Subdued Growth No Barrier To HBM Holdings Limited (HKG:2142) With Shares Advancing 54%

HBM Holdings Limited (HKG:2142) shareholders would be excited to see that the share price has had a great month, posting a 54% gain and recovering from prior weakness. This latest share price bounce rounds out a remarkable 867% gain over the last twelve months.

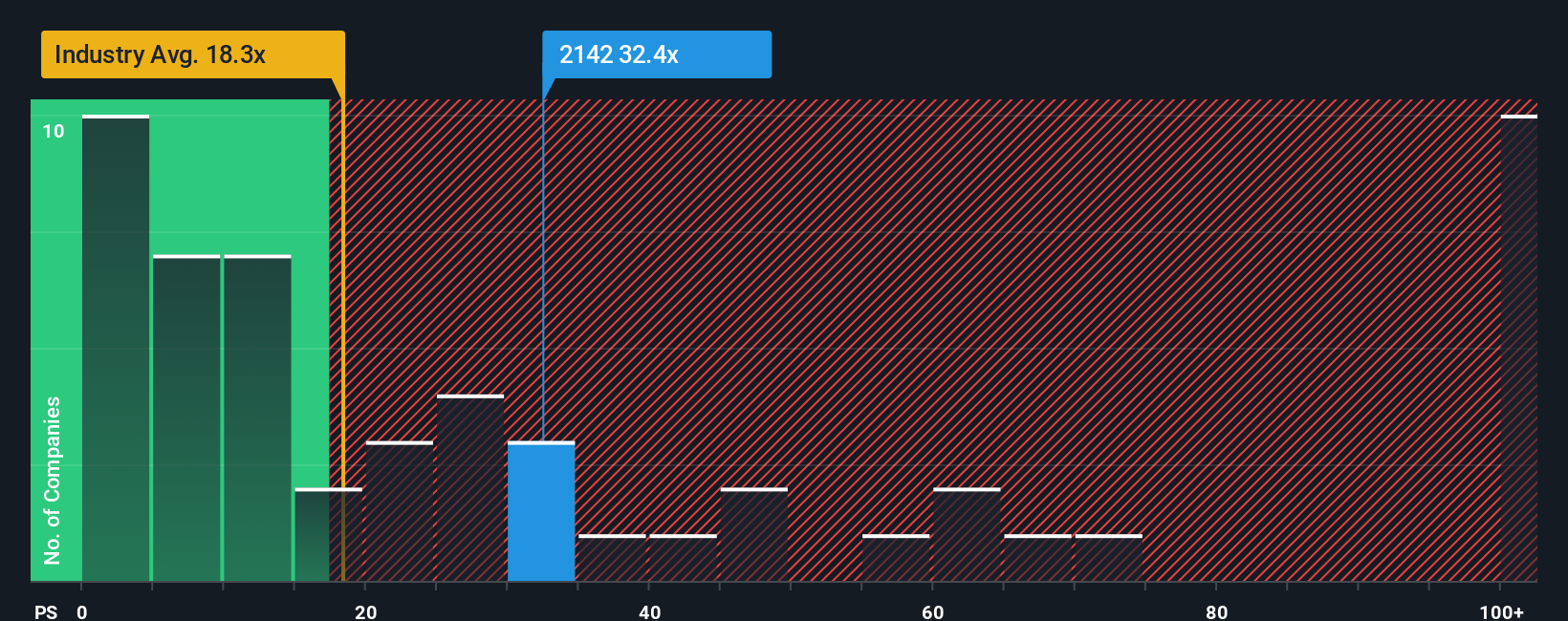

Since its price has surged higher, HBM Holdings' price-to-sales (or "P/S") ratio of 32.4x might make it look like a strong sell right now compared to other companies in the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios below 18.3x and even P/S below 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for HBM Holdings

What Does HBM Holdings' P/S Mean For Shareholders?

HBM Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on HBM Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For HBM Holdings?

In order to justify its P/S ratio, HBM Holdings would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 57%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next three years should generate growth of 55% per year as estimated by the two analysts watching the company. With the industry predicted to deliver 319% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that HBM Holdings is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Shares in HBM Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that HBM Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for HBM Holdings that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if HBM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2142

HBM Holdings

A biopharmaceutical company, engages in the discovery, development, and commercialization of antibody therapeutics focusing on immunology and oncology in Mainland China, the United States, Europe, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives