Hua Medicine (Shanghai) (HKG:2552) adds HK$246m to market cap in the past 7 days, though investors from five years ago are still down 49%

Hua Medicine (Shanghai) Ltd. (HKG:2552) shareholders should be happy to see the share price up 14% in the last month. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 49% in that half decade.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

Because Hua Medicine (Shanghai) made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Hua Medicine (Shanghai) grew its revenue at 64% per year. That's better than most loss-making companies. The share price drop of 8% per year over five years would be considered let down. You could say that the market has been harsh, given the top line growth. So now is probably an apt time to look closer at the stock, if you think it has potential.

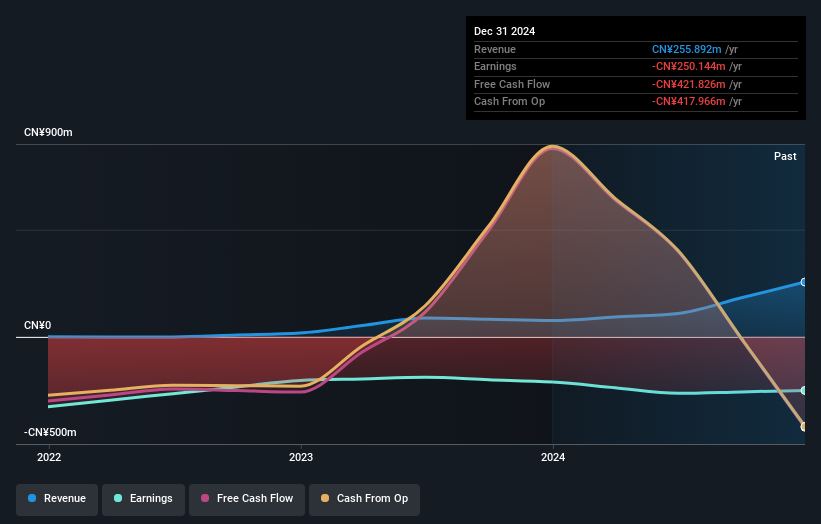

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Hua Medicine (Shanghai)'s financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Hua Medicine (Shanghai) shareholders have received a total shareholder return of 39% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Hua Medicine (Shanghai) (1 is concerning!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hua Medicine (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2552

Hua Medicine (Shanghai)

Engages in the development and commercialization of drugs for the treatment of diabetes in China.

Imperfect balance sheet very low.

Market Insights

Community Narratives