- Philippines

- /

- Banks

- /

- PSE:AUB

Asian Undervalued Small Caps With Insider Buying To Watch In July 2025

Reviewed by Simply Wall St

As of July 2025, the Asian markets are navigating a complex landscape marked by mixed economic signals and geopolitical developments. While global indices like the S&P MidCap 400 and Russell 2000 have shown robust performance, reflecting investor optimism in smaller-cap stocks, Asia's small-cap sector presents unique opportunities for those looking to explore undervalued assets amidst these dynamic conditions. In such an environment, identifying promising stocks often involves assessing factors like insider buying activity and market positioning that can offer insights into potential value beyond immediate market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Credit Corp Group | 9.1x | 2.1x | 30.58% | ★★★★★★ |

| East West Banking | 3.2x | 0.7x | 30.41% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.3x | 6.9x | 28.02% | ★★★★★☆ |

| Growthpoint Properties Australia | NA | 5.6x | 21.96% | ★★★★★☆ |

| Dicker Data | 19.2x | 0.7x | -16.31% | ★★★★☆☆ |

| Build King Holdings | 3.3x | 0.1x | 23.21% | ★★★★☆☆ |

| Eureka Group Holdings | 17.9x | 5.5x | 28.69% | ★★★★☆☆ |

| China XLX Fertiliser | 5.0x | 0.3x | -7.64% | ★★★☆☆☆ |

| China Lesso Group Holdings | 7.1x | 0.4x | -252.99% | ★★★☆☆☆ |

| Tabcorp Holdings | NA | 0.7x | -47.40% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

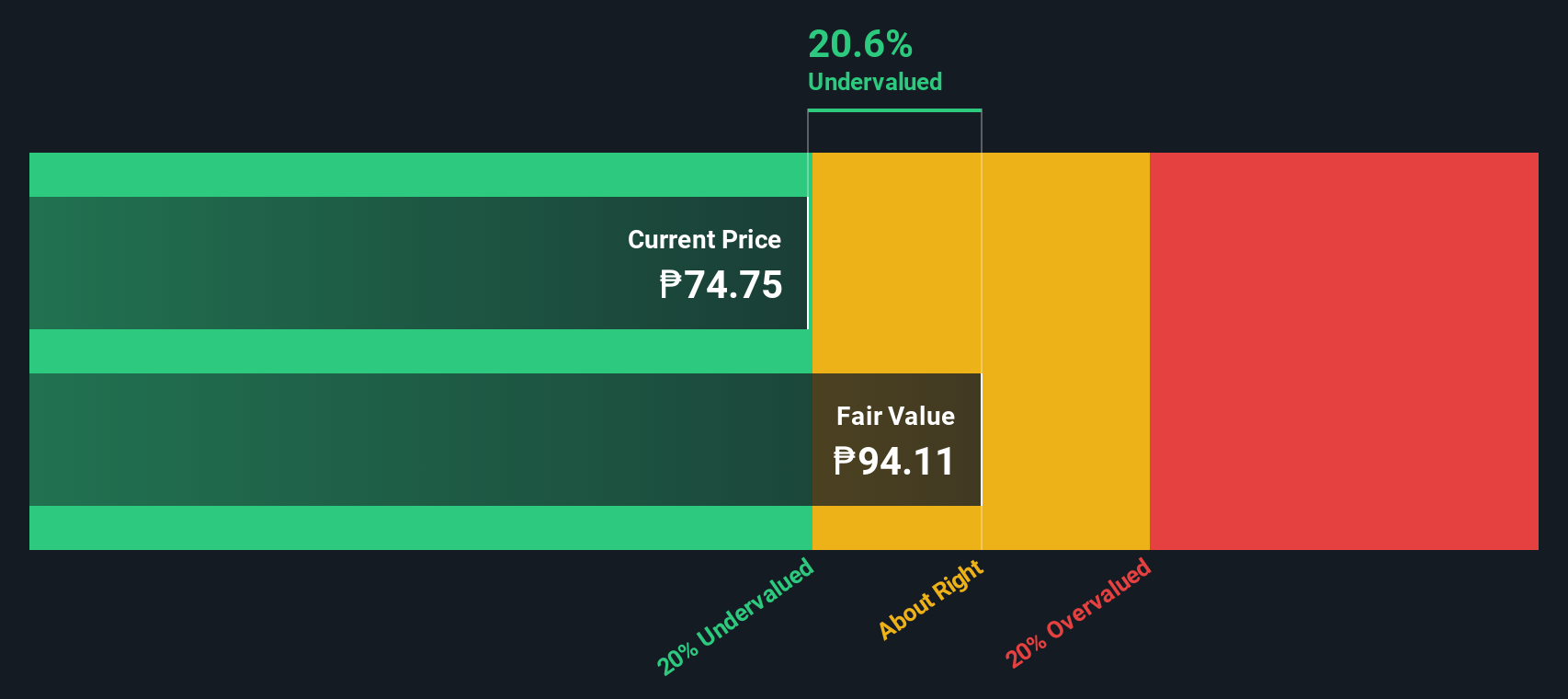

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Asia United Bank is a Philippine-based commercial bank that provides a range of financial services including deposits, loans, and treasury products, with a market capitalization of approximately ₱30.42 billion.

Operations: Asia United Bank generates revenue primarily through its core banking operations, with a notable emphasis on maintaining a high gross profit margin, reaching up to 98.91% in recent periods. The bank's cost of goods sold remains relatively low compared to its total revenue, while operating expenses are significant, driven largely by general and administrative costs. Sales and marketing expenses are comparatively minor but consistently present across periods. Net income margins have shown variability but reached as high as 54.61%, indicating effective cost management and profitability strategies over time.

PE: 4.9x

Asia United Bank, a smaller player in the banking sector, has shown potential with its recent financial performance. For Q1 2025, net income rose to PHP 3.14 billion from PHP 2.34 billion the previous year, indicating strong growth. Insider confidence is evident with Manuel Gomez's purchase of 15,090 shares valued at approximately PHP 890,310 in June 2025. Recent leadership changes include Manuel Bengson taking over as Senior VP of Treasury Group on July 14th; his extensive experience could drive further strategic gains for the bank's treasury operations.

- Delve into the full analysis valuation report here for a deeper understanding of Asia United Bank.

Gain insights into Asia United Bank's past trends and performance with our Past report.

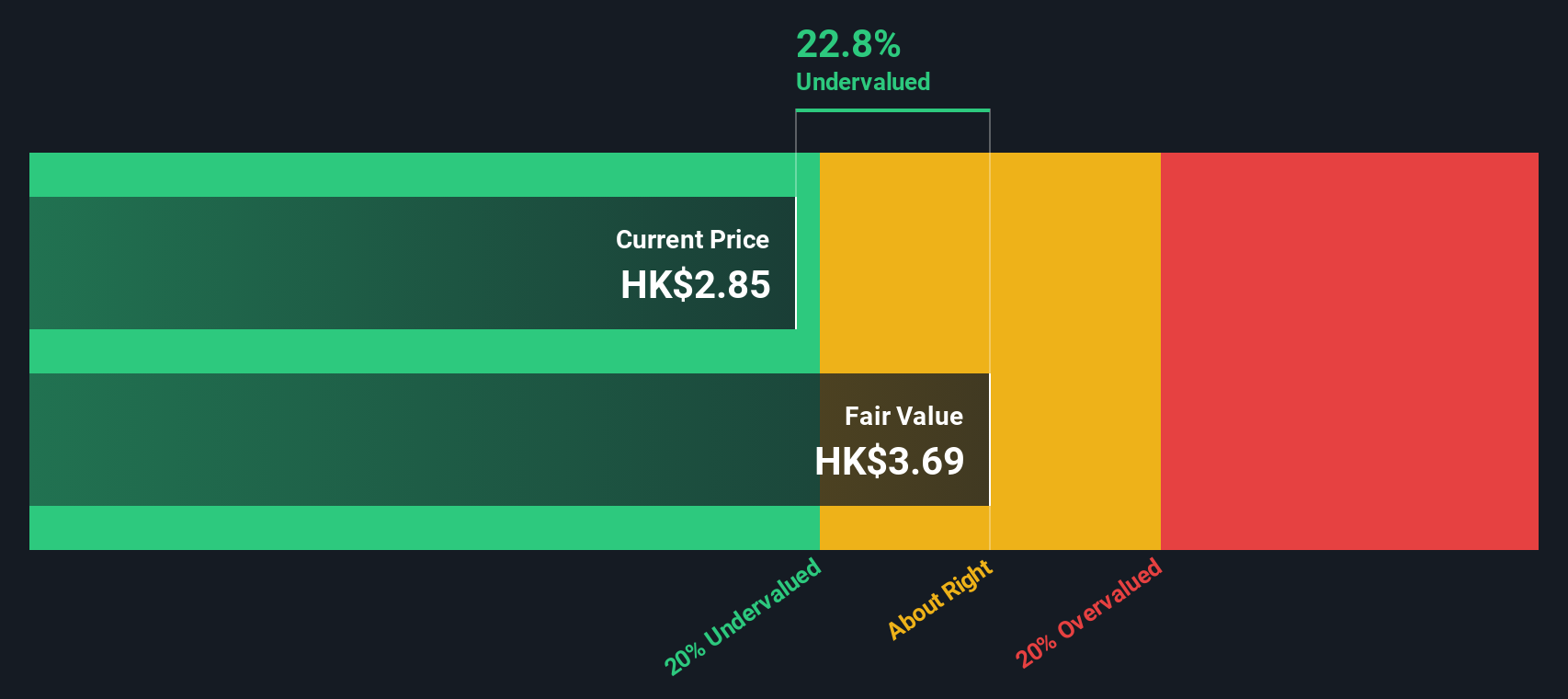

SSY Group (SEHK:2005)

Simply Wall St Value Rating: ★★★★★☆

Overview: SSY Group is a company engaged in the production and sale of medical materials and intravenous infusion solutions, with a market cap of HK$5.67 billion.

Operations: The primary revenue stream comes from Intravenous Infusion Solution and Others, contributing significantly to the total revenue. The gross profit margin has shown fluctuations, peaking at 62.92% in mid-2019 before declining to 54.39% by mid-2024. Operating expenses are primarily driven by sales and marketing costs, which consistently form a substantial portion of total expenses.

PE: 7.8x

SSY Group, a smaller entity in the pharmaceutical sector, is making strides with its innovative SYN045 tablets, now advancing to Phase IIa trials following promising Phase I results. The company has secured multiple drug approvals from China's National Medical Products Administration recently, including Paracetamol Granules and Furosemide Tablets. Insider confidence is evident as insiders increased their shareholdings between June 2025 and July 2025. With an ongoing share repurchase program aimed at enhancing shareholder value, SSY Group shows potential for growth in the competitive Asian market.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer of building materials and interior decoration products, with a market cap of CN¥20.65 billion.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with recent figures showing CN¥27.03 billion. The cost of goods sold (COGS) for the same period was CN¥19.73 billion, resulting in a gross profit of CN¥7.29 billion and a gross profit margin of 26.99%. Operating expenses amounted to CN¥3.42 billion, with significant allocations towards sales and marketing as well as general and administrative expenses. Net income stood at CN¥1.68 billion, reflecting a net income margin of 6.23%.

PE: 7.1x

China Lesso Group Holdings is gaining attention in the Asian market due to its potential for earnings growth at 12.29% annually, despite its reliance on external borrowing for funding. The recent insider confidence displayed by CEO Manlun Zuo, who acquired 6.1 million shares valued at HK$26.99 million, highlights a belief in future prospects. While debt coverage remains a concern, strategic changes with new executive appointments and dividend affirmations suggest an optimistic outlook for this small cap company amidst evolving industry dynamics.

- Click here to discover the nuances of China Lesso Group Holdings with our detailed analytical valuation report.

Understand China Lesso Group Holdings' track record by examining our Past report.

Summing It All Up

- Explore the 45 names from our Undervalued Asian Small Caps With Insider Buying screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:AUB

Asia United Bank

Provides banking and other financial products and services to individual consumers, MSMEs, and corporations in the Philippines.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.