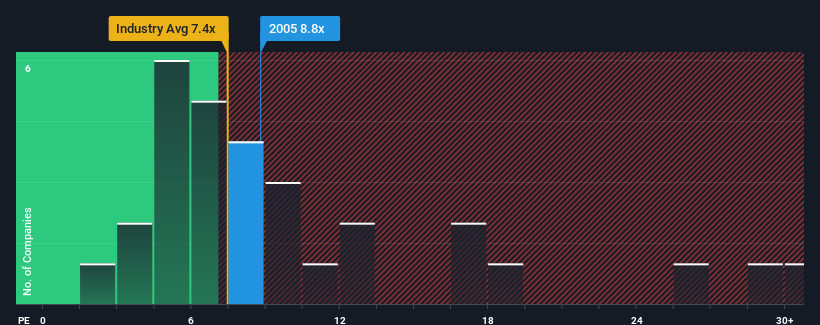

It's not a stretch to say that SSY Group Limited's (HKG:2005) price-to-earnings (or "P/E") ratio of 8.8x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, SSY Group has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for SSY Group

Is There Some Growth For SSY Group?

The only time you'd be comfortable seeing a P/E like SSY Group's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 18%. The latest three year period has also seen an excellent 120% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the four analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 15% per year, which is not materially different.

With this information, we can see why SSY Group is trading at a fairly similar P/E to the market. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of SSY Group's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - SSY Group has 1 warning sign we think you should be aware of.

If you're unsure about the strength of SSY Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Undervalued with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026