March 2025's Global Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

As global markets grapple with declining consumer confidence and persistent inflation, small-cap stocks have faced increased volatility, with indices like the Russell 2000 experiencing notable downturns. Despite these challenges, opportunities may arise for discerning investors who focus on companies exhibiting strong fundamentals and strategic insider buying, which can signal potential value amidst broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 19.3x | 4.9x | 24.14% | ★★★★★★ |

| Security Bank | 4.7x | 1.1x | 32.30% | ★★★★★☆ |

| Puregold Price Club | 9.1x | 0.4x | 26.01% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 27.18% | ★★★★★☆ |

| Hong Leong Asia | 8.6x | 0.2x | 47.32% | ★★★★☆☆ |

| Gamma Communications | 22.2x | 2.3x | 36.44% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 11.7x | 1.9x | 23.13% | ★★★★☆☆ |

| Franchise Brands | 38.0x | 2.0x | 27.08% | ★★★★☆☆ |

| Optima Health | NA | 1.5x | 45.05% | ★★★★☆☆ |

| Yixin Group | 8.8x | 0.8x | -264.41% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

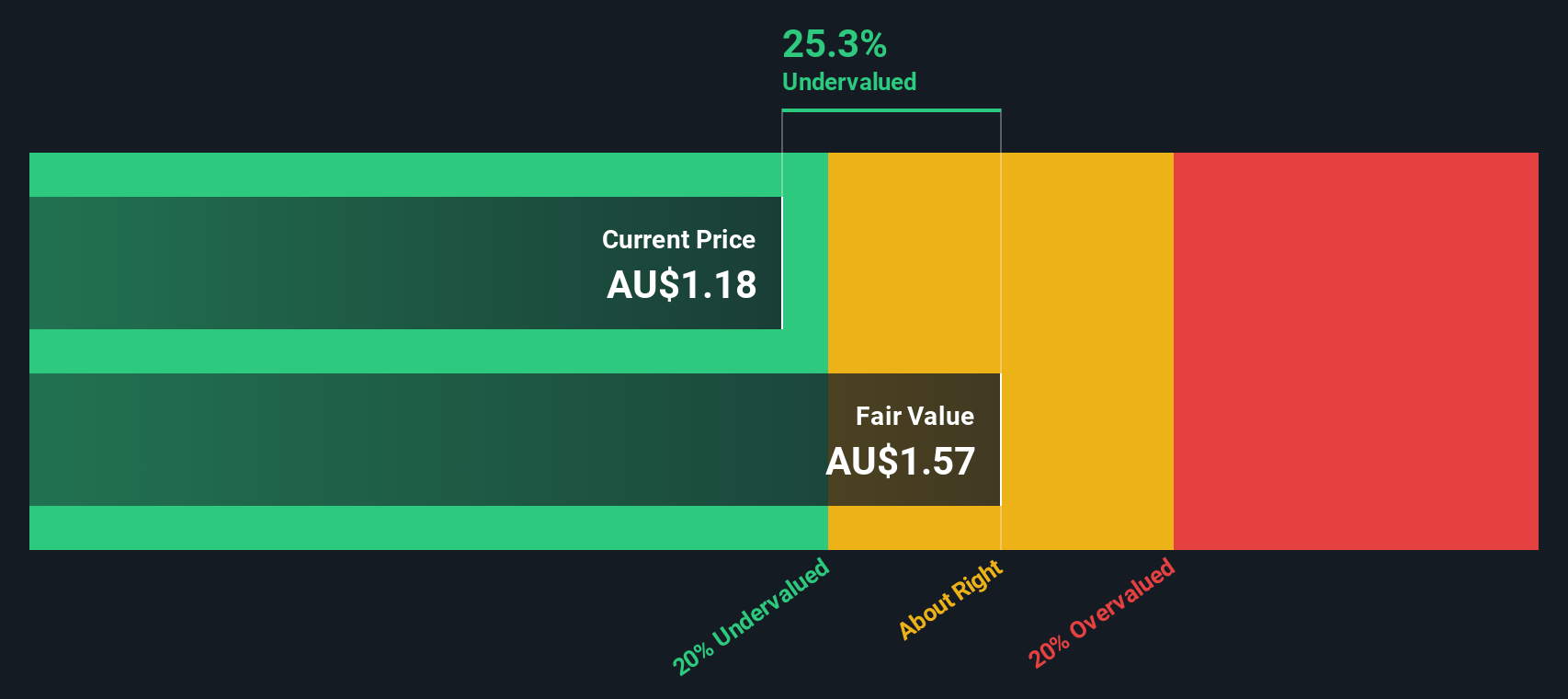

Abacus Group (ASX:ABG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Abacus Group is a diversified property investment and management company focusing on commercial, retail, and industrial assets with a market cap of A$2.5 billion.

Operations: Abacus Group generates revenue primarily through its operations, with a notable gross profit margin reaching as high as 81.56% in recent periods. The company's cost structure includes significant operating expenses, which have fluctuated but recently stood at A$36.49 million. Non-operating expenses have also been substantial, impacting overall profitability with figures reaching up to A$369.83 million in certain quarters. Despite these costs, the company has experienced variations in net income margin over time, reflecting changes in both revenue and expense dynamics.

PE: -9.9x

Abacus Group, despite reporting a net loss of A$5.72 million for the half-year ending December 2024, shows promising growth potential with earnings projected to rise by 82% annually. Insider confidence is evident through recent share purchases. The company's reliance on external borrowing poses some risk; however, its strategic participation in events like the Mobile World Congress highlights an active pursuit of growth opportunities. With a dividend payout targeting up to 95% of FFO, Abacus maintains shareholder engagement amidst financial challenges.

- Click here to discover the nuances of Abacus Group with our detailed analytical valuation report.

Explore historical data to track Abacus Group's performance over time in our Past section.

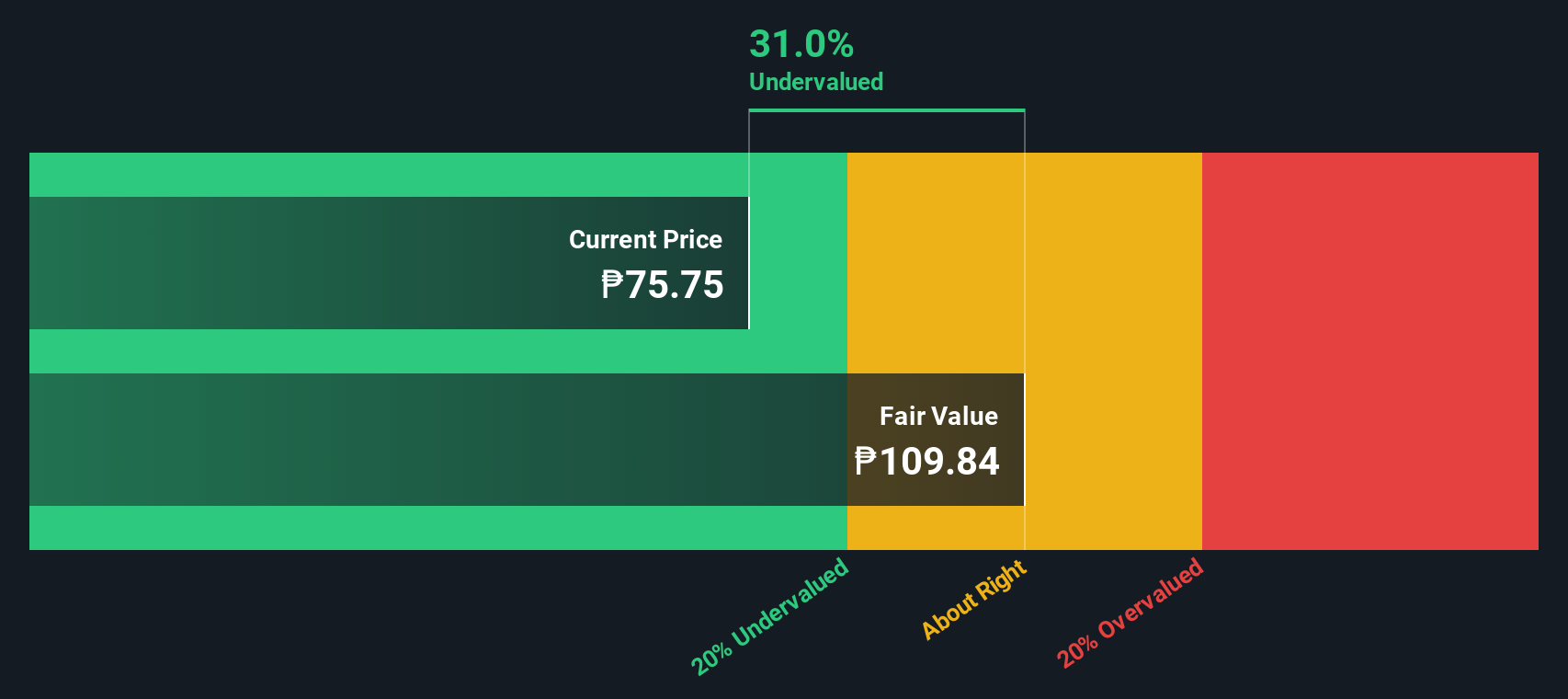

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Security Bank is a financial institution in the Philippines offering a range of services including retail, commercial, and corporate banking, with a market capitalization of approximately ₱102.06 billion.

Operations: Security Bank generates its revenue primarily through interest income, with operating expenses accounting for a significant portion of its costs. The net income margin has shown variability over time, reaching 23.28% in the latest period. Operating expenses are consistently driven by general and administrative costs, which have been increasing over recent periods.

PE: 4.7x

Security Bank's recent earnings report shows a net income increase to PHP 11.24 billion from PHP 9.11 billion the previous year, with basic earnings per share rising to PHP 14.91 from PHP 12.08. Insider confidence is evident as John David G. Yap acquired over 55,000 shares valued at approximately PHP 4 million, suggesting potential optimism about future performance despite a high bad loans ratio of 3.4% and low allowance for bad loans at 83%.

- Navigate through the intricacies of Security Bank with our comprehensive valuation report here.

Examine Security Bank's past performance report to understand how it has performed in the past.

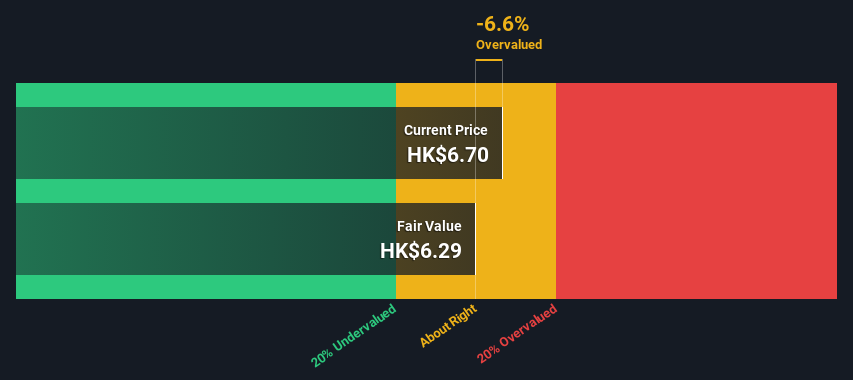

HBM Holdings (SEHK:2142)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: HBM Holdings focuses on the development of innovative therapies in tumor immunology and immune diseases, with a market cap of HK$1.65 billion.

Operations: HBM Holdings generates its revenue primarily from the development of innovative therapies in tumor immunology and immune diseases, with a recent quarterly revenue of $72.21 million. The company has seen fluctuations in its net income margin, moving from negative to positive figures over time, reaching 0.29% as of the latest data point. Operating expenses are significant, with research and development being a major component at $29.80 million in the most recent period.

PE: 26.3x

HBM Holdings, a company with a strong foundation in antibody discovery, has recently engaged in strategic collaborations and licensing agreements to bolster its innovative therapeutic offerings. The partnership with Insilico Medicine aims to leverage AI for next-gen antibody applications, while the co-development of HBM9378/SKB378 targets COPD treatment. Insider confidence is evident as Jingsong Wang acquired 400,000 shares for approximately RMB 1.4 million between late 2024 and early 2025. Despite volatile share prices recently, these developments highlight potential growth avenues amidst high operational efficiency.

- Get an in-depth perspective on HBM Holdings' performance by reading our valuation report here.

Review our historical performance report to gain insights into HBM Holdings''s past performance.

Key Takeaways

- Explore the 116 names from our Undervalued Global Small Caps With Insider Buying screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HBM Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2142

HBM Holdings

A clinical-stage biopharmaceutical company, engages in the discovery and development of differentiated antibody therapeutics in immunology and oncology disease areas.

Flawless balance sheet and fair value.