- Japan

- /

- Specialty Stores

- /

- TSE:2726

Discover 3 Stocks Including WuXi XDC Cayman That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In a global market environment where major indices like the S&P 500 and Nasdaq Composite are reaching record highs, there is a notable divergence between growth and value stocks, with growth shares significantly outperforming. Amidst this mixed performance landscape, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies in stock valuations. In such conditions, a good stock might be one that demonstrates strong fundamentals but is currently trading below its estimated intrinsic value due to broader market trends or sector-specific challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.16 | CN¥52.08 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | US$122.36 | US$244.39 | 49.9% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.61 | CN¥76.93 | 49.8% |

| S Foods (TSE:2292) | ¥2742.00 | ¥5472.35 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP288.85 | CLP577.11 | 49.9% |

| Acerinox (BME:ACX) | €10.03 | €20.04 | 49.9% |

| NCSOFT (KOSE:A036570) | ₩204500.00 | ₩408990.47 | 50% |

| U.S. Physical Therapy (NYSE:USPH) | US$94.06 | US$187.03 | 49.7% |

| Equifax (NYSE:EFX) | US$265.29 | US$529.48 | 49.9% |

| Almacenes Éxito (BVC:EXITO) | COP2190.00 | COP4369.08 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

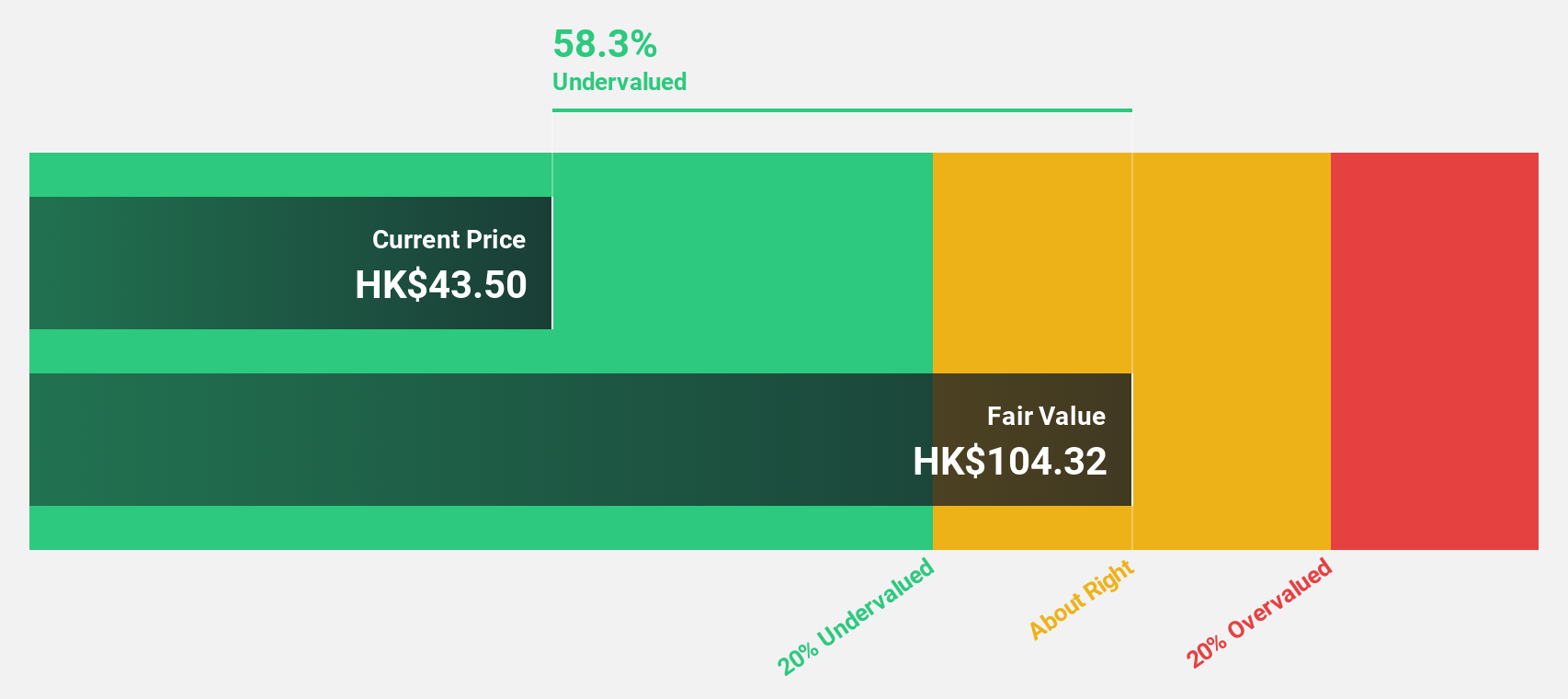

WuXi XDC Cayman (SEHK:2268)

Overview: WuXi XDC Cayman Inc. is an investment holding company that functions as a contract research, development, and manufacturing organization across China, North America, Europe, and other international markets with a market cap of HK$37.56 billion.

Operations: The company generates revenue of CN¥2.80 billion from its pharmaceuticals segment.

Estimated Discount To Fair Value: 18.8%

WuXi XDC Cayman is trading at HK$31.35, approximately 18.8% below its estimated fair value of HK$38.59, suggesting potential undervaluation based on cash flows. Despite a forecasted low return on equity of 16.9% in three years, the company's earnings and revenue are expected to grow significantly faster than the Hong Kong market, with earnings projected to increase by 27.17% annually and revenue by 26%. Recent presentations reinforce its strategic positioning in the industry.

- In light of our recent growth report, it seems possible that WuXi XDC Cayman's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in WuXi XDC Cayman's balance sheet health report.

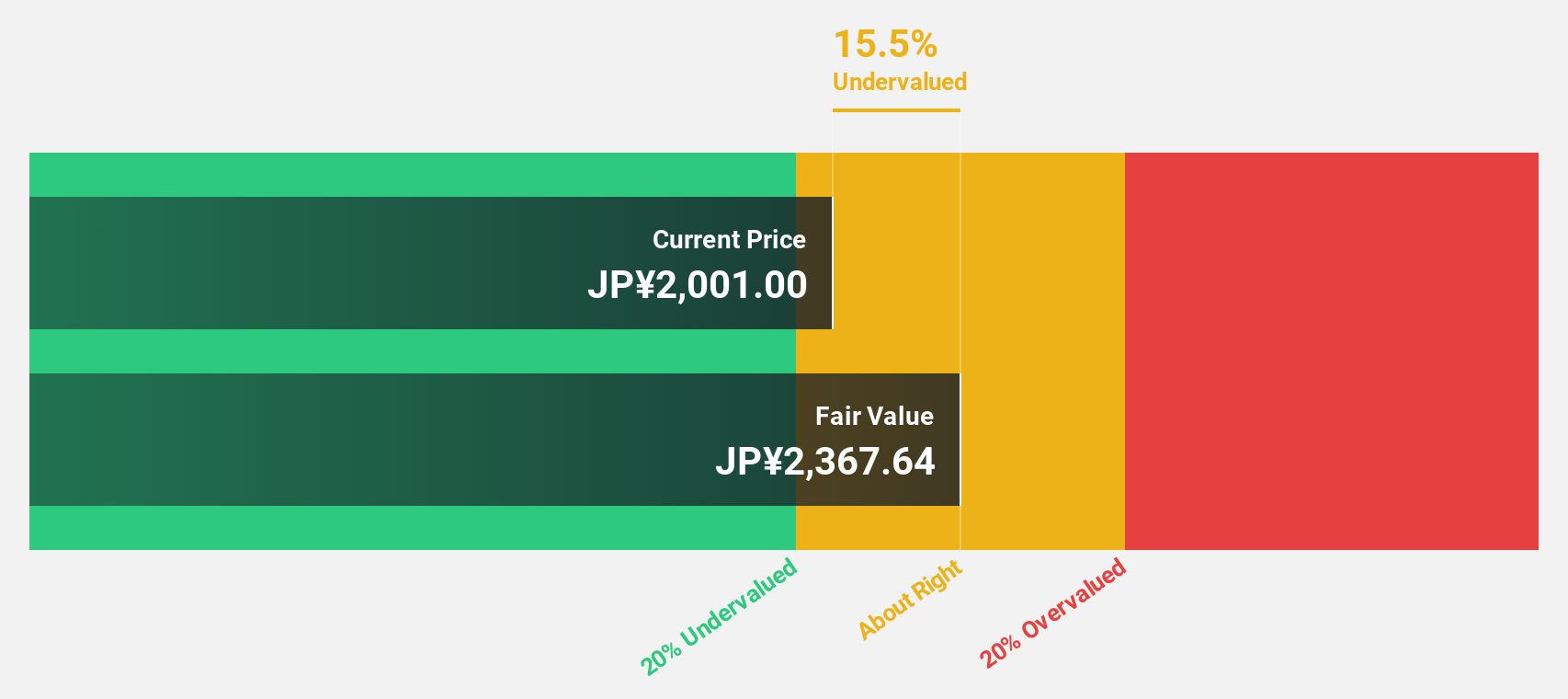

PAL GROUP Holdings (TSE:2726)

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥289.99 billion.

Operations: The company's revenue segments include the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories in Japan.

Estimated Discount To Fair Value: 19.2%

PAL GROUP Holdings is trading at ¥3,340, below its estimated fair value of ¥4,134.36, indicating potential undervaluation based on cash flows. The company's earnings and revenue are projected to grow faster than the Japanese market at 11.9% and 8.2% annually, respectively. Despite recent share price volatility and stable dividend guidance of ¥50 per share for fiscal year-end February 2025, PAL GROUP's financial outlook remains robust with an operating profit forecast of ¥22.96 billion.

- Our comprehensive growth report raises the possibility that PAL GROUP Holdings is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of PAL GROUP Holdings stock in this financial health report.

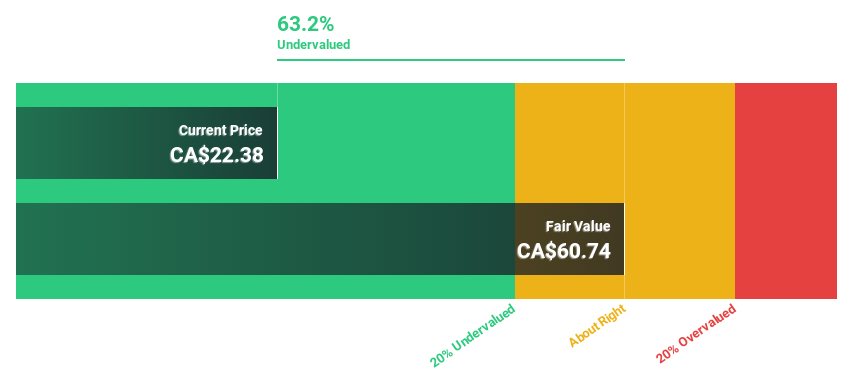

Barrick Gold (TSX:ABX)

Overview: Barrick Gold Corporation is involved in the exploration, mine development, production, and sale of gold and copper properties both in Canada and internationally, with a market cap of CA$42.72 billion.

Operations: The company's revenue segments include Carlin ($2.96 billion), Cortez ($1.74 billion), Kibali ($718 million), Lumwana ($821 million), Bulyanhulu ($457 million), North Mara ($635 million), Other Mines ($1.86 billion), Pueblo Viejo ($1.32 billion), Loulo-Gounkoto ($1.51 billion), and Turquoise Ridge ($1.07 billion).

Estimated Discount To Fair Value: 36.6%

Barrick Gold's current trading price of CA$24.44 is significantly below its estimated fair value of CA$38.55, highlighting undervaluation based on cash flows. Despite an unstable dividend history, the company's earnings are projected to grow at 20% annually, outpacing the Canadian market's 15.8%. Recent legal victories and resource expansions in Nevada bolster its position, while ongoing buybacks reflect confidence in future performance amidst expected revenue growth of 7.7% per year.

- Insights from our recent growth report point to a promising forecast for Barrick Gold's business outlook.

- Dive into the specifics of Barrick Gold here with our thorough financial health report.

Where To Now?

- Click here to access our complete index of 910 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives