- South Korea

- /

- Interactive Media and Services

- /

- KOSDAQ:A376300

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

As global markets react positively to the recent de-escalation of U.S.-China trade tensions, Asian tech stocks have garnered attention amid this favorable climate. In the current environment, a good stock might be characterized by its resilience to market fluctuations and its ability to leverage technological advancements for sustained growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.38% | 30.19% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| PharmaEssentia | 31.42% | 57.71% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.10% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Cowell e Holdings | 20.16% | 24.57% | ★★★★★★ |

| PharmaResearch | 25.33% | 28.36% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

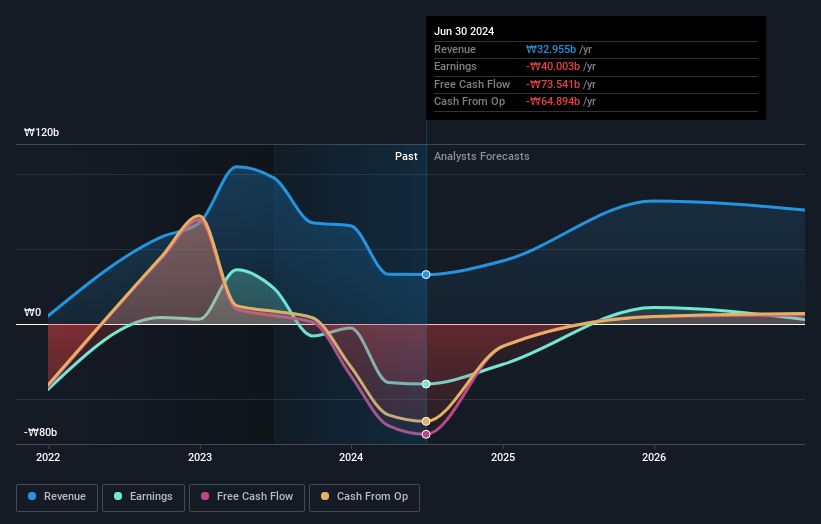

Overview: ABL Bio Inc. is a biotech research company specializing in the development of therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩3.05 trillion.

Operations: ABL Bio Inc. generates revenue primarily through its biotechnology segment, which focuses on startups and contributes ₩33.40 billion to its income. The company is engaged in developing therapeutic drugs targeting immuno-oncology and neurodegenerative diseases.

ABL Bio's recent strategic partnership with GSK, leveraging its innovative Grabody-B platform to develop treatments for neurodegenerative diseases, underscores its position in the biotech landscape. This collaboration could potentially bring ABL Bio up to £2.075 billion in milestone payments, alongside tiered royalties on net sales, highlighting significant future revenue streams. With a 21.7% annual revenue growth outpacing the Korean market's 7.6%, and anticipated profitability within three years, ABL Bio is navigating a transformative phase amidst challenging yet lucrative biotechnological advancements. Despite current unprofitability and a volatile share price, these developments suggest a promising horizon fueled by strategic alliances and advanced R&D capabilities.

- Click to explore a detailed breakdown of our findings in ABL Bio's health report.

Assess ABL Bio's past performance with our detailed historical performance reports.

DEAR U (KOSDAQ:A376300)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dear U Co., Ltd. is an information technology company with a market capitalization of approximately ₩1.16 billion.

Operations: The company focuses on the information technology sector. It has a market capitalization of approximately ₩1.16 billion.

DEAR U Co., LTD. is navigating a transformative phase with its recent acquisition by SM Entertainment, enhancing its strategic positioning in the entertainment tech sector. This move, involving a KRW 95.6 billion investment for an 8.05% stake, underscores a significant commitment to growth and market expansion. With revenue projected to increase by 22.9% annually and earnings expected to surge by 37.1%, DEAR U stands out for its aggressive expansion strategy amidst a highly volatile market environment characterized by rapid technological advancements and shifting consumer preferences in digital content consumption.

- Click here and access our complete health analysis report to understand the dynamics of DEAR U.

Understand DEAR U's track record by examining our Past report.

CStone Pharmaceuticals (SEHK:2616)

Simply Wall St Growth Rating: ★★★★☆☆

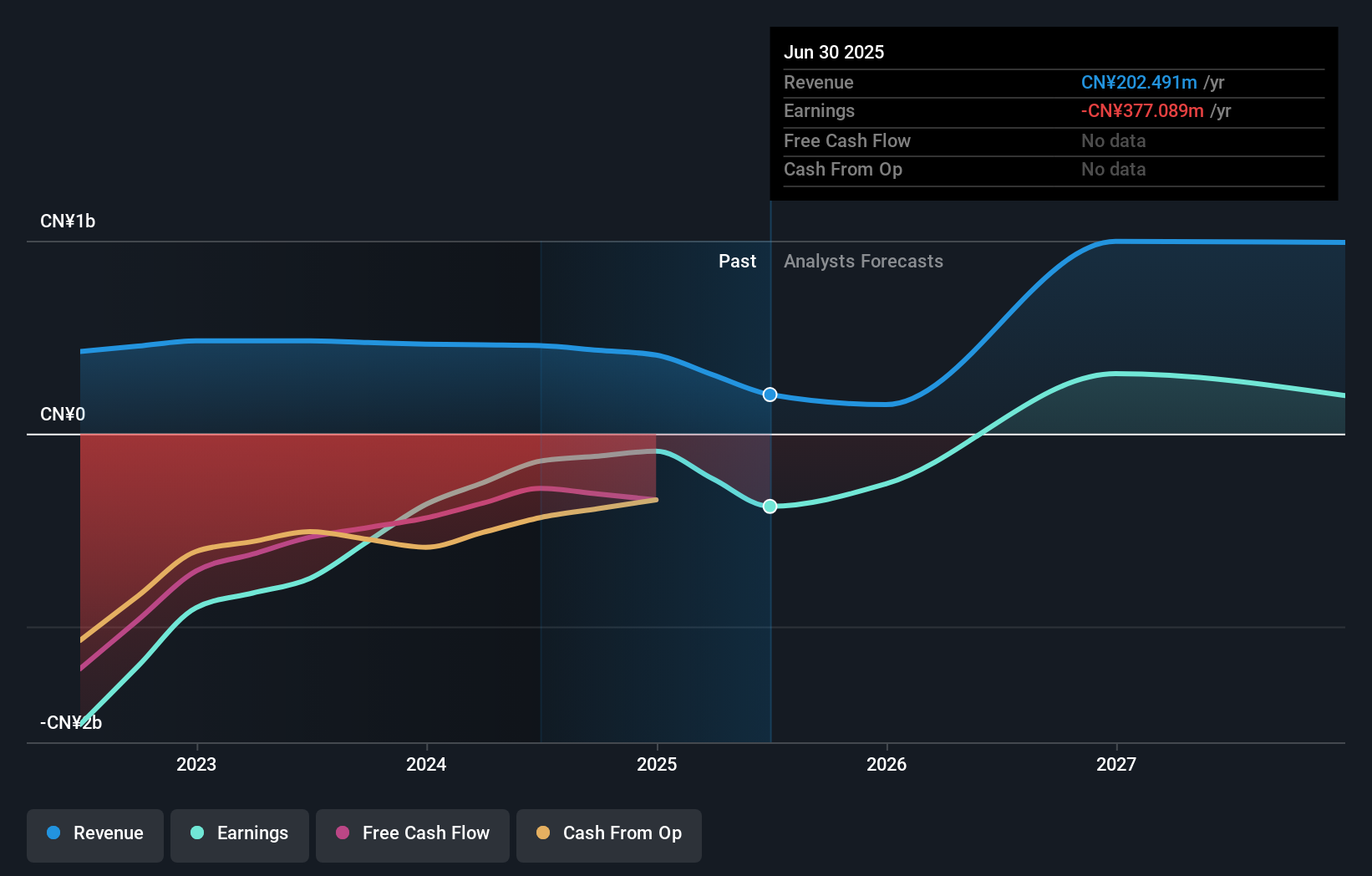

Overview: CStone Pharmaceuticals is a biopharmaceutical company focused on researching and developing anti-cancer therapies to meet the unmet medical needs of cancer patients in China and internationally, with a market cap of HK$3.99 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥407.21 million.

CStone Pharmaceuticals is making significant strides in the biotech sector, particularly with its groundbreaking trispecific antibody, CS2009. Recently showcased at the AACR Annual Meeting, this innovative treatment combines PD-1, VEGFA, and CTLA-4 targets to potentially revolutionize immunotherapy for solid tumors. The company's commitment to R&D is evident from its substantial investment totaling HKD 234.64 million in follow-on equity offerings to fuel further development. With a robust pipeline aimed at addressing unmet medical needs in oncology, CStone's strategic focus on advanced cancer therapies positions it well within Asia's competitive biotech landscape.

Make It Happen

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 486 more companies for you to explore.Click here to unveil our expertly curated list of 489 Asian High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A376300

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives