- Hong Kong

- /

- Entertainment

- /

- SEHK:777

High Growth Tech Stocks In Hong Kong Featuring SUNeVision Holdings And Two Others

Reviewed by Simply Wall St

The Hong Kong market has recently experienced mixed performance, with the Hang Seng Index gaining 2.14% amid broader global economic uncertainties and fluctuating investor sentiment. As inflation data and economic indicators continue to influence market dynamics, high-growth tech stocks in Hong Kong present intriguing opportunities for investors seeking to navigate these volatile conditions. In this article, we will explore three promising tech stocks in Hong Kong, starting with SUNeVision Holdings, that have shown potential despite the current market challenges.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 45.88% | 45.90% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.37% | 39.10% | ★★★★★☆ |

| Joy Spreader Group | 35.36% | 107.63% | ★★★★★☆ |

| Akeso | 32.76% | 55.08% | ★★★★★★ |

| Cowell e Holdings | 31.40% | 35.53% | ★★★★★★ |

| Innovent Biologics | 21.24% | 60.09% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 26.67% | 9.08% | ★★★★★☆ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 34.77% | 92.44% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our SEHK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SUNeVision Holdings Ltd., with a market cap of HK$13.64 billion, is an investment holding company that provides data centre and IT facility services in Hong Kong.

Operations: The company generates revenue primarily from its data centre and IT facilities segment, contributing HK$2.46 billion, and from its Extra-Low Voltage (ELV) and IT systems segment, which brings in HK$213.03 million.

SUNeVision Holdings reported a 15.6% revenue growth rate, significantly outpacing the Hong Kong market's 7.5% per year average. Earnings are projected to grow at 13.6% annually, above the market's 10.8%. With sales reaching HKD 2.67 billion and net income of HKD 907 million for FY2024, the company demonstrates robust financial health despite modest earnings growth of just 0.2%. Recent changes in bylaws aim to align with updated listing rules and enhance shareholder communication, reflecting proactive governance.

- Dive into the specifics of SUNeVision Holdings here with our thorough health report.

Evaluate SUNeVision Holdings' historical performance by accessing our past performance report.

CStone Pharmaceuticals (SEHK:2616)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CStone Pharmaceuticals is a biopharmaceutical company that researches, develops, and commercializes immuno-oncology and precision medicines to address the unmet medical needs of cancer patients in China and internationally, with a market cap of HK$1.98 billion.

Operations: The company focuses on the research, development, and commercialization of immuno-oncology and precision medicines. Its primary revenue stream comes from pharmaceuticals, generating CN¥463.84 million.

CStone Pharmaceuticals is making significant strides in the biopharmaceutical sector, particularly with its innovative treatments like sugemalimab. The company’s R&D expenses have been substantial, reflecting their commitment to innovation; for example, they spent $150 million on R&D in 2023. Revenue is expected to grow at an impressive rate of 28.5% annually, outpacing the Hong Kong market's average of 7.5%. Additionally, earnings are forecasted to surge by 69.5% per year over the next three years, highlighting strong growth potential driven by successful clinical trials and strategic partnerships.

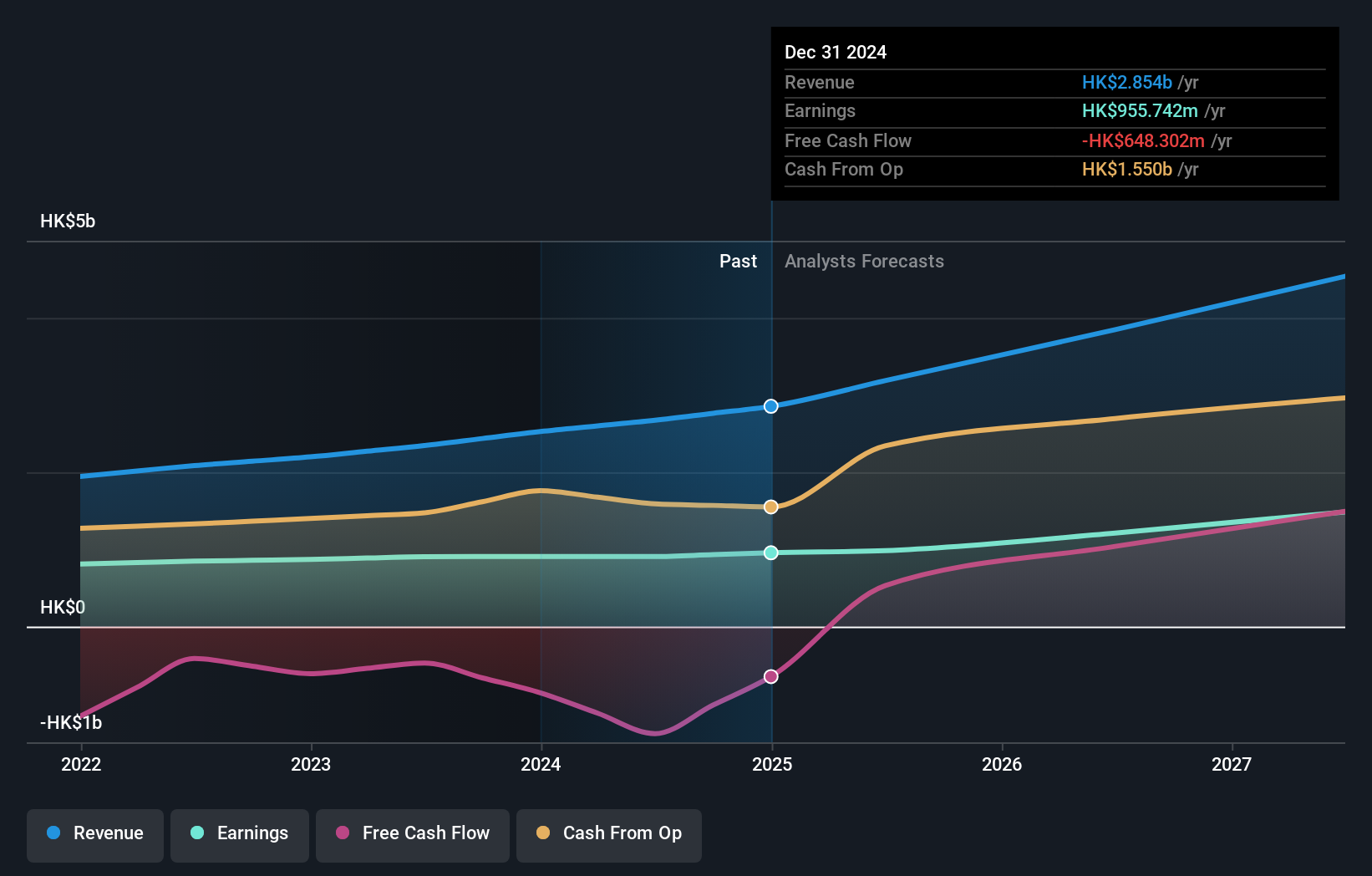

NetDragon Websoft Holdings (SEHK:777)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NetDragon Websoft Holdings Limited develops and offers online and mobile games in the People's Republic of China, the United States, the United Kingdom, and internationally, with a market cap of HK$5.60 billion.

Operations: The company generates revenue primarily from the development and distribution of online and mobile games across multiple regions, including China, the US, and the UK. It operates in a highly competitive market with significant investments in game development and marketing.

NetDragon Websoft Holdings has demonstrated robust growth potential, with earnings expected to increase by 30% annually, significantly outpacing the Hong Kong market's average of 10.8%. The company reported sales of ¥3.30 billion for the first half of 2024, although this represents a decrease from ¥3.68 billion in the previous year. Their R&D expenses highlight their commitment to innovation; for example, they spent ¥500 million in H1 2024. Despite a net profit margin drop from 10.5% to 6.7%, NetDragon continues to invest heavily in its AI and software segments, which could drive future performance.

Seize The Opportunity

- Delve into our full catalog of 49 SEHK High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetDragon Websoft Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:777

NetDragon Websoft Holdings

Provides online and mobile games the People’s Republic of China, the United States, the United Kingdom, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives