Beijing Tong Ren Tang Chinese Medicine Company Limited's (HKG:3613) 28% Share Price Plunge Could Signal Some Risk

The Beijing Tong Ren Tang Chinese Medicine Company Limited (HKG:3613) share price has fared very poorly over the last month, falling by a substantial 28%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

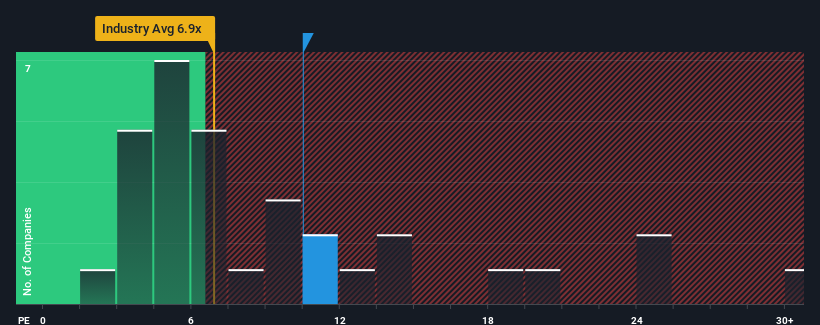

In spite of the heavy fall in price, there still wouldn't be many who think Beijing Tong Ren Tang Chinese Medicine's price-to-earnings (or "P/E") ratio of 10.5x is worth a mention when the median P/E in Hong Kong is similar at about 9x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for Beijing Tong Ren Tang Chinese Medicine as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Beijing Tong Ren Tang Chinese Medicine

Is There Some Growth For Beijing Tong Ren Tang Chinese Medicine?

In order to justify its P/E ratio, Beijing Tong Ren Tang Chinese Medicine would need to produce growth that's similar to the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 26% last year. The latest three year period has also seen an excellent 64% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 9.5% per year over the next three years. With the market predicted to deliver 16% growth per year, the company is positioned for a weaker earnings result.

With this information, we find it interesting that Beijing Tong Ren Tang Chinese Medicine is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Beijing Tong Ren Tang Chinese Medicine's plummeting stock price has brought its P/E right back to the rest of the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Beijing Tong Ren Tang Chinese Medicine currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for Beijing Tong Ren Tang Chinese Medicine that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tong Ren Tang Chinese Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3613

Beijing Tong Ren Tang Chinese Medicine

Engages in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to wholesalers and individuals.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives