- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1302

LifeTech Scientific And 2 More Penny Stocks With Promising Potential

Reviewed by Simply Wall St

Global markets have been experiencing a mix of highs and uncertainties, with U.S. stock indexes nearing record levels despite inflation concerns that have influenced interest rate expectations. In such a climate, the appeal of penny stocks remains noteworthy as they offer potential opportunities for investors seeking growth in smaller or newer companies. While the term "penny stocks" might seem outdated, their affordability combined with strong financial underpinnings can present promising prospects for those looking to diversify their portfolios.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.66B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £478.61M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.61M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$45.35B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.38 | £336.16M | ★★★★☆☆ |

Click here to see the full list of 5,687 stocks from our Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$6.67 billion.

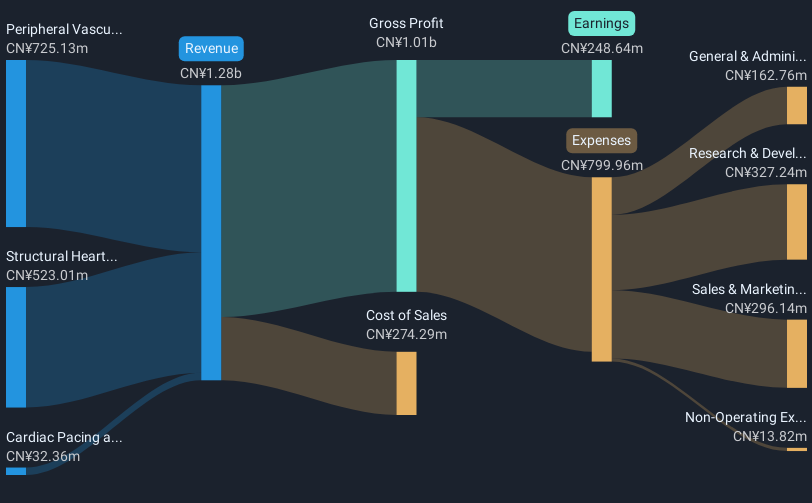

Operations: The company's revenue is primarily derived from its Peripheral Vascular Diseases Business at CN¥725.13 million, followed by the Structural Heart Diseases Business at CN¥523.01 million, and the Cardiac Pacing and Electrophysiology Business at CN¥32.36 million.

Market Cap: HK$6.67B

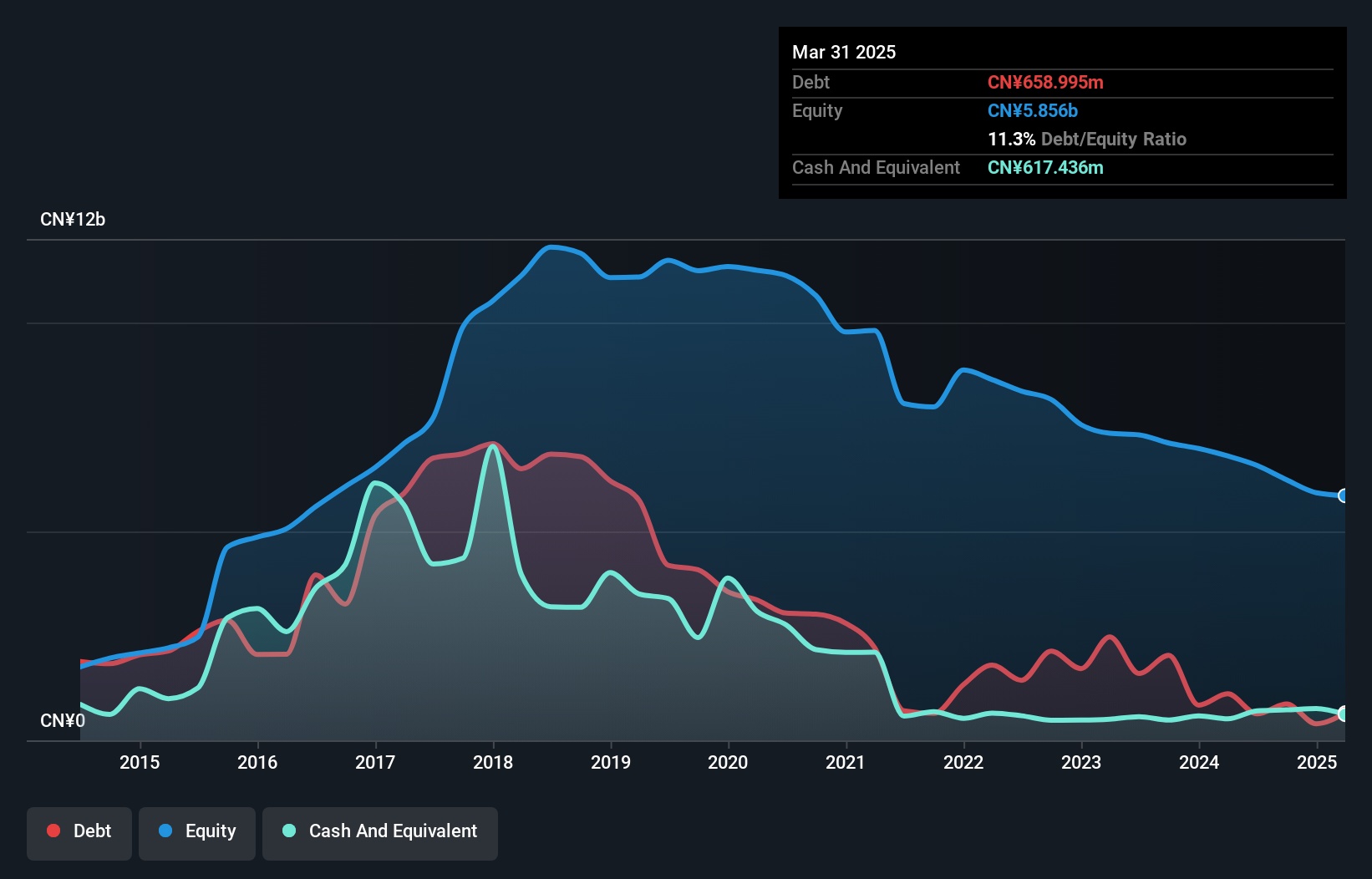

LifeTech Scientific's financial performance indicates challenges, with negative earnings growth over the past year and a decrease in profit margins from 28% to 19.4%. However, its short-term assets significantly exceed both short and long-term liabilities, suggesting strong liquidity. The company's debt to equity ratio has improved markedly over five years, now at 2.9%, and it holds more cash than total debt, indicating prudent financial management. A recent approval of the Ankura Aortic Stent Graft System by China's NMPA may bolster future prospects as it addresses unmet clinical needs with innovative technology and international patents.

- Click here and access our complete financial health analysis report to understand the dynamics of LifeTech Scientific.

- Evaluate LifeTech Scientific's prospects by accessing our earnings growth report.

HBM Holdings (SEHK:2142)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HBM Holdings Limited is a clinical-stage biopharmaceutical company focused on discovering and developing differentiated antibody therapeutics for immunology and oncology, with a market cap of HK$2.93 billion.

Operations: The company's revenue of $72.21 million is derived from the development of innovative therapies in tumor immunology and immune diseases.

Market Cap: HK$2.93B

HBM Holdings Limited, a clinical-stage biopharmaceutical company, recently became profitable and has shown strong financial health with short-term assets exceeding liabilities and more cash than debt. The company's recent partnership with Windward Bio AG for HBM9378/SKB378, an antibody targeting chronic obstructive pulmonary disease (COPD), could enhance its revenue streams through potential milestone payments up to $970 million. Despite management's inexperience, the board is seasoned with experienced directors like Ms. Weiwei Chen taking key roles. The approval of HBM9378/SKB378 by China's NMPA further strengthens its position in developing innovative therapies for unmet medical needs.

- Get an in-depth perspective on HBM Holdings' performance by reading our balance sheet health report here.

- Assess HBM Holdings' previous results with our detailed historical performance reports.

Beijing Haixin Energy TechnologyLtd (SZSE:300072)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Haixin Energy Technology Co., Ltd. operates in the energy technology sector and has a market cap of CN¥7.99 billion.

Operations: Beijing Haixin Energy Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥7.99B

Beijing Haixin Energy Technology Co., Ltd. is currently pre-revenue, with its market cap at CN¥7.99 billion, indicating potential for growth despite its unprofitable status. The company's debt is well covered by operating cash flow, and short-term assets significantly exceed both short and long-term liabilities, suggesting solid financial management. However, the board's inexperience may pose challenges in strategic decision-making. Recent developments include a special shareholders meeting to discuss an A-share offering plan and related transactions with the controlling shareholder, which could impact future capital structure and shareholder returns if executed effectively.

- Take a closer look at Beijing Haixin Energy TechnologyLtd's potential here in our financial health report.

- Explore Beijing Haixin Energy TechnologyLtd's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Click here to access our complete index of 5,687 Penny Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1302

LifeTech Scientific

An investment holding company, develops, manufactures, and trades in interventional medical devices for cardiovascular and peripheral vascular diseases and disorders worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives