Shanghai Junshi Biosciences Co., Ltd.'s (HKG:1877) Share Price Boosted 31% But Its Business Prospects Need A Lift Too

Despite an already strong run, Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) shares have been powering on, with a gain of 31% in the last thirty days. The annual gain comes to 131% following the latest surge, making investors sit up and take notice.

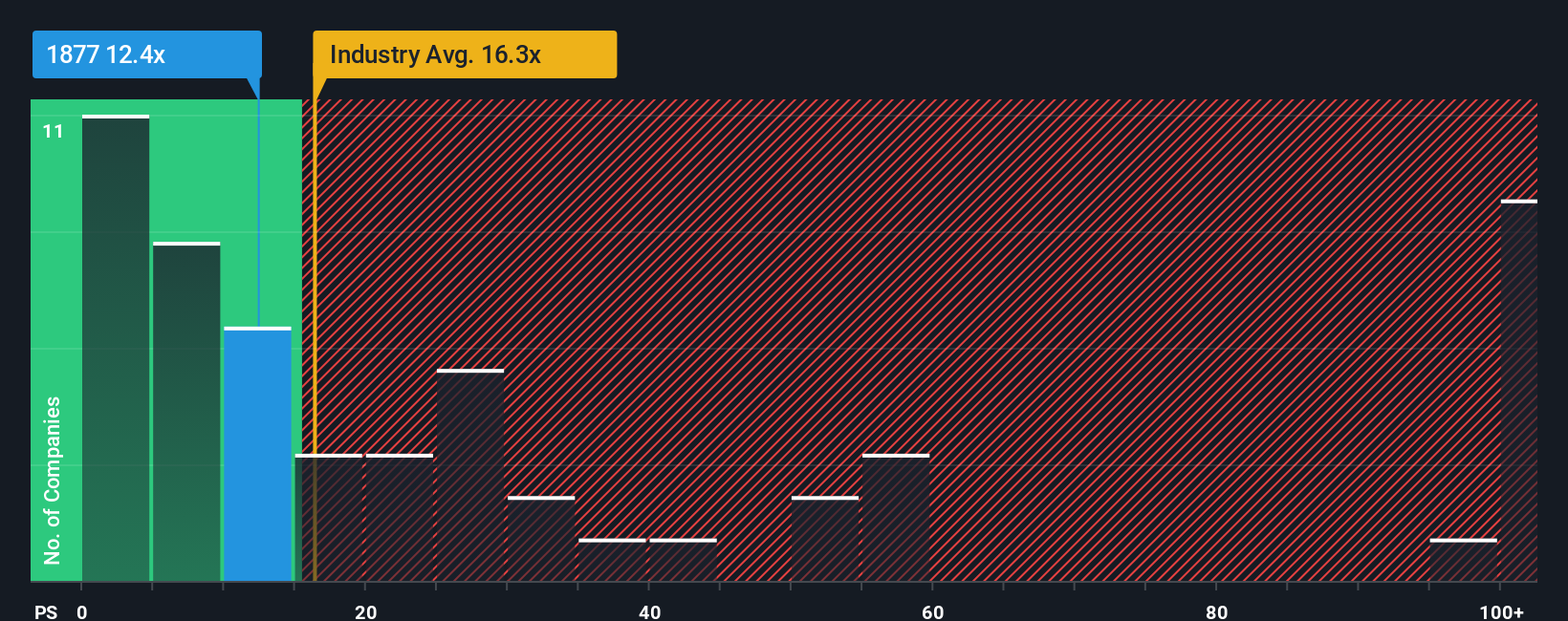

Even after such a large jump in price, Shanghai Junshi Biosciences' price-to-sales (or "P/S") ratio of 12.4x might still make it look like a buy right now compared to the Biotechs industry in Hong Kong, where around half of the companies have P/S ratios above 16.3x and even P/S above 40x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Shanghai Junshi Biosciences

How Has Shanghai Junshi Biosciences Performed Recently?

With revenue growth that's inferior to most other companies of late, Shanghai Junshi Biosciences has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Junshi Biosciences.How Is Shanghai Junshi Biosciences' Revenue Growth Trending?

Shanghai Junshi Biosciences' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 32% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 2,162% growth forecast for the broader industry.

With this in consideration, its clear as to why Shanghai Junshi Biosciences' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shanghai Junshi Biosciences' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shanghai Junshi Biosciences' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shanghai Junshi Biosciences that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives