What China Resources Pharmaceutical Group (SEHK:3320)'s Onshore Debt Refinancing Plan Means For Shareholders

Reviewed by Sasha Jovanovic

- China Resources Pharmaceutical Group Limited recently proposed amending its articles of association to reflect updated Hong Kong rules on treasury shares and website-based shareholder communication, while its subsidiary CR Pharmaceutical Commercial received approval in China to register up to RMB3 billion in medium term notes for refinancing interest-bearing debt.

- Together, these changes highlight the group’s efforts to modernise its corporate framework and improve balance sheet flexibility by extending its onshore funding options.

- We’ll now examine how the planned issuance of RMB3 billion in medium term notes for debt repayment shapes China Resources Pharmaceutical Group’s investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is China Resources Pharmaceutical Group's Investment Narrative?

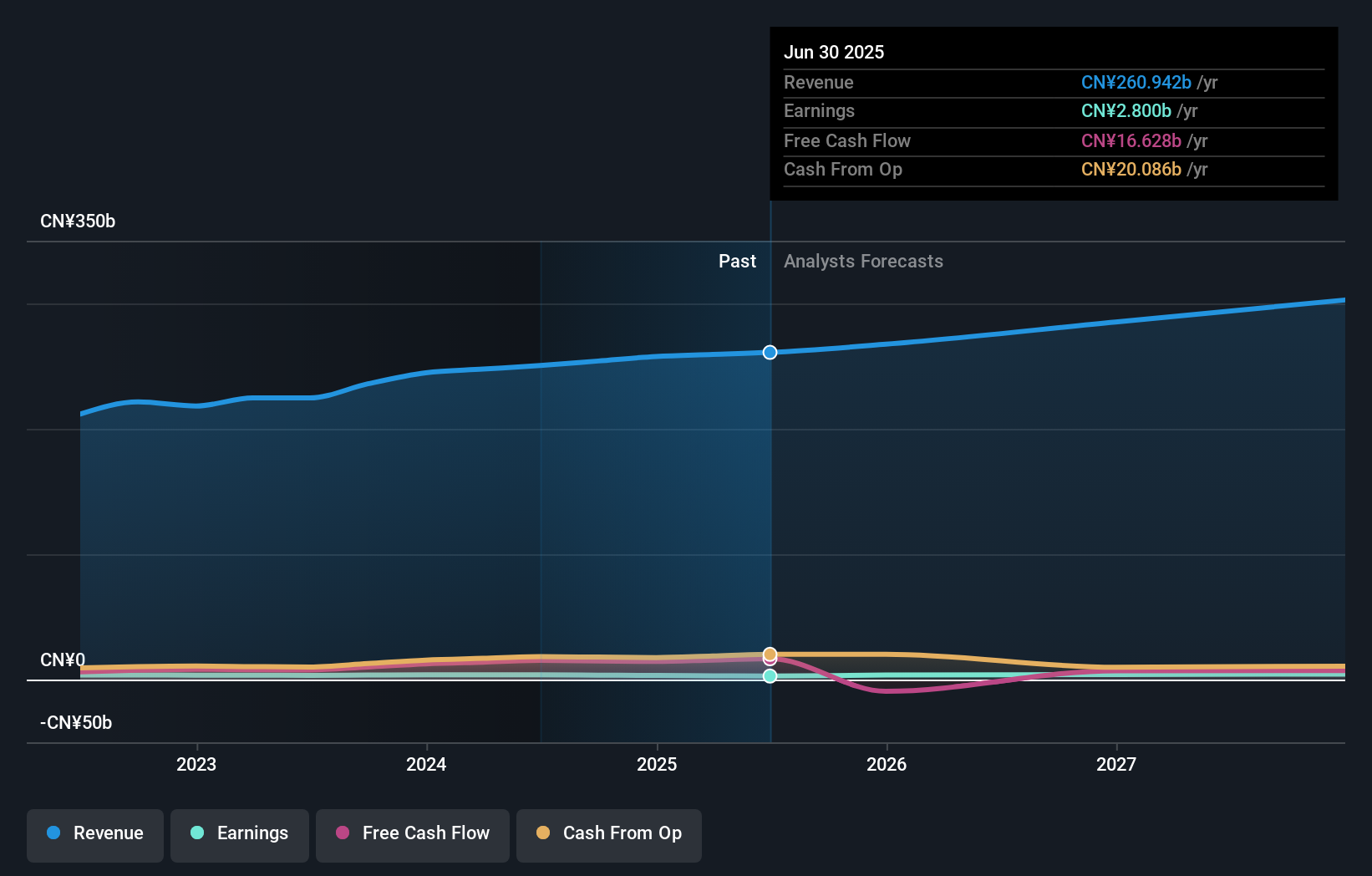

To own China Resources Pharmaceutical Group, you need to be comfortable with a large, lower-margin distributor that looks inexpensive on earnings but is working through weaker profitability and board turnover. The recent approval for up to RMB3 billion in onshore medium term notes, earmarked for repaying interest-bearing debt, potentially softens one of the key near-term concerns around its leveraged balance sheet, though the impact will depend on actual issuance terms. At the same time, the proposed article amendments around treasury shares and digital shareholder communication look more like housekeeping than a major catalyst. Near term, the main drivers still sit with any improvement in profit margins and evidence that the relatively new management team can stabilise earnings, while high debt and limited board experience remain front-of-mind risks.

However, investors should not ignore how the high debt load could still constrain flexibility. China Resources Pharmaceutical Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on China Resources Pharmaceutical Group - why the stock might be worth just HK$6.80!

Build Your Own China Resources Pharmaceutical Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Resources Pharmaceutical Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Resources Pharmaceutical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Resources Pharmaceutical Group's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3320

China Resources Pharmaceutical Group

An investment holding company, engages in the manufacture, distribution, and retail of pharmaceutical and other healthcare products in Mainland China and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026