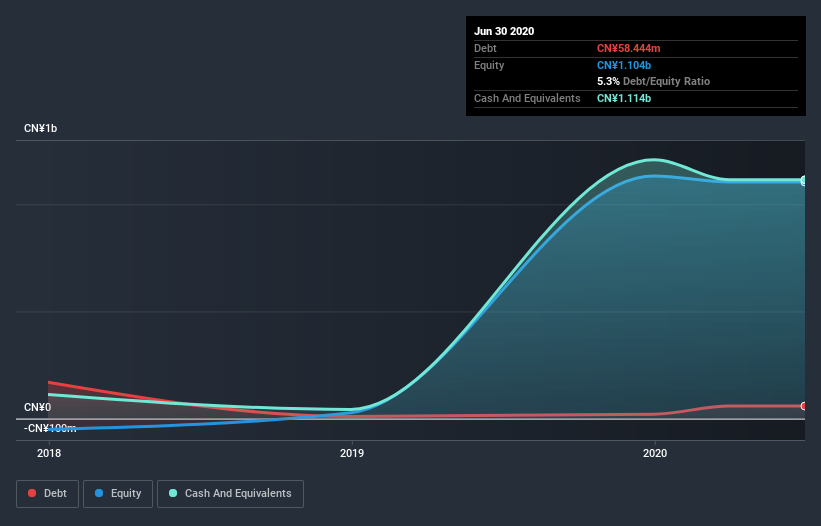

SinoMab BioScience had plenty of cash in the bank when it last reported. That allows management to focus on growing the business, and not feel like the recent capital raising was a matter of urgency. And with the share price up 148% in the last year , the market is focussed on that blue sky potential. The image below shows how SinoMab BioScience's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

SinoMab BioScience shareholders have gained 21% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 26%. Shareholders are doubtless excited that the stock price has been doing even better lately, with a gain of 33% in just ninety days. It's worth taking note when returns accelerate, as it can indicate positive change in the underlying business, and winners often keep winning. It's always interesting to track share price performance over the longer term. But to understand SinoMab BioScience better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for SinoMab BioScience you should know about.

SinoMab BioScience is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade SinoMab BioScience, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3681

SinoMab BioScience

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of therapeutics for the treatment of immunological diseases primarily monoclonal antibody (mAb)-based biologics in Mainland China and Hong Kong.

Low risk with imperfect balance sheet.

Market Insights

Community Narratives