Market Participants Recognise Keymed Biosciences Inc.'s (HKG:2162) Revenues Pushing Shares 31% Higher

Keymed Biosciences Inc. (HKG:2162) shares have continued their recent momentum with a 31% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 61%.

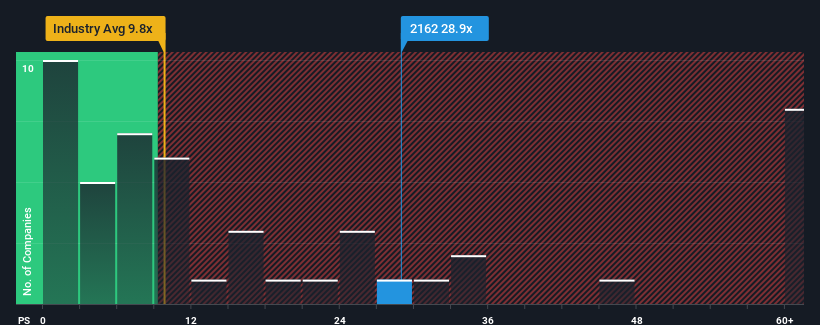

Following the firm bounce in price, Keymed Biosciences' price-to-sales (or "P/S") ratio of 28.9x might make it look like a strong sell right now compared to other companies in the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios below 9.8x and even P/S below 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Keymed Biosciences

How Keymed Biosciences Has Been Performing

Keymed Biosciences could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Keymed Biosciences will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Keymed Biosciences' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. Pleasingly, revenue has also lifted 288% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 71% per year over the next three years. With the industry only predicted to deliver 55% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Keymed Biosciences is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Keymed Biosciences' P/S

Keymed Biosciences' P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Keymed Biosciences shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Keymed Biosciences is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Keymed Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2162

Keymed Biosciences

A biotechnology company, focuses on in-house discovery and development of biological therapies in the autoimmune and oncology therapeutic areas.

Excellent balance sheet and fair value.

Market Insights

Community Narratives