Top Dividend Stocks Including Aker Solutions For Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, characterized by geopolitical tensions and fluctuating consumer spending concerns, investors are navigating a complex environment. As major indices experience volatility and economic indicators signal mixed sentiments, dividend stocks can offer stability and income potential in uncertain times. A good dividend stock typically combines a history of consistent payouts with strong fundamentals, providing a reliable income stream amidst market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.75% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2011 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

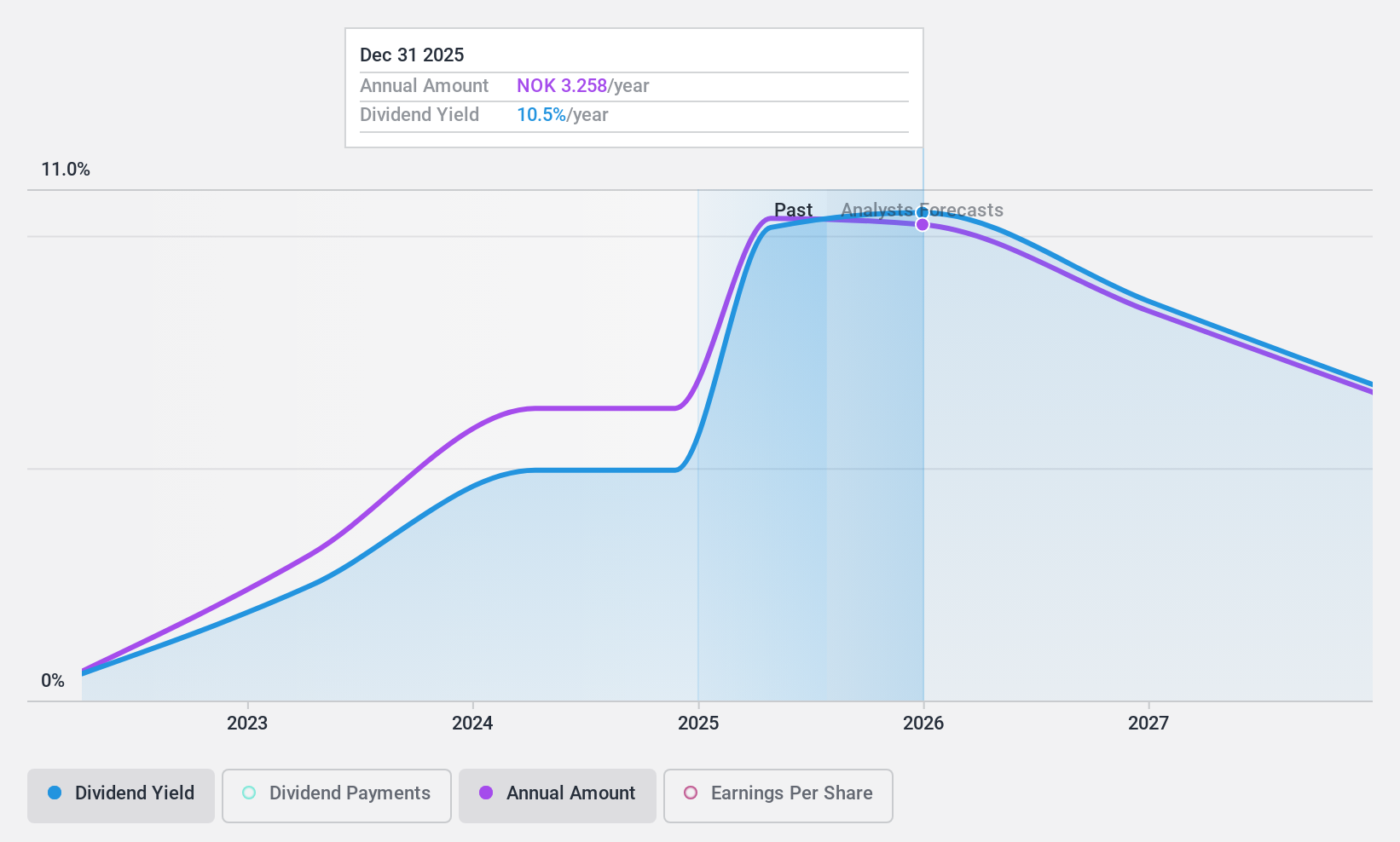

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aker Solutions ASA offers solutions, products, systems, and services to the oil and gas industry across various countries including Norway, the United States, Brazil, and others with a market cap of NOK15.85 billion.

Operations: Aker Solutions' revenue is primarily derived from its Renewables and Field Development segment at NOK38.09 billion and Life Cycle services at NOK13.25 billion.

Dividend Yield: 9.9%

Aker Solutions plans to propose a NOK 3.30 per share dividend for 2024, equating to about 50% of net income, pending approval. Despite significant revenue growth in 2024, the company's high cash payout ratio indicates dividends aren't well-covered by cash flows. Historically volatile and unreliable dividends may concern investors seeking stability. Recent strategic contracts in renewable energy sectors could bolster future financial performance but do not directly address current dividend sustainability challenges.

- Navigate through the intricacies of Aker Solutions with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Aker Solutions' current price could be quite moderate.

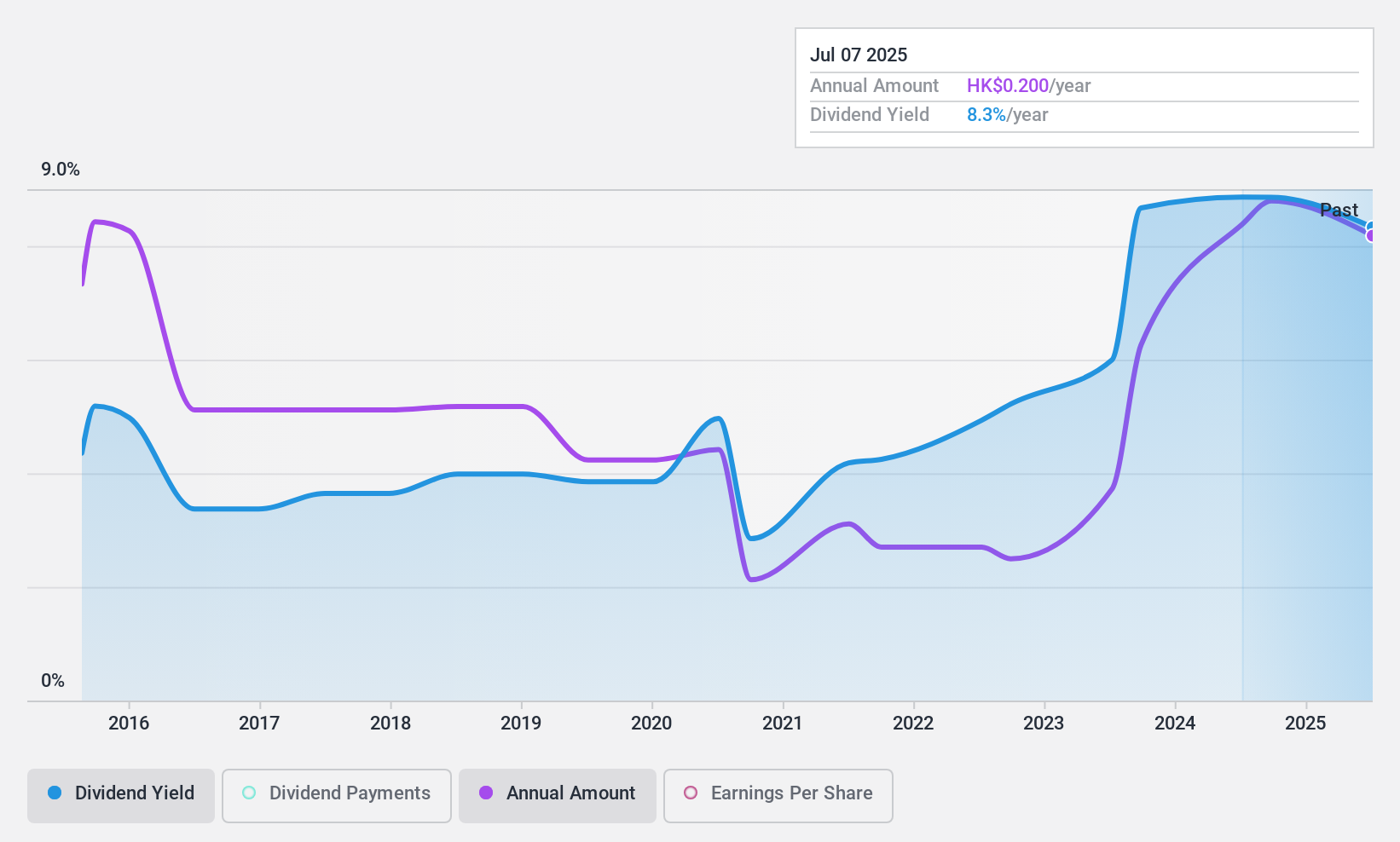

Pak Fah Yeow International (SEHK:239)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pak Fah Yeow International Limited, with a market cap of HK$779.10 million, is an investment holding company involved in manufacturing, marketing, and distributing healthcare products under the Hoe Hin brand name.

Operations: Pak Fah Yeow International Limited generates revenue through its segments, with HK$247.67 million from healthcare products, HK$10.03 million from property investments, and HK$7.52 million from treasury investments.

Dividend Yield: 8.6%

Pak Fah Yeow International trades significantly below its estimated fair value, offering a high dividend yield of 8.6%, placing it among the top dividend payers in Hong Kong. Despite this, its dividend history is marked by volatility and unreliability over the past decade. However, dividends are well-covered by both earnings and cash flows with low payout ratios of 22% and 38.9%, respectively, suggesting current payouts are sustainable despite past inconsistencies.

- Delve into the full analysis dividend report here for a deeper understanding of Pak Fah Yeow International.

- Our expertly prepared valuation report Pak Fah Yeow International implies its share price may be lower than expected.

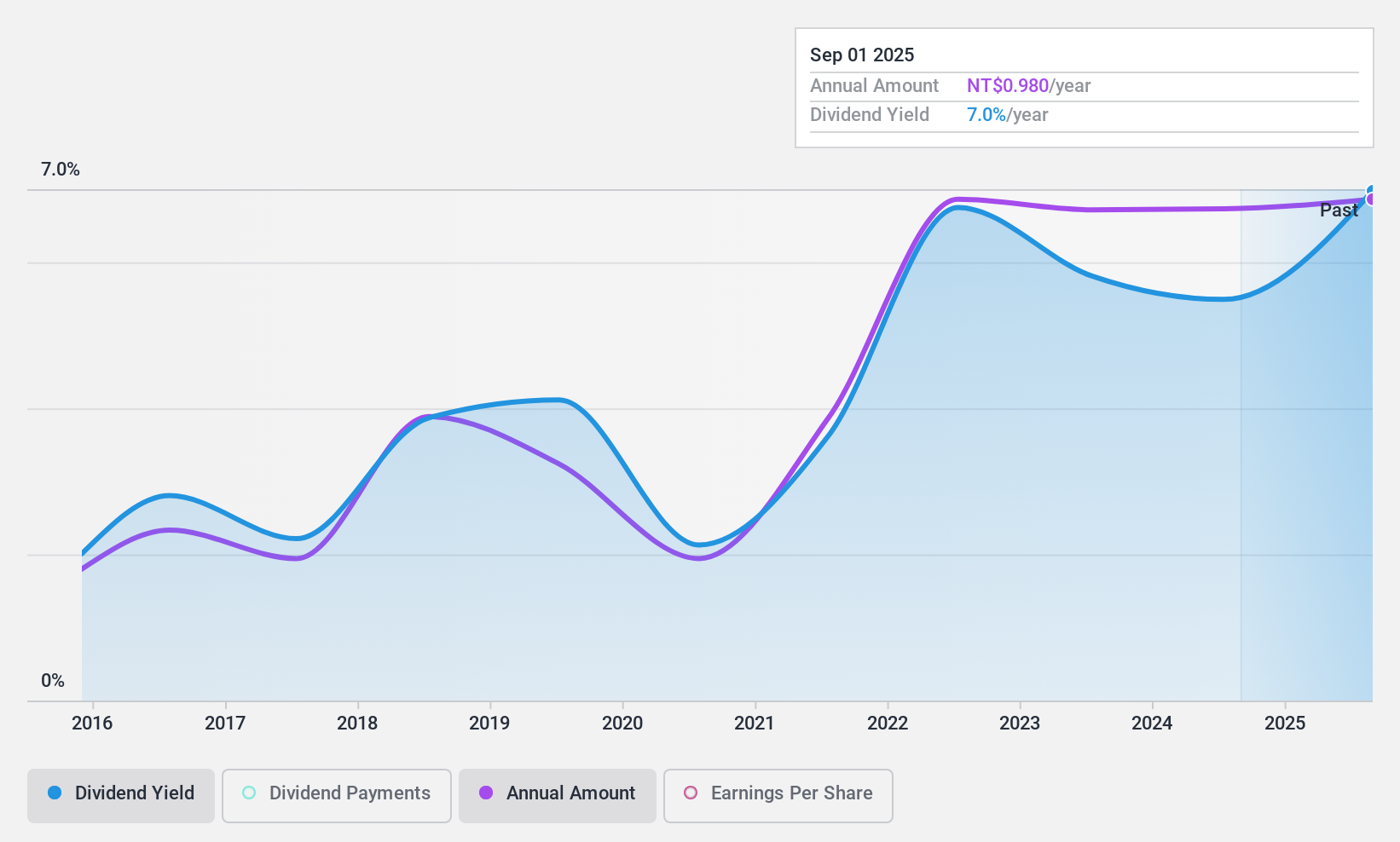

Yem Chio (TWSE:4306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yem Chio Co., Ltd. is involved in the research, design, manufacture, processing, trading, and sale of packaging materials both in Taiwan and internationally with a market cap of NT$11.64 billion.

Operations: Yem Chio Co., Ltd.'s revenue is primarily derived from its Tape Manufacturing Department (NT$13.42 billion), followed by the Property Division (NT$3.61 billion), and the Packaging Material Path Department excluding tape manufacturing (NT$1.42 billion), with additional contributions from the Special Chemicals Department (NT$441.54 million).

Dividend Yield: 5.4%

Yem Chio's dividend yield of 5.43% ranks it in the top 25% of Taiwan's market, yet its sustainability is questionable due to dividends not being covered by free cash flows. The payout ratio stands at a reasonable 60.1%, indicating coverage by earnings, but historical volatility and unreliability over the past decade raise concerns about consistency. Trading below fair value may appeal to some investors, though recent operational reviews suggest potential strategic shifts.

- Get an in-depth perspective on Yem Chio's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Yem Chio is priced lower than what may be justified by its financials.

Taking Advantage

- Click through to start exploring the rest of the 2008 Top Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4306

Yem Chio

Engages in researching, designing, manufacturing, processing, trading, and sale of packaging materials in Taiwan and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives