Sanai Health Industry Group Company Limited (HKG:1889) Might Not Be As Mispriced As It Looks After Plunging 29%

Unfortunately for some shareholders, the Sanai Health Industry Group Company Limited (HKG:1889) share price has dived 29% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

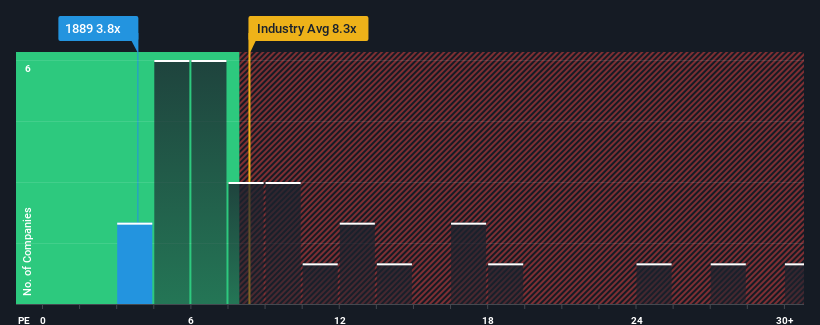

Following the heavy fall in price, Sanai Health Industry Group's price-to-earnings (or "P/E") ratio of 3.8x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, Sanai Health Industry Group's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Sanai Health Industry Group

Is There Any Growth For Sanai Health Industry Group?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Sanai Health Industry Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's bottom line. Even so, admirably EPS has lifted 133% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Comparing that to the market, which is only predicted to deliver 21% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Sanai Health Industry Group's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Sanai Health Industry Group's P/E looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Sanai Health Industry Group revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Sanai Health Industry Group (1 is a bit concerning!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1889

Sanai Health Industry Group

An investment holding company, engages in the manufacture, marketing, and sale of branded prescription and non-prescription drugs, as well as Chinese pharmaceutical products in the People’s Republic of China and Hong Kong.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives